Gold Price Talking Points

The price of gold appears to be staging a V-shape rebound as it attempts to get back above the psychologically important $2000 mark, and the Federal Open Market Committee (FOMC) Minutes may do little to derail the bullish price action as the crowding behavior in the US Dollar looks poised to persist.

Gold Price Stages V-Shape Rebound with Federal Reserve Minutes on Tap

Prior to the pullback from the record high ($2075), the price of gold marked the longest stretch of gains since 2006 as it increased for nine consecutive weeks, and the macroeconomic backdrop may keep the precious metal afloat as it trades to fresh yearly highs during every single month so far in 2020.

As a result, the FOMC Minutes may fuel the rebound from the monthly low ($1863) as Chairman Jerome Powell and Co. remain “committed to using our full range of tools to support the economy,” and the statement may indicate more of the same for the next interest rate decision on September 16 as the committee shows little intentions of scaling back its non-standard measures.

It seems as though the FOMC is in no rush to alter the course for monetary policy as the central bank extends its lending facilities through the end of the year, and the low interest rate environment along with the ballooning central bank balance sheets may continue to act as a backstop for the price of gold as market participants look for an alternative to fiat-currencies.

Meanwhile, the net-long US Dollar bias from July looks poised to persist even though the DXY index trades to a fresh yearly low (92.13) in August, with the IG Client Sentiment report still showing retail traders net-long USD/CHF, USD/CAD and USD/JPY, while the crowd remains net-short GBP/USD, AUD/USD, EUR/USD and NZD/USD.

With that said, current market conditions keep the price of gold afloat as it trades to fresh yearly highs during every single month so far in 2020, and the pullback from the record high ($2075) may prove to be an exhaustion in the bullish behavior rather than a change in trend as the Relative Strength Index (RSI) recovers from its lowest reading since June.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

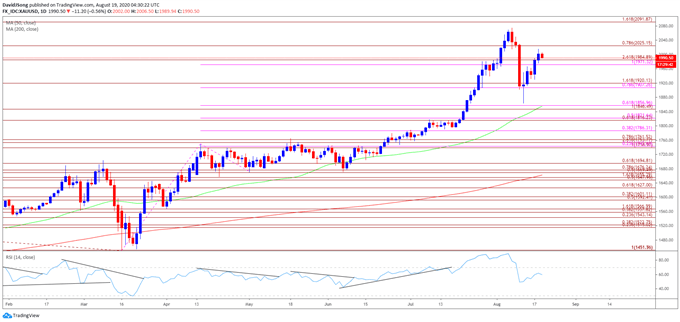

Gold Price Daily Chart

Source: Trading View

- The technical outlook for the price of gold remains constructive as it trades to fresh yearly highs during every single month so far in 2020, with the bullish behavior also taking shape in August as precious metal tags a new 2020 high ($2075).

- The price of gold cleared the previous record high recorded in September 2011 ($1921) even though the Relative Strength Index (RSI) failed to retain the upward from June, but the indicator registered a new extreme reading (88) for 2020 as the oscillator pushed into overbought territory for the third time this year.

- In turn, therecent sell-signalin the RSI could be indicative of a potential exhaustion in the bullish behavior rather than a change in trend as it recovers from its lowest reading since June.

- Will keep a close eye on the RSI as it reverses course and approaches overbought territory, with a break above 70 likely to be accompanied by higher gold prices amid the behavior seen in July.

- The V-shape rebound from the monthly low ($1863) may gather pace as the price of gold carves a series of higher highs and lows this week, but need a break/close above the $2025 (78.6% expansion) region to bring the record high ($2075) on the radar, with the next area of interest coming in around $2092 (161.8% expansion).

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong