Get the Asia AM Digest every day before Tokyo equity markets open – sign up here !

The British Pound traded broadly higher amid reports that UK and EU negotiators have struck a deal on the amount that the former country will pay to meet its obligations to the regional block before leaving it. The US Dollar likewise advanced as the Senate tax cut proposal advanced out of committee and toward a floor a vote, bringing the prospect of inflation-boosting fiscal stimulus one step closer to realization.

Hopes that a tax cut will boost corporate earnings appeared to bolster overall risk appetite. The benchmark S&P 500 stock index soared and sentiment-linked currencies including the Australian and New Zealand Dollars gained ground against most of their top counterparts (save for Sterling and the greenback). On the other side of the spectrum, the anti-risk Japanese Yen declined. The Euro lost ground as the OECD predicted that the ECB will not raise the baseline interest rate until 2020.

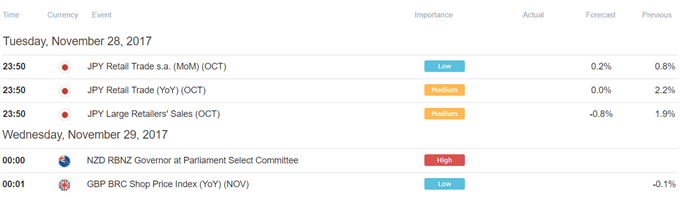

DailyFX Economic Calendar: Asia Pacific (all times in GMT)

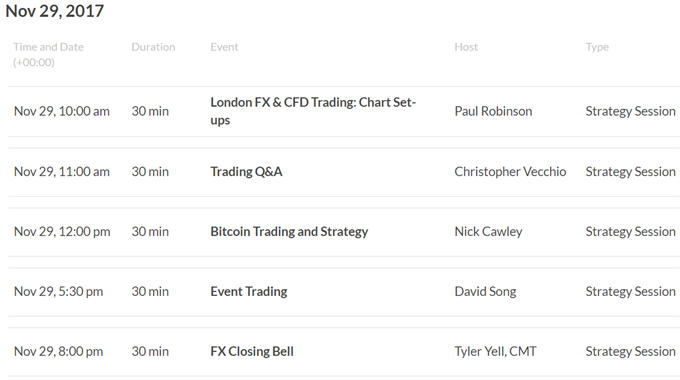

DailyFX Webinar Calendar – CLICK HERE to Register (all times in GMT)

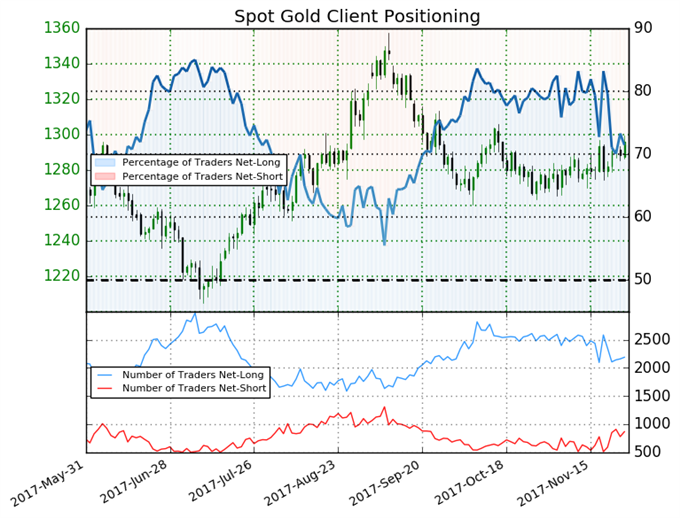

IG Client Sentiment Index Chart of the Day: Gold

CLICK HERE to learn more about the IG Client Sentiment Index

Retail trader data shows 71.5% of traders are net-long gold, with the ratio of traders long to short at 2.5 to 1. The number of traders net-long is 1.6% higher than yesterday and 4.1% lower from last week, while the number of traders net-short is 8.6% higher than yesterday and 3.6% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests gold prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current gold price trend may soon reverse higher despite the fact traders remain net-long.

Five Things Traders are Reading

- Pound Has Violent Brexit Swings, SPX Hits Record Despite North Korea by John Kicklighter, Chief Strategist

- NZD/USD Recovery Vulnerable to Dovish RBNZ Parliament Testimony by David Song, Currency Analyst

- Trading the Majors - Price Action Setups by James Stanley, Currency Strategist

- OECD Sees Strong Short-Term Growth, Housing Bubbles and Rate Hikes by Dylan Jusino, DailyFX Research

- Consumer Sentiment Stands Firm at 17-Year High by Dylan Jusino, DailyFX Research

To get the Asia AM Digest every day before the Tokyo cash equity open, sign up here

To get the US AM Digest every day before the US cash equity open, sign up here

To get both reports daily, sign up here