Oil Price Analysis and News

- Oil Price Momentum Remains Bearish Despite Iranian Sanctions

- Oil Waivers alleviate supply shock concerns

For a more in-depth analysis on Oil Prices, check out the Q4 Forecast for Oil

Oil Prices Falls Despite Iranian Sanctions

The decline in crude oil prices have shown no significant signs of easing despite the imposition of US sanctions on Iran’s oil sector as investors grow concerned over a potential slowdown that may curb oil demand growth. Alongside this, Iranian sanctions had largely been priced in, while the announcement from the Trump administration to provide oil waivers added to the bearish tone in oil prices.

US Oil Waivers Alleviate Supply Shock Concerns

The US has given 180-day exemptions to 8 oil importers, China, India, South Korea, Italy, Greece, Taiwan and Turkey, which import roughly three-quarters of Iran’s oil. This in turn has initially softened the blow of Iranian sanctions, reducing investors’ fears of a near term supply shock with the US noting that exemptions could possibly be renewed.

| Country | Iranian Oil Imports | Exemptions |

|---|---|---|

| China | 650kbpd | 360kbpd |

| India | 560kbpd | 300kbpd |

| South Korea | 235kbpd | 200kbpd |

| Italy | 174kbpd | |

| Turkey | 161kbpd | |

| Japan | 141kbpd | |

| Greece | 78kbpd | |

| Taiwan | 11kbpd |

Source: Refinitiv. Data showing Iranian oil import data from the first six months of 2018 and announcement of oil exemptions. Updates to follow for other countries.

Surging Global Supply Reduces Iranian Sanction Effect

As mentioned previously, oil production has been surging in recent months from the top 3 largest oil producers (US, Russia and Saudi Arabia). Most notably in the US, who have recorded an increase in crude oil inventories for 6 consecutive weeks amid the US government’s sale of barrels from its Strategic Petroleum Reserves (SPR). As a reminder, back in August, the US DoE stated it August that it would offer 11mbpd of oil for sale from the SPR with the proposed sale from October 1st-November 30th.

What is the Strategic Petroleum Reserve?

The SPR is the world’s largest oil stockpile, which holds around 660mln barrels of US crude. According to the Energy Department, it is predominantly intended to be used in the event of a war (2011 Libyan War) that disrupts global oil supply or following a natural disaster (hurricanes) so that the US economy would be protected from supply shocks in times of tightened supply. However, non-emergency sales can be authorized in order to respond to minor supply disruptions or to raise federal revenue.

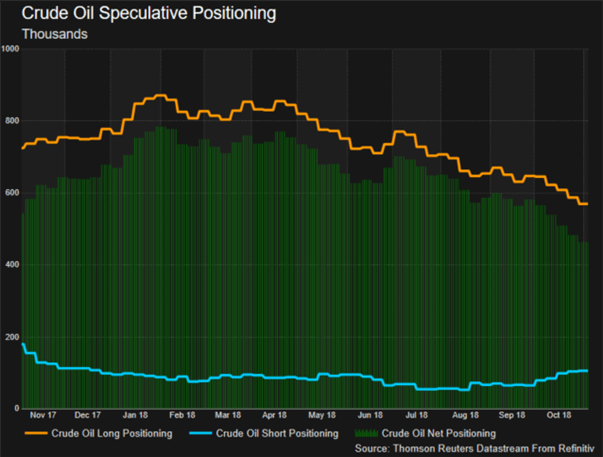

Crude Oil Speculative Shed Long Positions

As oil prices continue to dip, net long positioning has also tailed off as speculative long positions are at the lowest level since December 2016. Alongside this, speculative shorts have picked up since the beginning of October. However, with net positioning still very long, a further unwind poses a risk of further downside in prices.

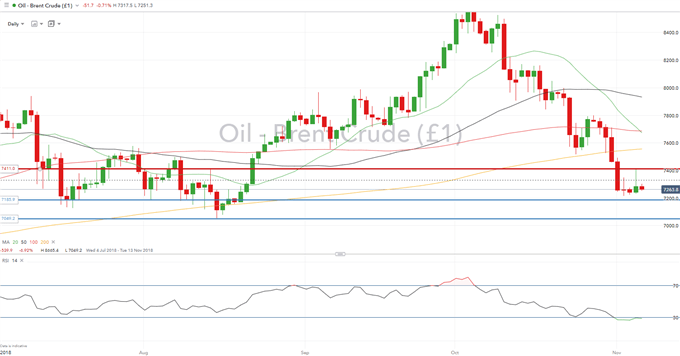

OIL PRICE CHART: Daily Time-Frame (July-November 2018)

Despite prices finding support at the 38.2% Fibonacci Retracement of the $147.50-$27.43 drop. Momentum remains on the downside with the initial target for sellers at $71.85, before a test of the August low at $70.50. On the topside, resistance is seen at the 200DMA ($75.55), while last week’s high ($74.11) may also cap price action.

Crude oil price forecast – what next for the commodity?

According to IG speculative positioning, US Crude prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Oil - US Crude-bearish contrarian trading bias.

OIL TRADING GUIDES

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX