Canadian Dollar Talking Points

USD/CAD trades in a narrow range following the failed attempt to test the March/June low (1.3315), but the Federal Reserve interest rate decision may sway the exchange rate as the central bank is scheduled to release the updated Summary of Economic Projections (SEP).

USD/CAD Outlook Hinges on Fed Summary of Economic Projections (SEP)

USD/CAD pulled back from the monthly high (1.3259) as the Bank of Canada (BoC) pledged to carry out its “large-scale asset purchases of at least $5 billion per week,” and it seems as though the central bank will retain the current policy throughout the remainder of the year as Governor Tiff Macklem and Co. expect the “strong reopening phase to be followed by a protracted and uneven recuperation phase.”

The Federal Open Market Committee (FOMC) may follow a similar approach as the central bank mulls an outcome-based approach versus a calendar-based forward guidance for monetary policy, and more of the same from Chairman Jerome Powell and Co. may generate a limited market reaction as the committee vows to “increase its holdings of Treasury securities and agency residential and commercial mortgage-backed securities at least at the current pace.”

It remains to be seen if the Summary of Economic Projections (SEP) will indicate a looming shift in the monetary policy outlook as the Federal Reserve plans to “achieve inflation that averages 2 percent over time,” and the update may produce headwinds for the US Dollar if the interest rate dot-plot shows a downward revision in the longer-run forecast for the Fed Funds rate.

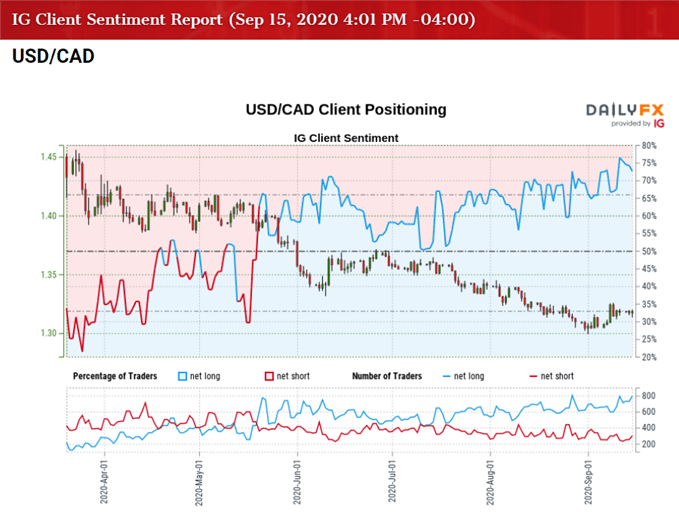

Meanwhile, the crowding behavior in USD/CAD persists ahead of the FOMC rate decision even though the Fed’s balance sheet climbs back above $7 trilling in August, with retail traders net-long the pair since mid-May.

The IG Client Sentiment report shows 71.76% of traders are still net-long USD/CAD, with the ratio of traders long to short at 2.54 to 1. The number of traders net-long is 1.77% lower than yesterday and 20.16% higher from last week, while the number of traders net-short is 0.65% lower than yesterday and 3.39% higher from last week.

The rise in net-short position comes following the failed attempt to test the March/June low (1.3315), but the pick up in net-long interest suggests the tilt in retail sentiment will persist over the coming days as 61.34% of traders were net-long USD/CAD during the previous week.

With that said, the crowding behavior may continue to coincide with the bearish trend in USD/CAD, and the advance from the monthly low (1.2994) may end up being an exhaustion of the bearish price action rather than a change in market behavior as a bear-flag formation emerges in the DXY index.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

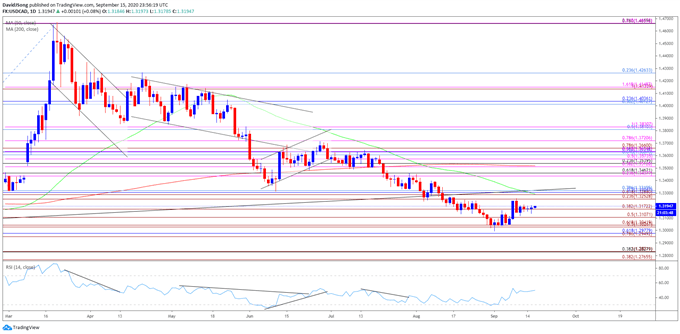

USD/CAD Rate Daily Chart

Source: Trading View

- Keep in mind, the USD/CAD correction from the 2020 high (1.4667) managed to fill the price gap from March, with the decline in the exchange rate pushing the Relative Strength Index (RSI) into oversold territory for the first time since the start of the year.

- Nevertheless, USD/CAD reversed from the March low (1.3315) in June, with both price and the RSI carving an upward trend during the month, but the bullish formations have been largely negated as the exchange rate snapped the range bound price action during the first half of July.

- USD/CAD managed to track the June range throughout July as the RSI broke out of a downward trend, but the failed attempt to push back above the 1.3440 (23.6% expansion) to 1.3460 (61.8% retracement) region has spurred a break of the March/June low (1.3315) even though the momentum indicator failed to push into oversold territory.

- The decline from the August high (1.3451) briefly pushed the RSI below 30, but lacked the momentum to produce a test of the January low (1.2957) as the indicator failed to reflect the extreme reading in June, with the oscillator quickly recovering from oversold territory.

- Nevertheless, the recent rebound in USD/CAD appears to have stalled ahead of the March/June low (1.3315), with the exchange rate trading in a narrow range following the failed attempt to close above the 1.3250 (23.6% expansion) region.

- Lack of momentum to hold above the 1.3170 (38.2% expansion) area may push USD/CAD back towards the 1.3110 (50% expansion) region, with the next area of interest coming in around1.3030 (50% expansion) to 1.3040 (61.8% expansion) followed by the Fibonacci overlap around 1.2950 (78.6% expansion) to 1.2980 (61.8% retracement).

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong