Australian Dollar Talking Points

AUD/USD struggles to retain the rebound from the September low (0.7006) as the US Dollar appreciates on the back of waning risk appetite, and shifts in investor confidence may continue to influence the exchange rate as key market trends get carried into October.

AUD/USD Rate Swayed by Swings in Risk Appetite with RBA on Hold

AUD/USD broadly tracks the recent weakness in global equity prices as the Reserve Bank of Australia (RBA) interest rate decision sparks a limited reaction, but the decline from the yearly high (0.7414) may turn out to be an exhaustion in the bullish trend rather than a change in market behavior as Governor Philip Lowe and Co. appear to be in no rush to alter the path for monetary policy.

Looking ahead, the update to the federal budget may keep the RBA on the sidelines as Treasurer Josh Frydenberg plans to deliver an “additional $17.8 billion in personal income tax relief to support the economic recovery, including an additional $12.5 billion over the next 12 months,” with the fresh figures for 2020-21 bringing the “overall support to $507 billion,including $257 billion in direct economic support.”

In turn, the RBA may rely on its current tools to insulate the economy after tweaking the Term Funding Facility (TFF) in September, and the central bank may stick to the same script at the next meeting on November 3 as “the Board continues to consider how additional monetary easing could support jobs as the economy opens up further.”

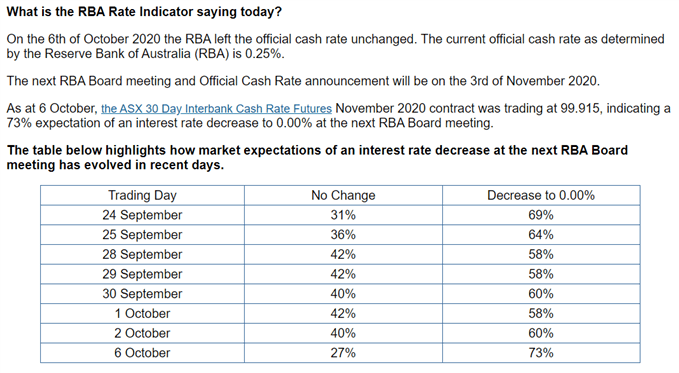

However, market participants have pushed out expectations for monetary stimulus as the ASX 30 Day Interbank Cash Rate Futures reflect a greater than 70% probability for a rate cut in November, and speculation for lower interest rates paired with a further deterioration in risk appetite may keep AUD/USD under pressure as key market trends remain in place.

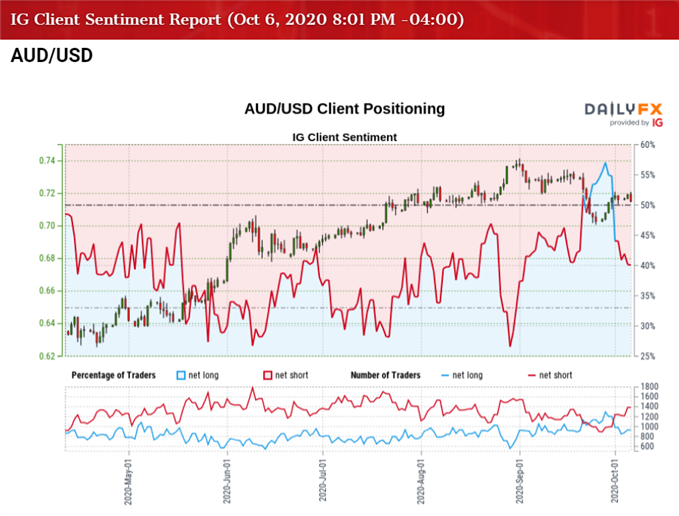

At the same time, the crowding behavior in AUD/USD has resurfaced in October as the IG Client Sentiment report shows 41.58% of traders are now net-long the pair, with the ratio of traders short to long at 1.40 to 1. The number of traders net-long is 6.63% higher than yesterday and 12.97% lower from last week, while the number of traders net-short is 2.89% higher than yesterday and 37.62% higher from last week.

The decline in net-long position could be an indication of stop-loss orders getting triggered as AUD/USD struggles to retain the advance from the September low (0.7006), but the rise in net-short interest has spurred a further tilt in retail sentiment as 48.88% of traders were net-long the pair during the previous week.

With that said, the pullback from the yearly high (0.7414) may turn out to be an exhaustion in the bullish trend rather than a change in market behavior as the crowding behavior in AUD/USD reappears, with the Relative Strength Index (RSI) highlighting a similar dynamic as it reverses from oversold territory and breaks out a downward trend carried over from the previous month.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

AUD/USD Rate Daily Chart

Source: Trading View

- Keep in mind, the advance from the 2020 low (0.5506) gathered pace as AUD/USD broke out of the April range, with the exchange rate clearing the January high (0.7016) in June as the Relative Strength Index (RSI) pushed into overbought territory.

- AUD/USD managed to clear the June high (0.7064) in July even though the RSI failed to retain the upward trend from earlier this year, with the exchange rate pushing to fresh yearly highs in August and September to trade at its highest level since 2018.

- The RSI instilled a bullish outlook for AUD/USD during the same period as it threatened the downward trend from earlier this year to push into overbought territory for the fourth time in 2020, but a textbook sell-signal emerged as the indicator quickly slipped back below 70.

- The RSI established a downward trend in September as the indicator fell to its lowest level since April, but the bearish momentum seems to be abating as the RSI fails to push into oversold territory to reflect the extreme readings seen in March.

- As a result, the pullback from the yearly high (0.7414) may turn out to be an exhaustion in the bullish trend rather than a change in AUD/USD behavior as the RSI breaks out of the downward trend carried over from the previous month.

- However, the string of failed attempts to close above the 0.7180 (61.8% retracement) region has pushed AUD/USD back towards the Fibonacci overlap around 0.7090 (78.6% retracement) to 0.7140 (23.6% retracement), with a break of the September low (0.7006) opening up the 0.6970 (23.6% expansion) region.

- Need a close above 0.7180 (61.8% retracement) to bring the 0.7270 (23.6% expansion) region on the radar, with the next area of interest coming in around 0.7370 (38.2% expansion) to 0.7390 (38.2% expansion), which largely lines up with the 2020 high (0.7414).

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong