See our 3Q forecasts for the US Dollar, Oil and Equities in the DailyFX Trading Guides page

US Session Developments – USD, NZD, Gold

The US Dollar outperformed on Thursday with gains accelerating during the second half of the day. Demand for the greenback was high despite a drop in local government bond yields from all spectrum of maturity. Gains in USD weighed against gold prices which typically behave as an anti-fiat asset. Crude oil prices, which are denominated in the US Dollar, pared earlier gains as they became relatively cheaper.

Some weakness in emerging market currencies as well as deep losses in the New Zealand Dollar likely offered a lift to USD. The former were under pressure amidst US sanctions on Russia while the latter was hindered by a relatively dovish Reserve Bank of New Zealand monetary policy announcement. The Australian Dollar, being an alternative high yielding currency, was also weaker amidst greenback strength.

Meanwhile, the anti-risk Japanese Yen headed cautiously higher. Japan’s Nikkei 225 glided throughout the day, dragged down by automakers. This may have reflected worries ahead of trade talks between the US and Japan which started in Washington on Thursday. The latter country could yet avoid additional levies, and this could in-turn push Japanese shares higher while the Yen weakens.

Friday Asia/Pacific Sneak – Japanese GDP, Risk Trends

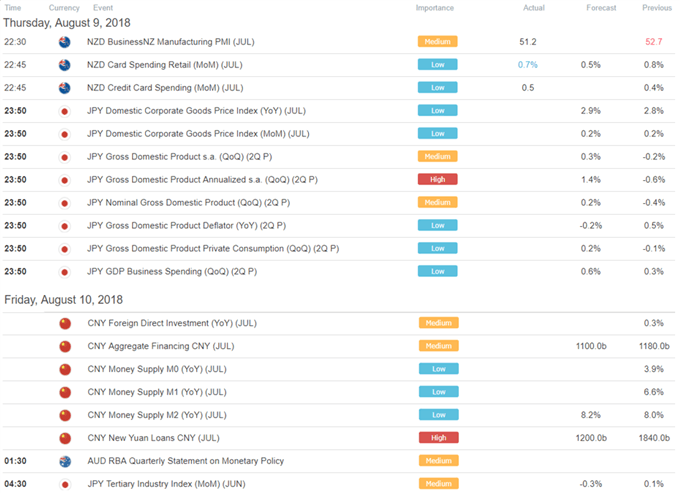

Speaking of Japan, the preliminary estimates of their second quarter GDP figures will cross the wires early into Friday’s Asia trading session. There, annualized growth is expected to clock in at 1.4% q/q from -0.6%. Even if GDP improves, this could have limited implications for the Yen given that the BoJ intends for interest rates to be low for an extend period of time as they struggle to achieve sustainable 2% inflation.

Join our LIVE Japanese GDP Webinar as we cover its impact on the Yen as well as what to expect for the currency going forward!

A mixed performance on Wall Street where the S&P 500 fell 0.14% while the NASDAQ Composite rose 0.04% could translate into sideways price action for Asia/Pacific benchmark indexes. This could be suddenly changed amidst a stray trade wars headline as tensions between the US and China still remain elevated.

DailyFX Economic Calendar: Asia Pacific (all times in GMT)

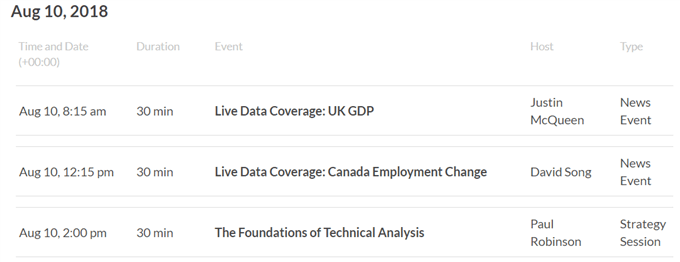

DailyFX Webinar Calendar – CLICK HERE to register (all times in GMT)

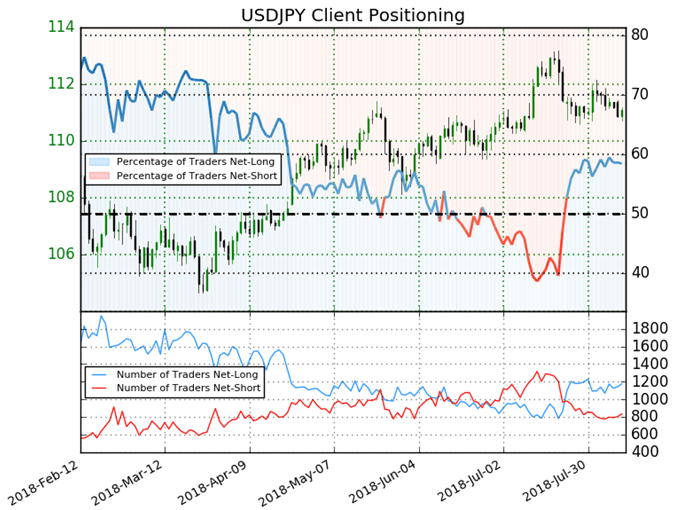

IG Client Sentiment Index Chart of the Day: USD/JPY

CLICK HERE to learn more about the IG Client Sentiment Index

Retail trader data shows 58.4% of traders are net-long with the ratio of traders long to short at 1.41 to 1. In fact, traders have remained net-long since Jul 23 when USD/JPY traded near 111.332; price has moved 0.2% lower since then. The number of traders net-long is 2.0% higher than yesterday and 1.0% higher from last week, while the number of traders net-short is 1.1% higher than yesterday and 0.7% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USD/JPY prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/JPY-bearish contrarian trading bias.

Five Things Traders are Reading:

- What is the NASDAQ FANG Group and Why Does it Matter? by Peter Hanks, Junior Analyst

- DXY Index Hovering Below Fresh Yearly Highs Ahead of July US CPI by Christopher Vecchio, CFA, Sr. Currency Strategist

- US Dollar Price Action Setups Ahead of US Inflation by James Stanley, Currency Strategist

- GBP/USD Price Analysis: British Pound Testing Downtrend Support by Michael Boutros, Currency Strategist

- Dow Pulls Back from Five Month Highs Ahead of US Inflation by James Stanley, Currency Strategist

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter