Gold Price Talking Points

The price of gold pulls back from a fresh yearly high ($1453) after breaking out of a short-term holding pattern, but current market conditions may keep gold prices afloat as market participants look to hedge against fiat currencies.

Topside Targets Back on Radar as Gold Breaks Out of Holding Pattern

The price of gold carves a fresh series of higher highs and lows as talks between US Treasury Secretary Steven Mnuchinand Chinese officials yield little signs of an imminent trade deal, and the precious metal may stage a larger advance ahead of the Federal Reserve interest rate decision on July 31 as the central bank comes under increased pressure to alter monetary policy.

It seems as though the Federal Open Market Committee (FOMC) will shift gears as Chairman Jerome Powell largelyendorses a dovish forward guidance, and the central bank may show a greater willingness to reverse the four rate hikes from 2018 as President Donald Trump tweets that “the Fed raised far too fast & too early.”

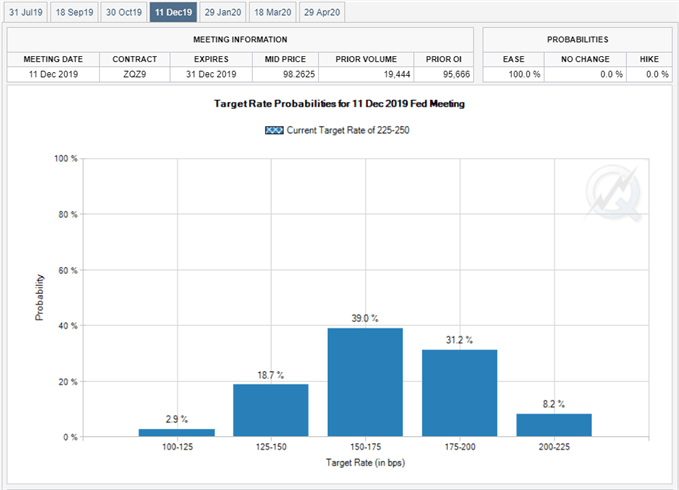

In turn, Fed Fund futures continue to show a 100% probability for at least a 25bp rate cut at the end of this month, but it seems as though market participants are bracing for a more accommodative stance as the benchmark interest rate is seen falling towards the 1.50% to 1.75% threshold in December.

It remains to be seen if Chairman Powell and Co. will establish a rate easing cycle as Boston Fed President Eric Rosengren, a 2019-voting member on the FOMC, insists that the “the economy’s doing actually quite well” and argues that the “we don’t need accommodation” as incoming data shows little signs of a looming recession.

With that said, the FOMC may vote for an “insurance cut” as the US and China struggle to reach a trade deal, but gold prices may continue to benefit from the current environment, and market participants may persistently look for an alternative to fiat-currencies amid the threat of a currency war.

In turn, gold prices may exhibit a more bullish behavior over the coming days, with the precious metal at risk of extending the advance from the monthly-low ($1382) as it breaks out of a triangle/wedge formation.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

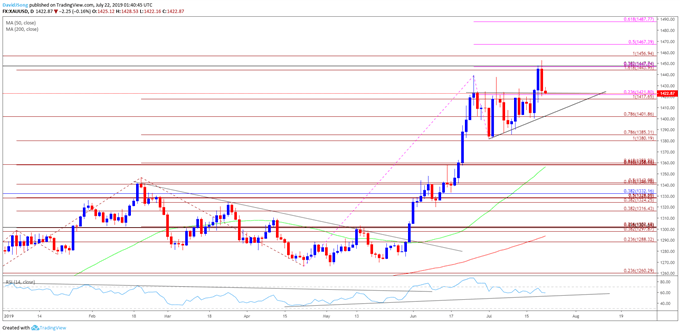

Gold Price Daily Chart

- Keep in mind, the broader outlook for gold is no longer mired by a head-and-shoulders formation as both price and the Relative Strength Index (RSI) break out of the bearish trends from earlier this year.

- Moreover, the recent pullback in bullion appears to have run its course as the Fibonacci overlap around $1380 (100% expansion) to $1385 (78.6% expansion) offers support, and the price of gold may exhibit a more bullish behavior as it carves a fresh series of higher highs and lows after breaking out of a triangle/wedge formation.

- In turn, topside targets are back on the radar for gold, but need a close above the Fibonacci overlap around $1444 (161.8% expansion) to $1448 (382.% retracement) to favor a more meaningful run at $1457 (100% expansion), with the next area of interest coming in around $1467 (50% expansion).

For more in-depth analysis, check out the 3Q 2019 Forecast for Gold

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong.