Talking Points:

- USD/JPY Breaks Below 99.00 With Retail Sentiment Back at Extreme.

- USDOLLAR Threatens 2016 Bear Trend; Flight to Quality on Tap?

Avoid the pitfalls of trading by steering clear of classic mistakes. Review these principles in the "Traits of Successful Traders" series.

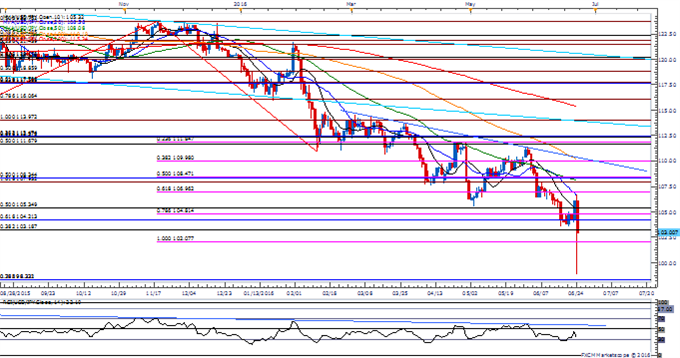

Chart - Created by David Song

- With USD/JPY tumbling to a fresh 2016 low of 98.81 following the U.K. Referendum, Japanese officials are ramping up the verbal intervention on the local currency, with both the Ministry of Finance (MoF) and the Bank of Japan (BoJ) pledging to act if needed; will be keeping a close eye on the Relative Strength Index (RSI) as it flirts with oversold territory.

- Despite lingering market expectations for additional monetary support, the BoJ may largely endorse a wait-and-see approach at the July policy meeting as Governor Haruhiko Kuroda and Co. monitor the impact of the negative-interest rate policy (NIRP), but heightening uncertainties surrounding the global outlook may keep the Yen afloat as Japan returns to its historical role as a net-lender to the world economy.

- Will continue to watch the downside for USD/JPY amid the bearish tilt in price & the RSI, with a close below 103.20 (38.2% retracement) raising the risk for a move towards the Fibonacci overlap around 98.30 (23.6% & 78.6% retracements).

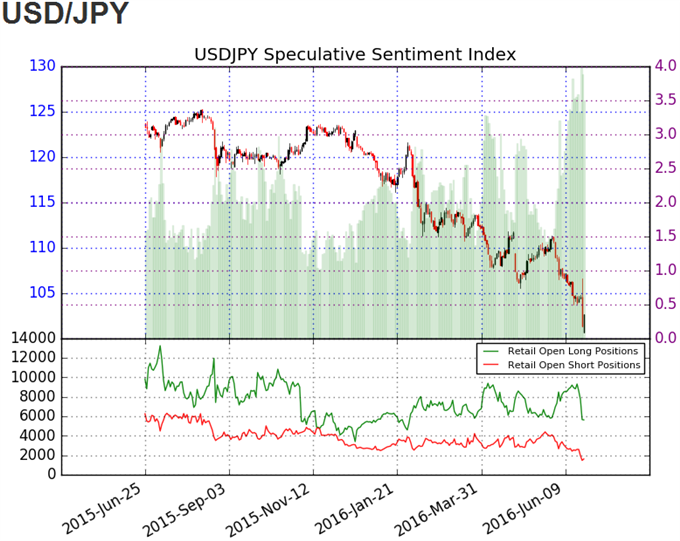

- The DailyFX Speculative Sentiment Index (SSI) shows the retail crowd remains net-long USD/JPY since the Bank of Japan (BoJ) introduced the negative interest-rate policy (NIRP) on January 29, with the ratio hitting an extreme earlier this month as it climbed towards +4.00.

- The ratio currently sits at +3.87 as 79% of traders are long, with short positions 42.4% lower from the previous week as open interest stands 34.3% below the monthly average.

Why and how do we use the SSI in trading? View our video and download the free indicator here

USDOLLAR(Ticker: USDollar):

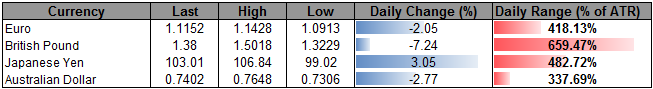

| Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

|---|---|---|---|---|---|

| US Dollar Index | 11920.69 | 12018.84 | 11717.61 | 1.79 | 419.61% |

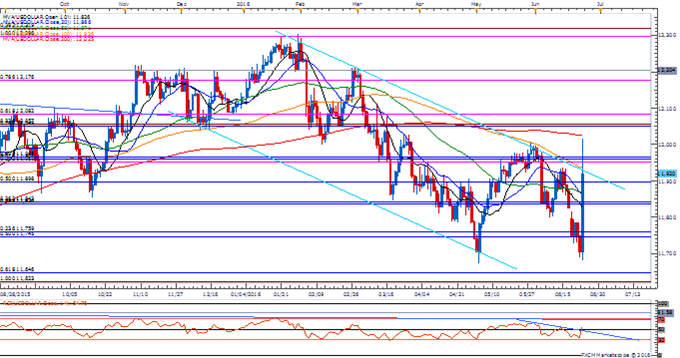

Chart - Created by David Song

- Failed test of the May low (11,672) may spur a larger recovery in the USDOLLAR as it makes a meaningful attempt to break out of the bearish formation from earlier this year, with the greenback climbing to a fresh monthly high of 12,017, while the RSI breaks out of the downward trend carried over from the previous month.

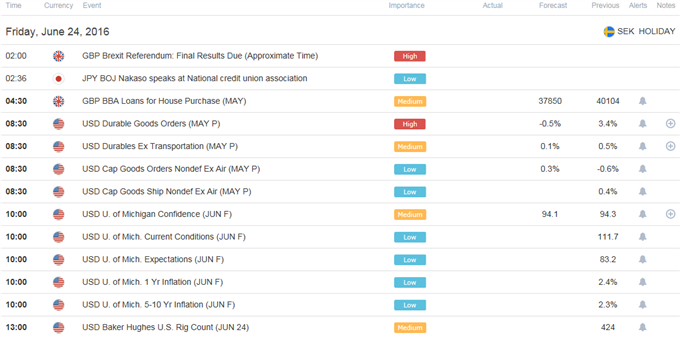

- Beyond market expectations for a 0.5% contraction in Durable Goods Orders, the flight to quality may keep the greenback afloat over the near-term, but the ongoing weakness in the U.S. economy may push the Federal Open Market Committee (FOMC) to further delay its normalization cycle in an effort to combat the external risks surrounding the region.

- Need a closing price above the Fibonacci overlap around 11,951 (38.2% expansion) to 11,965 (23.6% retracement) for conviction/confirmation of a near-term breakout, with the next topside target coming in around 12,049 (78.6% retracement) to 12,057 (23.6% expansion).

Click Here for the DailyFX Calendar

Get our top trading opportunities of 2016 HERE

Read More:

S&P 500: Crosses Important Short-term Resistance on Global Rally in Risk

USD/JPY Technical Analysis: A Return To USD/JPY Of 2008-2011?

EUR/USD Timing Compares Favorably with Early 2000s Base

EUR/USD: Breach of Weekly High to Fuel Reversal From Monthly Open

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.