EUR/USD Rate Talking Points

EUR/USD has broken out of the opening range for December following the Federal Reserve’s last meeting for 2020, and the exchange rate may continue to appreciate as long as the Relative Strength Index (RSI) holds in overbought territory.

EUR/USD Rates to Watch Following Break of Monthly Opening Range

EUR/USD continues to trade to fresh yearly highs in December as the Federal Open Market Committee (FOMC) remains on track to “increase our holdings of Treasury securities by at least $80 billion per month and of agency mortgage backed securities by at least $40 billion per month,” and key market trends may keep the exchange rate afloat as the US Dollar still reflects an inverse relationship with investor confidence.

Looking ahead, it seems as though the FOMC will continue to endorse a dovish forward guidance as the central bank remains “prepared to adjust the stance of monetary policy as appropriate,” and it remains to be seen if Chairman Jerome Powell and Co. will take additional steps at its next interest rate decision on January 27 as US lawmakers struggle to pass another round of fiscal stimulus.

Until then, swings in risk appetite may continue to sway EUR/USD even though the European Central Bank (ECB) expands the pandemic emergency purchase programme (PEPP) by EUR 500B to EUR 1.850 trillion ahead of 2021, and the tilt in retail sentiment also looks poised to persist as the crowding behavior from earlier this year resurfaces.

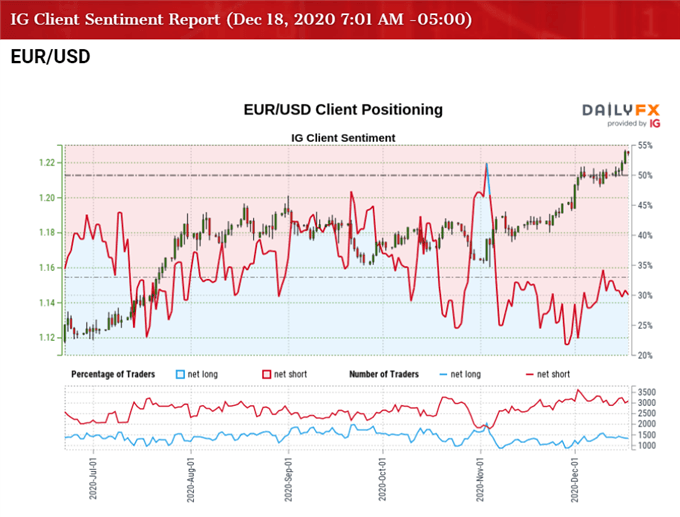

The IG Client Sentiment report shows 32.71% of traders are net-long EUR/USD, with the ratio of traders short to long standing at 2.06 to 1. The number of traders net-long is 4.76% higher than yesterday and 3.52% higher from last week, while the number of traders net-short is 1.28% lower than yesterday and 1.75% lower from last week.

The rise in net-long position comes as EUR/USD breaks out of the opening range for December, while the decline in net-short interest has helped to alleviate the tilt in retail sentiment as only 30.60% of traders were net-long EUR/USD during the previous week.

With that said, the consolidation from the September high (1.2011) appears to have been an exhaustion in the EUR/USD rally rather than a change in trend as the crowding behavior from earlier this resurfaces, and the exchange rate may continue to appreciate as long as the Relative Strength Index (RSI) tracks the upward trend from November to hold in overbought territory.

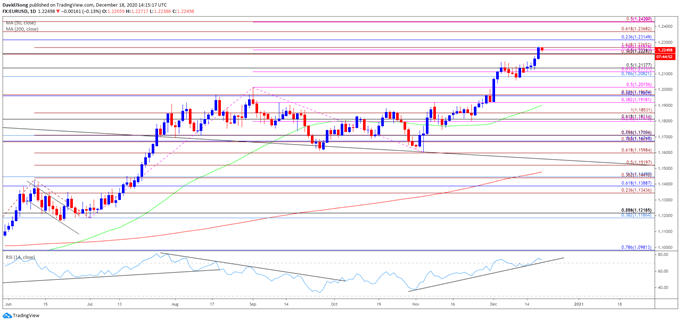

EUR/USD Rate Daily Chart

Source: Trading View

- Keep in mind, a ‘golden cross’ materialized in EUR/USD towards the end of June as the 50-Day SMA (1.1900) crossed above the 200-Day SMA (1.1479), with both moving averages tracking a positive slope ahead of 2021.

- The correction from the September high (1.2011) proved to be an exhaustion in the bullish price action rather than a change in trend following the string of failed attempts to close below the 1.1600 (61.8% expansion) to 1.1640 (23.6% expansion) region, with the Relative Strength Index (RSI) highlighting a similar dynamic as it broke out of the downward trend carried over from the end of July to recover from its lowest readings since March.

- The break/close above the 1.1960 (38.2% retracement) to 1.1970 (23.6% expansion) region has pushed EUR/USD to a fresh yearly highs in December, but need a close above the Fibonacci overlap around 1.2220 (50% retracement) to 1.2270 (161.8% expansion) to open up the 1.2320 (23.6% retracement) to 1.2370 (61.8% expansion) region.

- The April 2018 high (1.2414) comes up next followed by the 1.2430 (50% expansion) area.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong