Talking Points:

- US Nonfarm Payrolls beat expectations marginally, prior revised slightly higher.

- Unemployment Rate rises unexpectedly, but as participation rate rises – a positive development.

- EUR/USD reverses daily gains, AUD/USD moves lower sharply.

The March US labor market report wasn’t a blowout print, but it was good enough all around, posting the fifth month out of the last six with jobs growth >+200K (three-month average is +209K), helping ease concerns over recent weaker economic data. Heading into today, the Federal Reserve Bank of Atlanta’s GDPNow Q1’16 growth forecast was a meager +0.6%.

The jobs report, besides being marginally improved on the headline versus expectations, also contained some encouraging internals. Notably, the March jobs report showed that the participation rate ticked up: more citizens are entering the workforce, and the Unemployment Rate ticked higher; there is evidently still slack in the labor market.

Accordingly, as discussed in this morning’s NFP preview, the US Dollar (via the USDOLLAR Index) needed more than a middling ‘goldilocks’ print to rally on even a >+200K NFP headline. With wage growth accelerating above expectations, the March jobs report, in aggregate, is seen as a step in the right direction for the USDOLLAR Index. Markets may be focused on Fed Chair Janet Yellen’s recent commentary about rate rises being gradual, but the data today fits closer to the view that rates will rise in the first half of this year.

Here are the data that’s boosting the US Dollar this morning:

- USD Change in Nonfarm Payrolls (MAR): +215K versus +205K expected, from +245K (revised higher from +242K).

- USD Unemployment Rate (MAR): 5.0% versus 4.9% expected unch.

- USD Average Hourly Earnings (MAR): +2.3% versus +2.2% expected unch (y/y).

- USD Labor Force Participation (MAR): 63.0% versus 62.9% expected unch.

See the DailyFX economic calendar for Friday, April 1, 2016

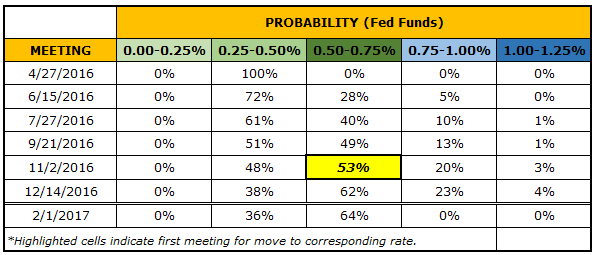

Table 1: Fed Funds Futures Contract Implied Probabilities: April 1, 2016

Following the data, market participants are taking the figures as a collective sign that the Federal Reserve will be raising rates sooner than previously anticipated; November is currently being priced-in as the most likely period for the next rate hike. There is currently a 53% chance of a rate hike in November, up from 45% pre-NFP this morning. Rate expectations for a hike in the first half of this year have edged up as well, from 20% to 28% after the data.

Chart 1: EUR/USD 1-minute Chart: April 1, 2016 Intraday

For now, in the immediate wake of the data, the US Dollar reversed some of its losses from earlier this week, with its recent intraday gains (via the USDOLLAR Index) moving back towards its highs on Wednesday. EUR/USD was rather volatile around the print, trading from $1.1421 ahead of the release to as low as $1.1385 thereafter; in between, EUR/USD spiked as high as $1.1434. At the time this report was written, EUR/USD was trading at $1.1395. With FX volatility edging higher again, it’s the right time to review risk management principles to protect your capital.

Read more: Preview for March NFPs and Setups for USD-pairs

If you haven't yet, read the Q2'16 Euro Forecast, "EUR/USD Stuck in No-Man’s Land Headed into Q2’16; Don’t Discount ’Brexit’," as well as the rest of all of DailyFX's Q2'16 quarterly forecasts.

--- Written by Christopher Vecchio, Currency Strategist

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form