Talking Points:

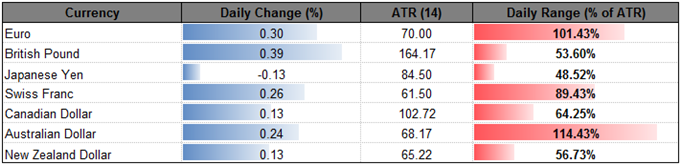

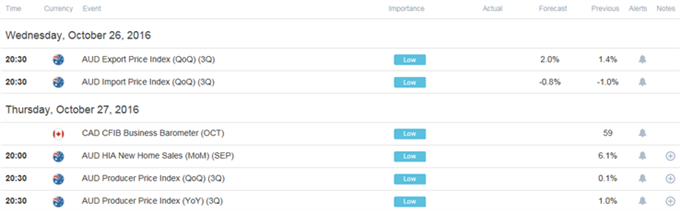

- AUD/USD Resilience to Persevere as Sticky Australia CPI Curbs Bets for RBA Rate-Cut.

- Canadian Dollar Weakness to Persist as BoC Adopts Dovish Outlook.

| Currency | Last | High | Low | Daily Change (pip) | Daily Range (pip) |

|---|---|---|---|---|---|

| AUD/USD | 0.7664 | 0.7709 | 0.7631 | 18 | 78 |

AUD/USD Daily

Chart - Created Using Trading View

- Failure to test the monthly high (0.7733) may keep AUD/USD range-bound ahead of the Reserve Bank of Australia’s (RBA) November 1 policy meeting as the central bank looks poised to endorse a wait-and-see approach; will retain a constructive outlook for the pair as long as it continues to close above the Fibonacci overlap around 0.7580 (50% expansion) to 0.7600 (23.6% retracement).

- The uptick in the headline Consumer Price Index (CPI) accompanied by the stickiness in the core rate of inflation may encourage the RBA to gradually move away from its easing-cycle as the rate-cuts from earlier this year continue to work their way through the real economy; may see more of the same from Governor Philip Lowe & Co. as the region continues to ‘grow at a moderate rate..

- Waiting for a break/close above the Fibonacci overlap around 0.7730 (61.8% retracement) to 0.7770 (61.8% expansion) to put the ascending triangle formation in play, with a break of the 2016-high (0.7835) opening up the next topside region of interest around 0.7860 (61.8% expansion).

| Currency | Last | High | Low | Daily Change (pip) | Daily Range (pip) |

|---|---|---|---|---|---|

| USD/CAD | 1.3333 | 1.3381 | 1.3315 | 18 | 66 |

USD/CAD Daily

Chart - Created Using Trading View

- Broader outlook for USD/CAD remains constructive as the pair preserves the upward trend carried over from the summer months, but the exchange rate stands at risk of facing a near-term pullback as it comes off of channel resistance, while the Relative Strength Index (RSI) appears to have made another failed attempt to break out of the bearish pattern; will keep a close eye on the slew of moving averages as the 50-Day looks poised to cross above the 200-Day, but the difference in slope largely negates the likelihood of a ‘golden cross.’

- With crude oil prices struggling to get back above $50, a further decline in energy prices may dampen the appeal of the Canadian dollar and push the Bank of Canada (BoC) to endorse an even more dovish outlook for monetary policy as Governor Stephen Poloz and Co. now see the economy returning ‘to full capacity around mid-2018, materially later than the Bank had anticipated in July;’ may see the BoC retain the current policy at the last 2016 policy meeting on December 7 as the central bank continues to lean on fiscal officials to support the real economy.

- Will continue to watch the topside targets especially on a longer-term horizon as USD/CAD preserves the ascending channel from earlier this year, with a break of the monthly high (1.3397) opening up the next region of interest around 1.3460 (61.8% retracement), while near-term support comes in around 1.2980 (61.8% retracement) to 1.3040 (50% expansion).

- The DailyFX Speculative Sentiment Index (SSI) shows a bit of back and forth in AUD/USD positioning, with the retail crowd flipping back net-short going into the end of the month, while traders have been net-short USD/CAD since October 20.

- AUD/USD SSI stands at -1.16 as 46% of traders are long, with short positions 16.3% lower from the previous week, while open interest stands 9.3% below the monthly average.

- USD/CAD SSI stands at -1.82 as 36% of traders are long, with short positions 51.4% higher from the previous week even as open interest stands 6.9% above the monthly average.

Why and how do we use the SSI in trading? View our video and download the free indicator here

Click Here for the DailyFX Calendar

Get our top trading opportunities of 2016 HERE

Read More:

EUR/CAD Rebound or Reversal? Line-in-the-Stand at 1.4600

USD Breakout – Does it Have Room to Run?

Gold Price and Oil See Headwinds as USD Strongest Since February

Forex Technical Focus: Range Highs for Nikkei; USD/JPY Lags

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.