Oil Price Talking Points

The price of oil breaks out of the range-bound price action from earlier this month amid an unexpected decline in US crude inventories, and efforts by the Organization of the Petroleum Exporting Countries (OPEC) may help to ward off a bear market as the group continues to regulate production.

Oil Price Breaks Out as US Crude Inventories Unexpectedly Contract

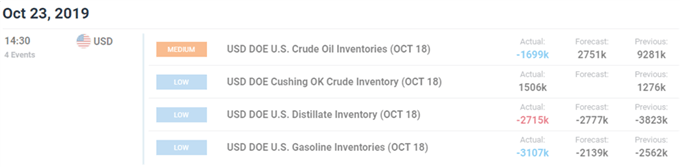

Oil climbs to a fresh monthly-high ($56.07) as US stockpiles of crude oil contracts 1699K in the week ending October 18 versus expectations for a 3000K expansion.

A deeper look at the report showed gasoline inventories also falling 3107K, with stockpiles of distillate fuel narrowing 2715K during the same period.

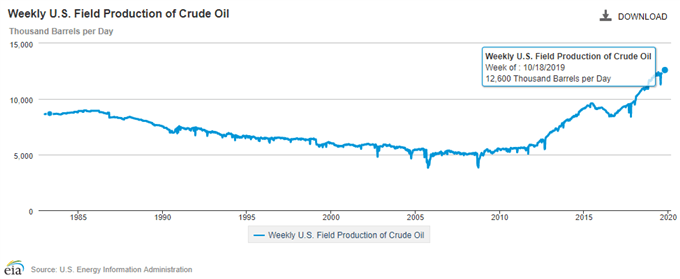

Keep in mind, weekly field production of crude sits at a record-high, with US output holding at 12,600K for the third consecutive week. In response, OPEC and its allies appear to be on track to regulate the energy market throughout 2020 as Russia Energy Minister Alexander Novak pledges to uphold “the agreement signed on July 2 to extend the deal until April 1.”

It remains to be seen if OPEC+ will unveil more measures at the next meeting starting on December 5 as the most recent Monthly Oil Market Report (MOMR) warns of lower consumption in 2019, with the forecast “revised lower by 0.04 mb/d to 0.98 mb/d, with total oil demand standing at 99.80 mb/d.”

The weakening outlook for oil consumption may push OPEC and its allies to ramp up its efforts in balancing the energy market especially as the US and China, the two largest consumers of oil, struggle to reach a trade deal.

With that said, the ‘Declaration of Cooperation’ may help to ward off a bear market, but OPEC and its allies may continue to respond to the rise in US output as the International Monetary Fund (IMF) cuts its global growth forecast.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss key themes and potential trade setups.

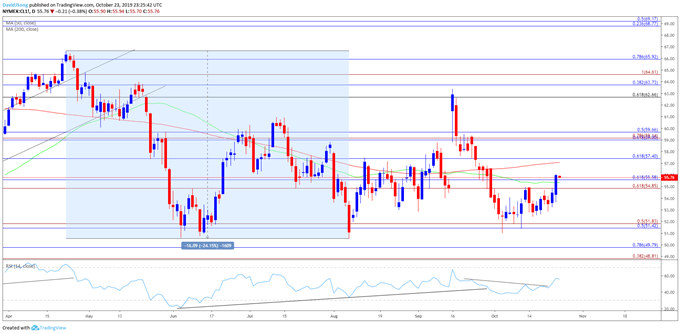

Crude Oil Daily Chart

Source: Trading View

- The broader outlook for crude oil remains tilted to the downside as a ‘death-cross’ formation took shape in July, with the Relative Strength Index (RSI) highlighting a similar dynamic as the oscillator snaps the upward trend from June.

- However, the flattening slopes in the 50-Day ($55.35) and 200-Day SMA ($57.06) warn of range-bound conditions as the moving averages converge with one another, with decline from the September-high ($63.38) failing to produce a test the 2019-low ($50.52).

- In turn, the lack of momentum to close below the Fibonacci overlap around $51.40 (50% retracement) to $51.80 (50% expansion) may keep oil prices afloat, with the break/close above the Fibonacci overlap around $54.90 (61.8% expansion) to $55.60 (61.8% retracement) raising the risk for a move towards $57.40 (61.8% retracement) as crude breaks out of the range-bound price action from earlier this month.

- Next area of interest comes in around $59.00 (61.8% retracement) to $59.70 (50% retracement) followed by the overlap around $62.70 (61.8% retracement) to $64.60 (100% expansion), which lines up with the September-high ($63.38)

For more in-depth analysis, check out the 4Q 2019 Forecast for Oil

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other markets the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong.