Gold Price Talking Points

The price of gold trades to a fresh yearly high ($1760) as it extends the series of higher highs and lows from the previous week, and the break above the November 2012 high ($1754) may keep the precious metal afloat as the Relative Strength Index (RSI) approaches overbought territory.

Gold Price Forecast: Breakout Pushes RSI Towards Overbought Territory

The price of gold has traded to fresh yearly highs during every single month so far in 2020, and the precious metal may continue to exhibit a bullish behavior as Federal Reserve Chairman Jerome Powell warns of a protracted recovery.

In a recent interview on CBS News, Chairman Powell started off by stating that the US economy may “recover steadily through the second half of this year” as states start to rollback the stay-at-home orders, but went onto say that the disruption in economic activity “could stretch through the end of next a year” if a second wave of infections emerge.

Chairman Powell mentioned that “it may take a while” for the US to recover from COVID-19 as “it's very plausible that the economy will take some time to gather momentum,” with the central bank emphasizing that the Federal Open Market Committee (FOMC) is “not out of ammunition” as the central bank expands its balance sheet.

Nevertheless, Chairman Powell revealed that officials “on the Federal Open Market Committee continue to think that negative interest rates is probably not an appropriate or useful policy for us here in the United States,” and it seems as though Fed officials will continue to tame speculation for a negative interest rate policy (NIRP) as “there's really no limit to what we can do with these lending programs that we have.”

In turn, the FOMC may become increasingly reliant on its unconventional tools as the benchmark interest rate sits at the effective lower bound (ELB), and it remains to be seen if the unprecedented efforts taken by monetary as well as fiscal authorities will spur a V-shaped recovery as US lawmakers try to pass another stimulus program.

With that said, the low interest rate environment along with the ballooning central bank balance sheets may act as a backstop for goldas marketparticipants look for an alternative to fiat-currencies, and the price for bullion may continue to exhibit a bullish behavior as it extends the series of higher highs and lows from the previous week.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

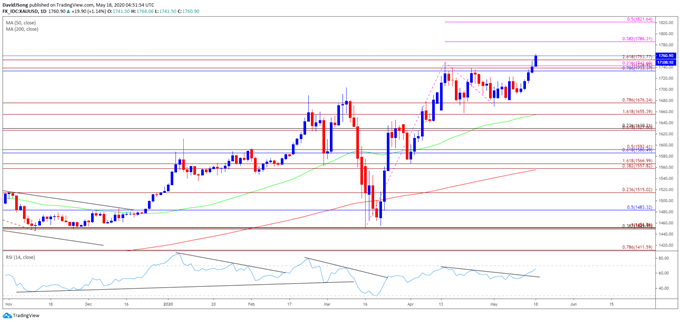

Gold Price Daily Chart

Source: Trading View

- The opening range for 2020 instilled a constructive outlook for the price of gold as the precious metal cleared the 2019 high ($1557), with the Relative Strength Index (RSI) pushing into overbought territory during the same period.

- A similar scenario materialized in February, with the price of gold marking the monthly low ($1548) during the first full week, while the RSI broke out of the bearish formation from earlier this year to push back into overbought territory.

- However, the monthly opening range for March as less relevant amid the pickup in volatility, with the decline from the monthly high ($1704) leading to a break of the January low ($1517).

- Nevertheless, the reaction to the former-resistance zone around $1450 (38.2% retracement) to $1452 (100% expansion) instilled a constructive outlook for bullion especially as the RSI reversed course ahead of oversold territory and broke out of the bearish formation from February.

- In turn, gold cleared the March high ($1704) to tag a new yearly high ($1748) in April, with the behavior also taking shape in May as the precious metal trades to a fresh 2020 high ($1764).

- The break/close above the $1754 (261.8% expansion) region, which lines up with the November 2012 high ($1754), opens up the $1786 (38.2% expansion) area, with the 2012 high ($1796) next on the radar.

- The RSI highlights a similar dynamic as the oscillator breaks out of the downward trend carried over from the previous month, and the bullish momentum may gather pace if the indicator breaks above 70 and pushes into overbought territory.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong