EUR/USD Rate Talking Points

EUR/USDpulls back from a fresh weekly high (1.0897) as Federal Reserve Chairman Jerome Powell tames speculation for a negative interest rate policy (NIRP), but the exchange rate may trade within a more defined range as the decline from earlier this month fails to produce a test of the April low (1.0727).

EUR/USD Rebound Fizzles as Fed Chairman Powell Tames Bets for NIRP

EUR/USD is little changed from earlier this week as Chairman Powell insists that “the committee’s view on negative rates really has not changed,” with the central bank head going onto say that “it’s not something that we’re considering” even as President Donald Trump pushes for negative US interest rates.

Nevertheless, Chairman Powell warns that the economic shock from COVID-19 “may require additional policy measures” as major cities like New York remain on lockdown, and it seems as though the Federal Open Market Committee (FOMC) will continue endorse a dovish forward guidance for monetary policy as the central bank head pledges to “use our tools to their fullest until the crisis has passed and the economic recovery is well under way.”

However, the FOMC may carry out a wait-and-see approach over the coming months as Fed officials stand “ready to address a range of possible outcomes,” and Chairman Powell and Co. may merely attempt to buy time at the next interest rate decision on June 10 as the“overall policy response to date has provided a measure of relief and stability, and will provide some support to the recovery when it comes.”

It seems as though the European Central Bank (ECB) will take a similar approach despite the German Constitutional Court ruling as President Christine Lagarde insists the central bank “will do everything necessary within our mandate to support the recovery.”

The response from ECB officials suggest the central bank will continue to expand its balance sheet throughout 2020 as board member Isabel Schnabel emphasizes that the Governing Council is “undeterred in our willingness and ability to act,” but it remains to be seen if President Lagarde and Co. will further support the monetary union as Italy passes a EUR 55B fiscal stimulus program.

In turn, the ECB may also endorse a dovish forward guidance at its next meeting on June 4, but the Euro may underperform against its US counterpart in the current environment as the Governing Council reiterates that Euro Area interest rates are expected to “remain at their present or lower levels until we have seen the inflation outlook robustly converge to a level sufficiently close to, but below, 2%.”

With that said, the Euro may face headwinds throughout 2020, but EUR/USD may trade within a more defined range in May as the decline from earlier this month fails to produce a test of the April low (1.0727).

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss key themes and potential trade setups surrounding foreign exchange markets.

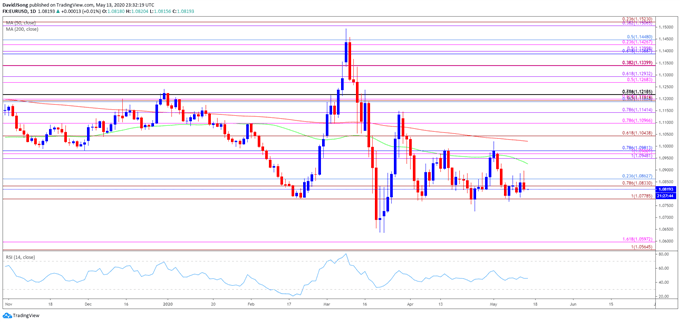

EUR/USD Rate Daily Chart

Source: Trading View

- Keep in mind, the monthly opening range has been a key dynamic for EUR/USD in the fourth quarter of 2019 as the exchange rate carved a major low on October 1, with the high for November occurring during the first full week of the month, while the low for December happened on the first day of the month.

- The opening range for 2020 showed a similar scenario as EUR/USD marked the high of the month on January 2, with the exchange rate carving the February high during the first trading day of the month.

- However, the opening range for March was less relevant amid the pickup in volatility, with the pullback from the yearly high (1.1495) producing a break of the February low (1.0778) as the exchange rate slipped to a fresh 2020 low (1.0636).

- Nevertheless, EUR/USD may trade within a more defined range in May amid the failed attempt to test the 1.1040 (61.8% expansion) region, which lines up with the April high (1.1039), while the decline from earlier this month appears to have stalled ahead of the April low (1.0727).

- In turn, EUR/USD may continue to track the April range amid the lack of momentum to break/close below the 1.0780 (100% expansion) region, with a move above the 1.0830 (78.6% expansion) to 1.0860 (23.6% retracement) area bringing the Fibonacci overlap around 1.0950 (100% expansion) to 1.0980 (78.6% retracement) on the radar.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong