See our 3Q forecasts for the US Dollar, Oil and Equities in the DailyFX Trading Guides page

Early Asia Session Developments – RBNZ, NZD, AUD/NZD

The New Zealand Dollar depreciated across the board as expected when the RBNZ monetary policy announcement crossed the wires. Heading into the decision, the markets were not anticipating a rate change which put their forward guidance as the key potential driver for NZD. In fact, expectations of policy tightening (as implied by New Zealand bank bill futures) point to Q4 2019 as the next move beforehand.

Those bets were largely disappointed as the Reserve Bank of New Zealand left rates unchanged at 1.75% and pushed back forecasts of an increase to Q3 2020. Indeed, local front-end government bond yields tumbled as the central bank released their August statement. The RBNZ anticipates their official benchmark lending rate to remain at 1.75% through 2019 into 2020.

Additional Comments from the RBNZ:

- Sees inflation rising towards 2% over projection period

- Sees inflation reaching 2% in 1Q 2021 vs 4Q 2020

- Recent moderation in growth could last longer

- Cuts 2Q 2018 growth forecast to 0.5% from 0.8%

- Path of inflation may be bumpy, citing oil and lower NZD

- Direction of next OCR move could be up or down

- Employment it roughly at maximum sustainable level

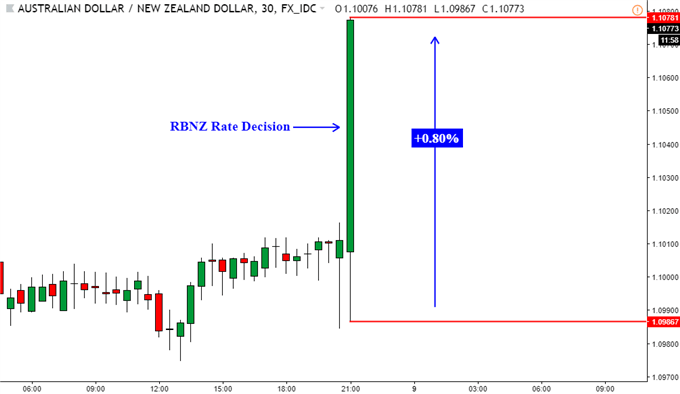

An hour after the announcement, RBNZ Governor Adrian Orr spoke and offered some more details. He said that if growth slows further below potential, they ‘would cut OCR’. Commenting on inflation, Mr. Orr noted that it remaining low gives them scope to keep rates lower for longer. Overall, the relatively dovish RBNZ offered the Australian Dollar upside momentum and AUD/NZD rose as much as 0.8% in the aftermath. You can see the reaction below:

US Session Developments – USD, Crude Oil, S&P 500

The US Dollar depreciated during the second half of Wednesday’s trading session. Its fall coincided with a decline in crude oil prices, the S&P 500 and with US government bond yields. This suggests an overall deterioration in market mood. Keep in mind that the greenback now boasts the highest yield in the majors FX spectrum. Thus, it can now be more prone to a deterioration in risk trends

This occurred as trade tensions between the world’s largest economies increased. After the US imposed $16b in Chinese import tariffs yesterday, China retaliated with imposing 25% in additional tariffs on $16b in US goods on Wednesday. This is set to take effect on August 23. Sentiment-linked oil prices were unable to capitalize on a less-than-expected decline in weekly US crude oil inventories. Those stockpiles contracted 1.3m bbl instead of API estimates calling for a 6.02m contraction.

A Look Ahead – Stocks, Japanese Yen, Australian Dollar

A relatively quiet economic data offering during Thursday’s Asia/Pacific region once again places risk trends as the key driver for markets. The deterioration in sentiment from the US session could echo into local benchmark indexes, sending them lower. This may allow the anti-risk Japanese Yen to gain while the sentiment-linked Australian Dollar rises. NZD could still be weighed down in the aftermath of the RBNZ.

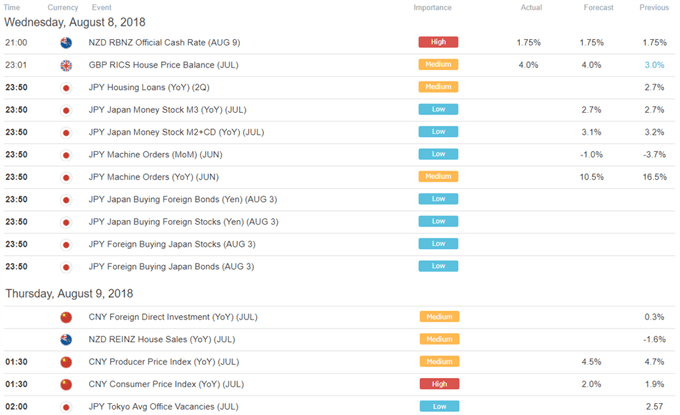

DailyFX Economic Calendar: Asia Pacific (all times in GMT)

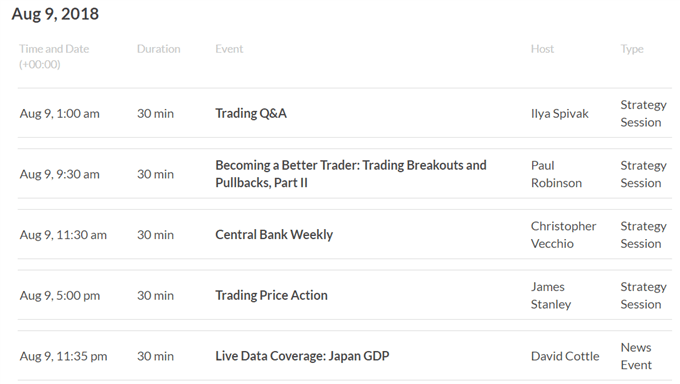

DailyFX Webinar Calendar – CLICK HERE to register (all times in GMT)

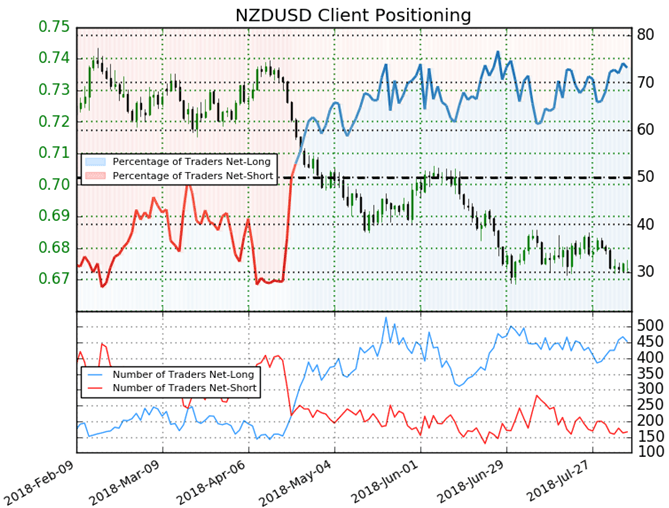

IG Client Sentiment Index Chart of the Day: NZD/USD

CLICK HERE to learn more about the IG Client Sentiment Index

Retail trader data shows 73.2% of NZD/USD traders are net-long with the ratio of traders long to short at 2.73 to 1. In fact, traders have remained net-long since Apr 22 when NZD/USD traded near 0.72691; price has moved 7.3% lower since then. The number of traders net-long is 3.2% lower than yesterday and 10.8% higher from last week, while the number of traders net-short is 5.1% lower than yesterday and 11.7% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests NZD/USD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger NZD/USD-bearish contrarian trading bias.

Five Things Traders are Reading:

- New Zealand Dollar Falters as RBNZ Leaves Rate Unchanged at 1.75% by Peter Hanks, DailyFX Research Team

- Crude Oil Price Forecast: Institutions, Trade War Threats Drop WTI by Tyler Yell, CMT, Forex Trading Instructor

- GBP/USD: Cable Crushed Through 1.3000, More Pain in Store? by James Stanley, Currency Strategist

- Weekly Technical Perspective on Crude Oil Prices (WTI) by Michael Boutros, Currency Strategist

- USD/CNH Appreciation Not a Problem for China, Reserves Figures Show by Christopher Vecchio, CFA, Sr. Currency Strategist

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter