Australian Dollar Talking Points

AUD/USD extends the decline from earlier this week amid waning hopes for an imminent US-China trade deal, and the exchange rate appears to be on track to test the 2019-low (0.6671) as it carves a fresh series of lower highs and lows.

AUD/USD Eyes 2019-Low as China Pledges to Retaliate to US Blacklist

The recent rebound in AUD/USD continues to unravel as China signaled it would retaliate against the Trump administration for blacklisting 8 tech companies, with China’s Foreign Ministry spokesman, Geng Shuang, urging the US to “immediately correct its mistake, withdraw the relevant decision and stop interfering in China’s internal affairs.”

During the press conference, Mr. Shuang went on to say that “the US violates the basic norms governinginternational relations, interferes in China's internal affairs and undermines China's interests,” and the comments suggest the trade talks starting on October 10 will bear little fruit as the Foreign Ministry pledges to “take resolute and powerful measures to safeguard our sovereignty, security and development interests.”

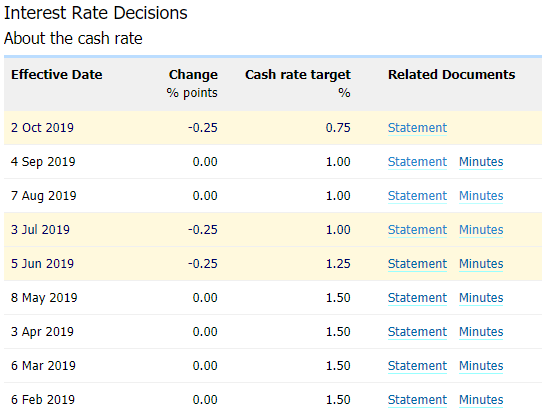

Signs of a prolonged US-China trade war may encourage the Reserve Bank of Australia (RBA) to further insulate the economy, and the central bank may continue to embark on its rate easing cycle as the board remains “prepared to ease monetary policy further if needed.”

The RBA may continue to push monetary policy into uncharted territory as the central bank gauges the effective lower bound (ELB) for the official cash rate (OCR), and it seems as though Australian policymakers will have little choice but to deploy non-standard measures as Governor Philip Lowe insist that unconventional monetary policy tools (UMPTs) “have proved to be an effective addition to central banks’ policy toolkit.”

With that said, it remains to be seen if the RBA will deliver another 25bp rate cut at the next meeting on November 5as Governor Lowe pushes for “a renewed focus on structural measures to lift the nation's productivity performance,”but the Australian Dollar may face a more bearish fate over the remainder of the year as the central bank continues to combat the weakening outlook for the Asia/Pacific region.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

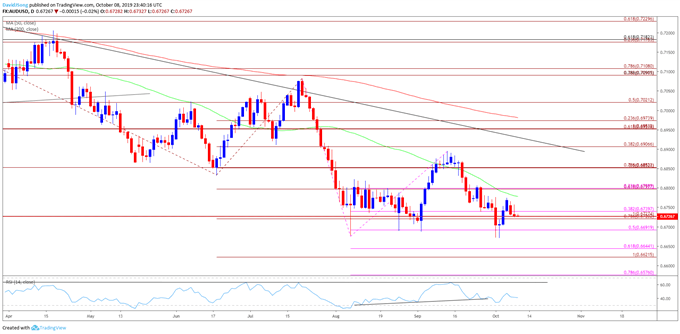

AUD/USD Rate Daily Chart

Source: Trading View

- Keep in mind, the AUD/USD rebound following the currency market flash-crash has been capped by the 200-Day SMA (0.6982), with the exchange rate marking another failed attempt to break/close above the moving average in July.

- More recently, AUDUSD has taken out the September-low (0.6688) following the RBA meeting, with the Relative Strength Index (RSI) offering a bearish signal as the oscillator snaps the bullish formation from August.

- Lack of momentum to hold above the Fibonacci overlap around 0.6720 (78.6% expansion) to 0.6740 (38.2% expansion) brings the 0.6690 (50% expansion) region on the radar, but the string of failed attempts to close below the stated level raises the risk for range-bound conditions.

- Need a close below 0.6690 (50% expansion) to open up the Fibonacci overlap around 0.6620 (100% expansion) to 0.6640 (61.8% expansion), with the next area of interest coming in around 0.6580 (78.6% expansion).

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong.