Gold Price Talking Points

The price of gold trades in a narrow range as Federal Reserve Chairman Jerome Powell largely refers to the June policy statement in front of US lawmakers, but current market conditions may keep the precious metal afloat as the pullback from the yearly high ($1765) reverses ahead of the May low ($1670).

Gold Price Holds Steady as Fed Pledges to Purchase at ‘Current Pace’

The price of gold has traded to fresh yearly highs during every single month so far in 2020, and it remains to be seen if the bullish behavior will persist in June amid the limited reaction to the Fed testimony.

Nevertheless, the prepared remarks for Congress suggest the Federal Open Market Committee (FOMC) has little intention of deploying more non-standard measures even though the central bank remains “committed to using our full range of tools” as Chairman Powell insists that “when this crisis is behind us, we will put them away.”

It seems as though the FOMC will carry out a wait-and-see approach as the committee vows to “increase our holdings of Treasury securities and agency mortgage-backed securities over coming months at least at the current pace,” and the central bank may stick to the same script at the next interest rate decision on July 29 as Fed officials pledge to “evaluate our monetary policy stance and communications as more information about the trajectory of the economy becomes available.”

In turn, Chairman Powell and Co. may continue to tame speculation for a yield-curve control program as “whether such an approach would usefully complement our main tools remains an open question,” and the FOMC may scale back the dovish forward guidance as the update to the Summary of Economic Projections (SEP) show “a general expectation of an economic recovery beginning in the second half of this year.”

With that said, the FOMC appears to be moving to the sidelines afterexpanding the scope of the Main Street Lending Program “to allow more small and medium-sized businesses to be able to receive support,” but the low interest rate environment along with the ballooning central bank balance sheets may continue to act as a backstop for the price of goldas marketparticipants look for an alternative to fiat-currencies.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

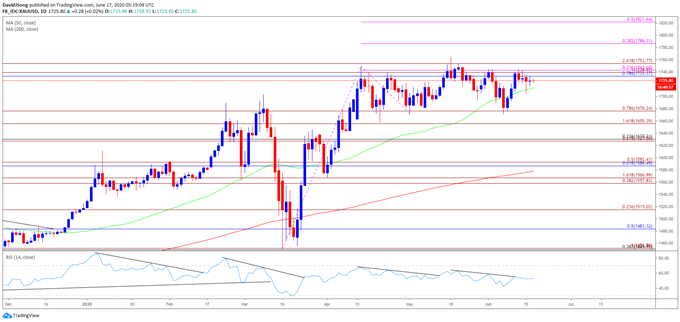

Gold Price Daily Chart

Source: Trading View

- The opening range for 2020 instilled a constructive outlook for the price of gold as the precious metal cleared the 2019 high ($1557), with the Relative Strength Index (RSI) pushing into overbought territory during the same period.

- A similar scenario materialized in February, with the price of gold marking the monthly low ($1548) during the first full week, while the RSI broke out of the bearish formation from earlier this year to push back into overbought territory.

- However, the monthly opening range for March as less relevant amid the pickup in volatility, with the decline from the monthly high ($1704) leading to a break of the January low ($1517).

- Nevertheless, the reaction to the former-resistance zone around $1450 (38.2% retracement) to $1452 (100% expansion) instilled a constructive outlook for bullion especially as the RSI reversed course ahead of oversold territory and broke out of the bearish formation from February.

- In turn, gold cleared the March high ($1704) to tag a new yearly high ($1748) in April, with the bullish behavior also taking shape in May as the precious metal traded to a fresh 2020 high ($1765).

- The bullish behavior may persist in June as the price of gold holds above the May low ($1670), with the RSI highlighting a similar dynamic as the indicator attempts to break out of the negative slope from the previous month.

- Failure to break/close below the $1676 (78.6% expansion) region has pushed the price of gold towards the monthly high ($1746), but waiting for a break/close above the Fibonacci overlap around $1733 (78.6% retracement) to $1743 (23.6% expansion) to bring the $1754 (261.8% expansion) region on the radar.

- Next area of interest coming in around $1786 (38.2% expansion) followed by the 2012 high ($1796).

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong