Oil Price Talking Points

The price of oil trades to a fresh monthly high ($87.95) despite another unexpected rise in US inventories, and an overbought reading in the Relative Strength Index (RSI) is likely to be accompanied by higher crude prices like the behavior seen earlier this month.

Crude Oil Forecast: Overbought RSI to Accompany Higher Crude Prices

The recent pullback in the price of oil triggered a textbook sell signal in the RSI as the oscillator slipped below 70, but the decline has turned out to be a correction in the broader trend as it appears to be on track to test the October 2014 high ($92.96).

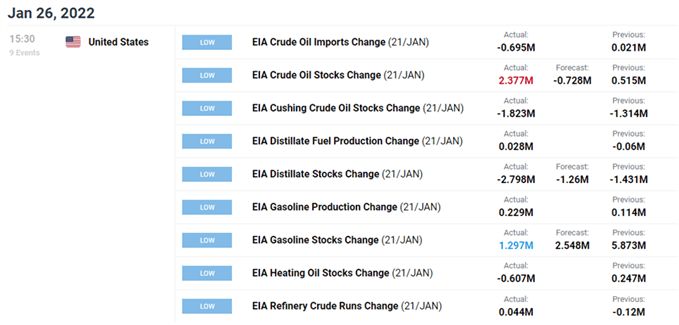

The recovery in the price of oil is undeterred by the 2.377M rise in US inventories as it extends the advance from the weekly low ($81.90), and current market conditions may keep crude prices afloat as the Organization of Petroleum Exporting Countries (OPEC) appear to be on a preset course in restoring production to pre-pandemic levels.

It remains to be seen if OPEC and its allies will respond to the rise US stockpiles as the most recent Monthly Oil Market Report (MOMR) emphasizes that “in 2022, world oil demand growth has been kept unchanged at 4.2 mb/d with total global consumption at 100.8 mb/d,” and the group may stay on track to “adjust upward the monthly overall production by 0.4 mb/d” amid the tepid recovery in US output.

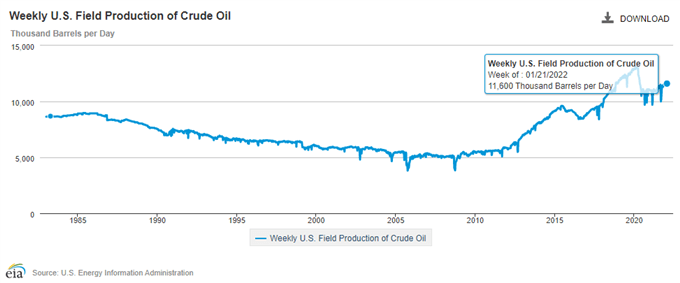

A deeper look at the fresh figures from the Energy Information Administration (EIA) shows weekly field production narrowing to 11,600K in the week ending January 21 after printing at 11,700 for two weeks, and the weakness in US output may continue to act as a backstop for the price of oil as evidence of limited supply are met with expectations for stronger demand.

With that said, the price of oil may exhibit a bullish trend in 2022 as OPEC and its allies remain in no rush to restore production to pre-pandemic levels, and an overbought reading in the Relative Strength Index (RSI) is likely to be accompanied by higher crude prices like the behavior seen earlier this month.

Oil Price Daily Chart

Source: Trading View

- Keep in mind, the price of oil cleared the July high ($76.98) after defending the May low ($61.56), with crude trading to a fresh 2021 high ($85.41) in October, which pushed the Relative Strength Index (RSI) above 70 for the first time since July.

- A similar development materialized in January as the price of oil cleared the 2021 high ($85.41), and another move above 70 in the oscillator is likely to be accompanied by higher crude prices like the behavior seen earlier this month.

- Need a break/close above the $88.10 (23.% expansion) region to bring the $91.60 (100% expansion) area on the radar, with a break above the October 2014 high ($92.96) opening up the Fibonacci overlap around $93.50 (61.8% retracement) to $94.90 (38.2% retracement).

- However, lack of momentum to break/close above the $88.10 (23.% expansion) region may push the price of oil back towards $84.20 (78.6% expansion), with the next area of interest coming in around $81.50 (100% expansion).

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong