New Zealand Dollar Talking Points

NZD/USD struggles to retain the rebound from earlier this week as the update to New Zealand’s Gross Domestic Product (GDP) report showed the first contraction since 2009, and the exchange rate may continue to give back the advance from the start of the month as the Relative Strength Index (RSI) appears to be on track to threaten the bullish formation from March.

NZD/USD RSI Approaches Trendline Support Ahead of RBNZ Meeting

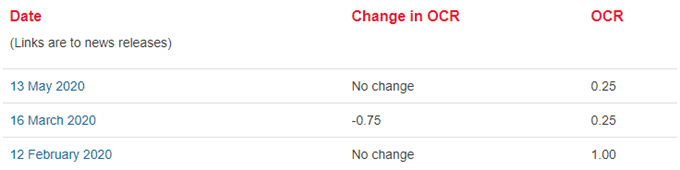

NZD/USD manages to retain the range bound price action from earlier this week amid the limited reaction to the semi-annual testimony with Federal Reserve Chairman Jerome Powell, and the exchange rate may continue to consolidate ahead of the Reserve Bank of New Zealand (RBNZ) interest rate decision on June 24 as the central bank is expected to keep the official cash rate (OCR) at the record low of 0.25%.

Source: RBNZ

However, the 1Q GDP report may put pressure on the RBNZ to further support the New Zealand economy as the growth rate contracts 1.6% versus projections for a 1.0% decline, and the development may undermine the consensus forecast put together by the New Zealand Institute of Economic Research (NZIER) as the group emphasizes that “the growth outlook for the New Zealand economy is V-shaped, with a sharp decline in activity forecast for the coming year, followed by a strong rebound.”

As a result, the RBNZ may retain a dovish forward guidance after expanding the Large Scale Asset Purchase (LSAP) programin May to NZ$60 billion from NZ$33 billion, and the central bank may continue to utilize its balance sheet in 2020 as the NZIER’s Shadow Board reveals that “opponents of a negative OCR consider QE (quantitative easing), as a support to stimulatory fiscal policy, to be a more effective way to support economic activity.”

In turn, it remains to be seen if the RBNZ will keep the door open for a negative interest rate policy (NIRP) as Chief Economist Yuong Ha reveals that “we’ve given the banking system until the end of the year to get ready so that the option is there for the Monetary Policy Committee in a year’s time.”

With that said, speculation for a NIRP in New Zealand may drag on NZD/USD as Federal Reserve Chairman Jerome Powell tames bets for negative US interest rates, and recent price action warns of a potential shift in market behavior as the Relative Strength Index (RSI) falls back from overbought territory and appears to be on track to threaten the bullish formation from March.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

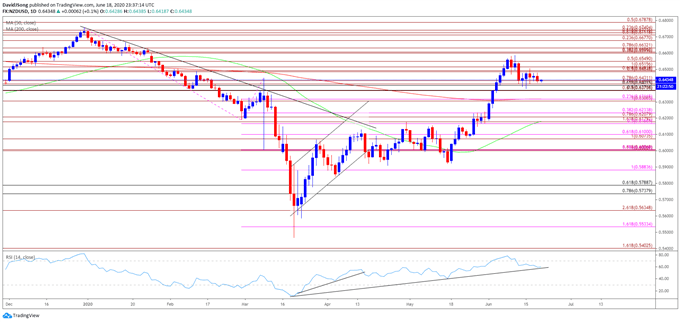

NZD/USD Rate Daily Chart

Source: Trading View

- Keep in mind, NZD/USD has failed to retain the range from the second half of 2019 as the decline from earlier this year produced a break of the October low (0.6204), with a ‘death cross’ taking shape in March as the 50-Day SMA (0.6182) crossed below the 200-Day SMA (0.6318).

- Nevertheless, NZD/USD managed to push above the February high (0.6503) earlier this month as the Relative Strength Index (RSI) extends the upward trend from earlier this year, but the indicator may highlight a potential shift in market behavior as the oscillator falls back from overbought territory and comes up against trendline support.

- In turn, the advance from the March low (0.5469) may continue unravel amid the lack of momentum to push above the Fibonacci overlap around 0.6600 (38.2% expansion) to 0.6630 (78.6% expansion), with a break/close below the 0.6400 (61.8% retracement) to 0.6430 (78.6% expansion) region bringing the 0.6370 (50% retracement) region on the radar.

- Next area of interest comes in around 0.6310 (100% expansion) to 0.6320 (23.6% expansion), which lines up with the 200-Day SMA (0.6318),followed by the Fibonacci overlap around 0.6170 (50% expansion) to 0.6230 (38.2% expansion).

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong