Talking Points:

- NZD Breaks Out on Strong Employment; Outlook Mired by Weak Wages, Bets for RBNZ Rate-Cut.

- USD/CAD Vulnerable to Further Losses on Another 7 to 3 FOMC Split.

| Currency | Last | High | Low | Daily Change (pip) | Daily Range (pip) |

|---|---|---|---|---|---|

| NZD/USD | 0.7292 | 0.7302 | 0.7181 | 108 | 121 |

NZD/USD Daily

Chart - Created Using Trading View

- NZD/USD looks poised for a larger recovery ahead of the Reserve Bank of New Zealand’s (RBNZ) final 2016 interest rate decision on November 10 as the pair breaks out of the downward trend carried over from September; failed attempt to close below 0.7040 (50% retracement) may pave the way for a longer-term series of higher highs & lows especially as the kiwi-dollar preserves the upward trend from earlier this year.

- Despite the 1.4% expansion in New Zealand Employment, the ongoing weakness in household earnings may encourage the RBNZ to deliver another rate-cut ahead of 2017 as Governor Graeme Wheeler and Co. warn ‘current projections and assumptions indicate that further policy easing will be required to ensure that future inflation settles near the middle of the target range.’

- Will keep a close eye on the topside targets ahead of the RBNZ meeting, with a close above 0.7280 (50% expansion) opening up the next region of interest coming in around 0.7350 (61.8% expansion) followed by the Fibonacci overlap around 0.7460 (78.6% expansion) to 0.7530 (78.6% retracement).

| Currency | Last | High | Low | Daily Change (pip) | Daily Range (pip) |

|---|---|---|---|---|---|

| USD/CAD | 1.3416 | 1.3422 | 1.336 | 26 | 62 |

USD/CAD Daily

Chart - Created Using Trading View

- Broader outlook for USD/CAD remains constructive as the exchange rate retains the bullish formation carried over from the summer months, but the pair stands at risk for a near-term pullback as it comes up against channel resistance; will keep a close eye on the Relative Strength Index (RSI) as the oscillator highlights similar dynamic and appears to have made a failed run at overbought territory.

- Even though Bank of Canada (BoC) Governor Stephen Poloz endorse a dovish outlook ahead of the next policy meeting on December 7, another 7 to 3 split within the Federal Open Market Committee (FOMC) may spur a near-term pullback in USD/CAD as it drags on interest-rate expectations.

- Need a break/close above 1.3460 (61.8% retracement) to open up the topside targets, but a move back below the Fibonacci overlap around 1.3300 (61.8% expansion) to 1.3310 38.2% retracement) would raise the risk for a move back towards the October low (1.3006).

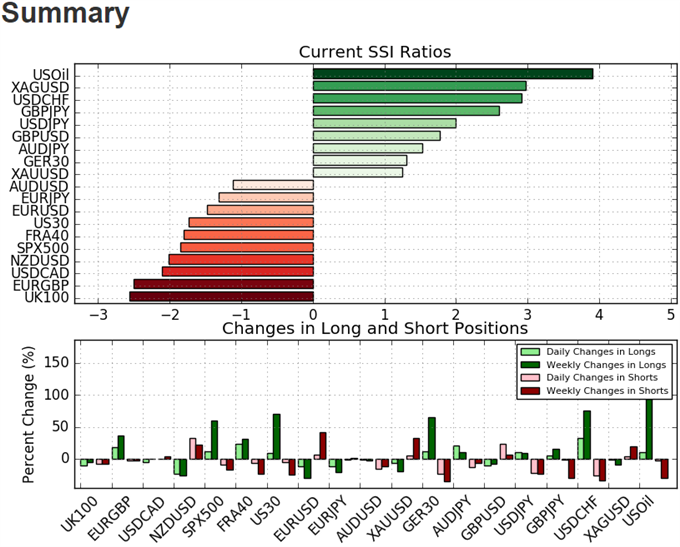

- The DailyFX Speculative Sentiment Index (SSI) shows the retail crowd remains net-short NZD/USD since October 28 even as the pair breaks out of a bearish formation, while traders have been net-short USD/CAD since October 20.

- NZD/USD SSI sits at -1.92 as 34% of traders are long, with short positions 21.0% higher from the previous week even as open interest stands 4.0% below the monthly average.

- USD/CAD SSI sits at -2.02 as 33% of traders are long, with short positions 3.7% higher from the previous week, while open interest stands 11.6% above the monthly average.

- Will keep close eye on NZD/USD positioning as the retail crowd gets caught on the wrong side; note the SSI ratio hit a 2016-extreme of -3.41 in September.

Why and how do we use the SSI in trading? View our video and download the free indicator here

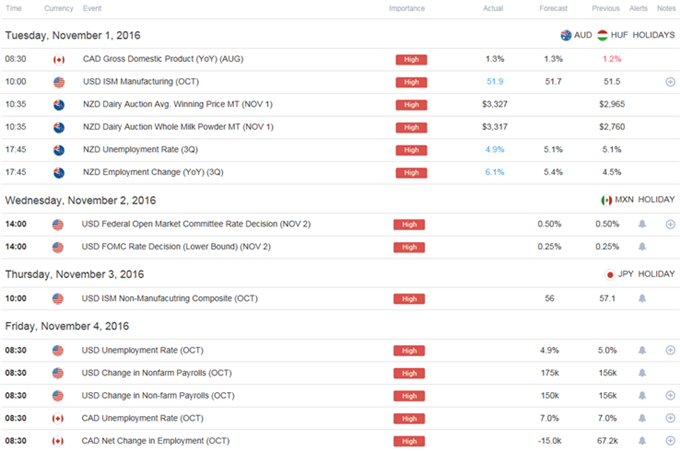

Click Here for the DailyFX Calendar

Get our top trading opportunities of 2016 HERE

Read More:

S&P 500: Election Volatility and Short-term Trading Levels

Forex Technical Focus: AUD/JPY and a Big Confluence

USD/JPY Rally Vulnerable to Wait-and-See BoJ, 7 to 3 FOMC Split

NZD/USD at Risk for Further Losses Heading into U.S. 3Q GDP

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.