Gold Price Talking Points

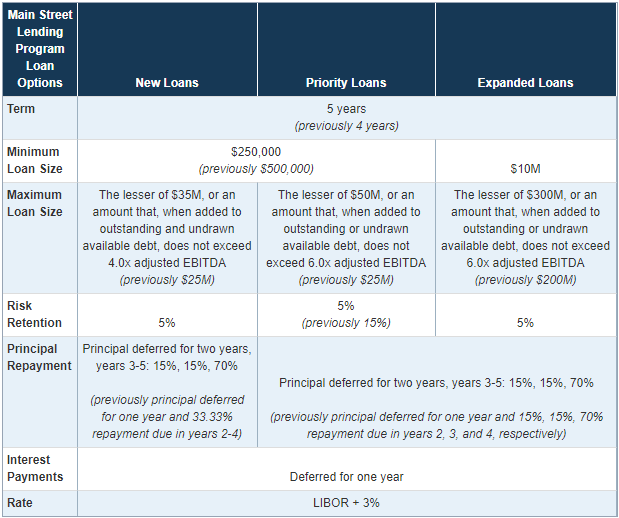

The price of gold retraces the decline following the unexpected rise in US Non-Farm Payrolls (NFP) as the Federal Reserve expands the scope of the “Main Street Lending Program to allow more small and medium-sized businesses to be able to receive support.”

Gold Price Fails to Clear May Low Ahead of FOMC Rate Decision

The price of gold traded to a fresh monthly low ($1671) as the US NFP report showed employment increasing 2.509 million in May versus forecasts for a 7.500 million decline, while the jobless rate narrowed to 13.3% from 14.7% in April amid projections for a 19.0% print.

The positive development may push the Federal Open Market Committee (FOMC) to the sidelines as the data sparks hope for a V-shaped recovery, and Chairman Jerome Powell and Co. may merely attempt to buy time at the next interest rate decision on June 10 as the central bank “expects the Main Street program to be open for lender registration soon and to be actively buying loans shortly afterwards.”

Source: FOMC

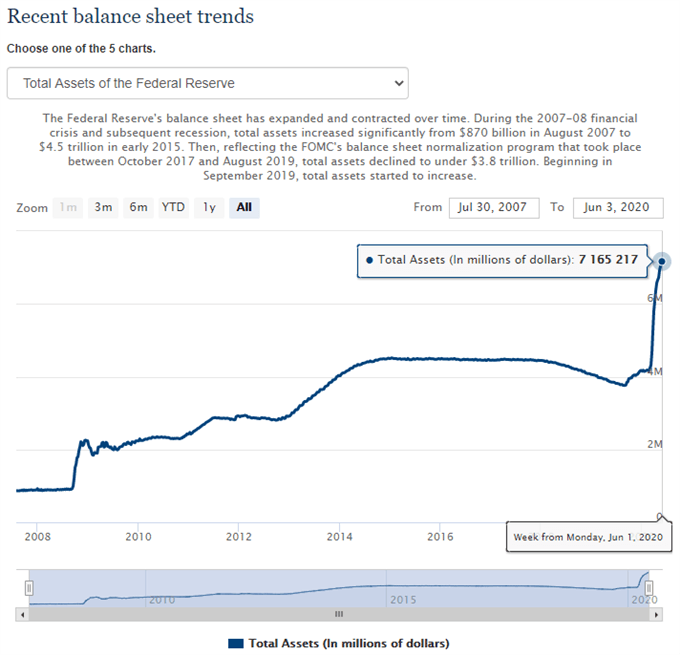

The new non-standard measure may encourage the FOMC to carry out a wait-and-see approach over the coming months as the balance sheet climbs above $7.1 trillion in June, and it remains to be seen if Fed officials will alter the forward guidance for monetary policy as Chairman Powelltames speculation for a negative interest rate policy (NIRP).

Source: FOMC

However, the FOMC may reiterate its commitment in “using its full range of tools to support the U.S. economy in this challenging time” as Fed officials express mixed views regarding the economic outlook, and the low interest rate environment along with the ballooning central bank balance sheets may continue to act as a backstop for goldas marketparticipants look for an alternative to fiat-currencies.

Keep in mind, the price of gold has traded to fresh yearly highs during every single month so far in 2020, and the precious metal may continue to exhibit a bullish behavior in June as the pullback from the yearly high ($1765) fails to produce a break of the May low ($1670).

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

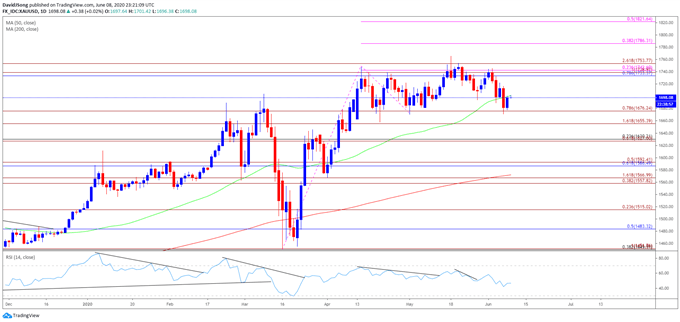

Gold Price Daily Chart

Source: Trading View

- The opening range for 2020 instilled a constructive outlook for the price of gold as the precious metal cleared the 2019 high ($1557), with the Relative Strength Index (RSI) pushing into overbought territory during the same period.

- A similar scenario materialized in February, with the price of gold marking the monthly low ($1548) during the first full week, while the RSI broke out of the bearish formation from earlier this year to push back into overbought territory.

- However, the monthly opening range for March as less relevant amid the pickup in volatility, with the decline from the monthly high ($1704) leading to a break of the January low ($1517).

- Nevertheless, the reaction to the former-resistance zone around $1450 (38.2% retracement) to $1452 (100% expansion) instilled a constructive outlook for bullion especially as the RSI reversed course ahead of oversold territory and broke out of the bearish formation from February.

- In turn, gold cleared the March high ($1704) to tag a new yearly high ($1748) in April, with the bullish behavior also taking shape in May as the precious metal traded to a fresh 2020 high ($1765).

- The bullish behavior may persist in June as the price of gold holds above the May low ($1670), with the RSI highlighting a similar dynamic as the indicator breaks out of the negative slope from the previous month.

- Failure to break/close below the $1676 (78.6% expansion) region may generate range bound prices for gold, but a break/close above the Fibonacci overlap around $1733 (78.6% retracement) to $1743 (23.6% expansion) opens up the $1754 (261.8% expansion) region, with the next area of interest coming in around $1786 (38.2% expansion) followed by the 2012 high ($1796).

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong