USD PRICE OUTLOOK: US DOLLAR EYES UPCOMING FED MEETING

- USD price action declines broadly as FX traders await the September Fed meeting

- The Fed could reignite US Dollar weakness if central bank officials echo dovish leanings

- EUR/USD and GBP/USD could spur US Dollar volatility amid renewed Brexit drama

The US Dollar looks positioned to take the hot seat this week in light of the September Fed meeting on tap. USD price action is trading defensively headed into the Federal Reserve announcement scheduled to cross market wires this Wednesday, September 16 at 18:00 GMT.

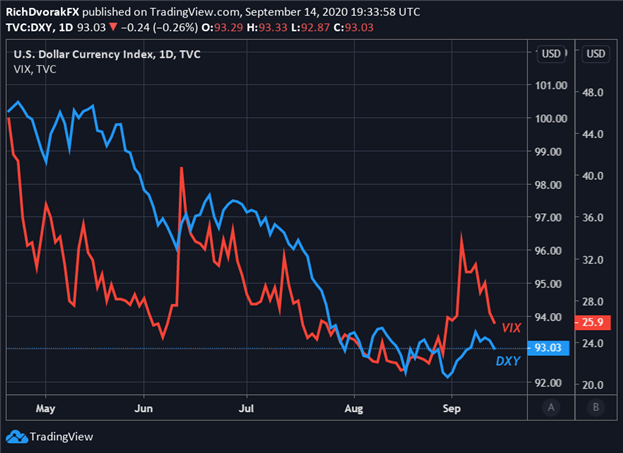

DXY INDEX - US DOLLAR PRICE CHART: DAILY TIME FRAME (20 APR TO 14 SEP 2020)

Chart created by @RichDvorakFX with TradingView

The DXY Index seems like it wants to resume its bearish trend developed since the broad-based US Dollar peaked in May. USD price action has potential to weaken further if FOMC officials agree to echo the status quo of accommodative monetary policy and loose financial conditions.

The Fed could weigh negatively on the US Dollar if the central bank reiterates its commitment to keeping markets flush with liquidity and letting inflation run hot. On the other hand, the Greenback has potential to catch a bid if the September Fed meeting prompts risk aversion and causes the S&P 500 VIX Index to rise sharply.

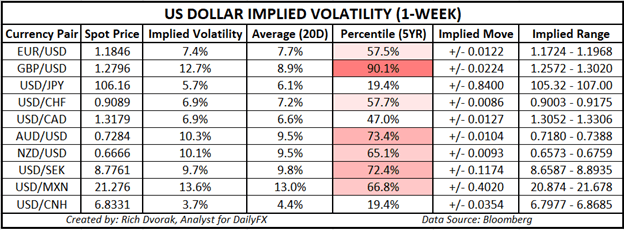

USD PRICE OUTLOOK - US DOLLAR IMPLIED VOLATILITY TRADING RANGES (1-WEEK)

Despite the Fed meeting on deck this week, expected US Dollar currency volatility is relatively muted. This is indicated by 1-week US Dollar implied volatility readings clocked as of Friday’s close, which look low when considering potential event risk surrounding a scheduled central bank decision. Broadly speaking, this might suggest that FX options traders expect subdued movement in the US Dollar around the FOMC statement this week.

GBP/USD implied volatility is expected to be the most volatile major currency pair this week with an implied volatility reading of 12.7%, which compares to its 20-day average reading of 8.9% and ranks in the top 90th percentile of measurements taken over the last five years.

Potential for heightened market activity in the Pound-Dollar largely surrounds the latest Brexit drama and upcoming Fed meeting. Options-implied trading ranges are calculated using 1-standard deviation (i.e. 68% statistical probability price action is contained within the implied trading range over the specified time frame).

Keep Reading: Gold Price Eyes Bullish Breakout as USD Drops Ahead of FOMC

-- Written by Rich Dvorak, Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight