Talking Points:

- USD/JPY Retail Sentiment Most Extreme Since 2015 as Pair Slips to Fresh Yearly Low.

- USDOLLAR Benefits From Better-than-Expected Data; Fed Rhetroic in Focus.

Avoid the pitfalls of trading by steering clear of classic mistakes. Review these principles in the "Traits of Successful Traders" series.

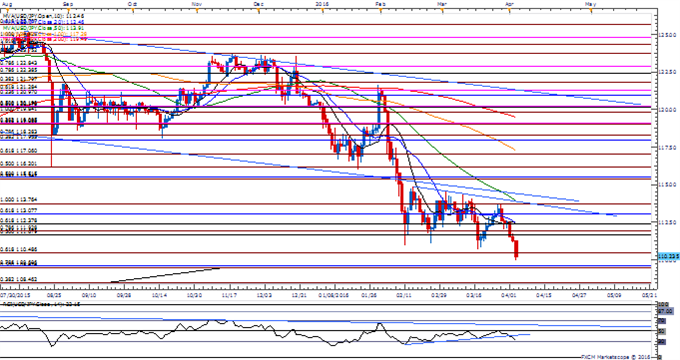

Chart - Created Using FXCM Marketscope 2.0

- Despite efforts by Japanese officials to weaken the local currency, USD/JPY breaks to fresh 2016 lows as market participants appear to be throttling back their appetite for risk, with the pair at risk for a further decline especially as the Relative Strength Index (RSI) fails to preserve the bullish formation carried over from February.

- With Bank of Japan (BoJ) Governor Haruhiko Kuroda scheduled to speak at the branch mangers’ meeting later this week, may see the central bank head continue to layout a dovish outlook for monetary policy as the board struggles to achieve the 2% target for inflation.

- The recent string of lower highs & lows continues to favor the downside targets, with the next region of interest coming in around 109.50 (50% expansion) to 109.60 (78.6% retracement), followed by 108.50 (38.2% expansion).

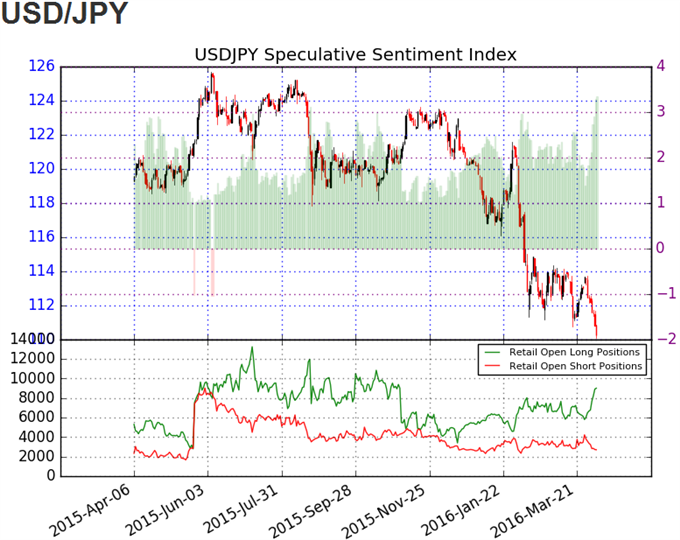

- Despite the ongoing decline in the exchange rate, the DailyFX Speculative Sentiment Index (SSI) shows the retail FX crowd remains net-long since January 29, with the ratio climbing to fresh near-term extremes as it advances to +3.36.

- With the ratio marking the highest reading since at least October 2015, the retail crowd may continue to fade the ongoing decline in USD/JPY as 77% of traders remain long, with long positions 52.5% higher from the previous week.

Why and how do we use the SSI in trading? View our video and download the free indicator here

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

USDOLLAR(Ticker: USDollar):

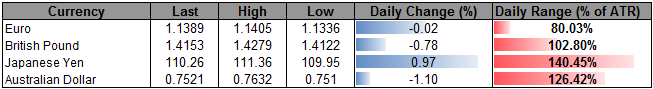

| Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

|---|---|---|---|---|---|

| DJ-FXCM Dollar Index | 11920.51 | 11942.77 | 11887.47 | 0.18 | 90.71% |

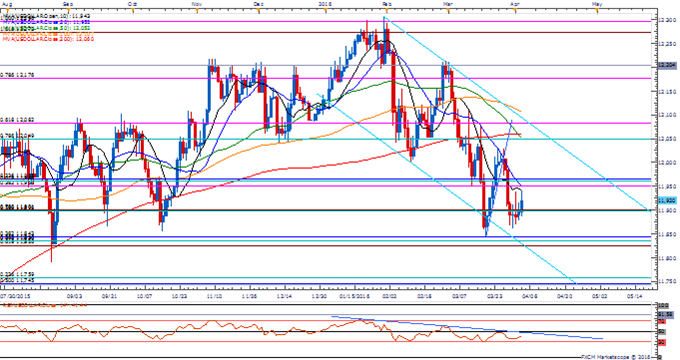

Chart - Created Using FXCM Marketscope 2.0

- Despite the better-than-expected ISM Non-Manufacturing survey, the fresh rhetoric coming out of the Federal Reserve may continue to produce headwinds for the USDOLLAR as the central bank remains in no rush to normalize monetary policy.

- The Federal Open Market Committee (FOMC) meeting minutes may continue to highlight an upbeat outlook for the U.S. economy, but more of the same from the central bank may do little to boost the appeal of the greenback as Fed officials forecast two rate-hikes for 2016.

- Will continue to watch the downside targets, with a break/close below 11,826 (61.8% expansion) to 11,843 (38.2% retracement) opening the door for a move towards 11,745 (50% retracement) to 11,759 (23.6% retracement) amid the failure to preserve the bullish formation from the March low (11,846).

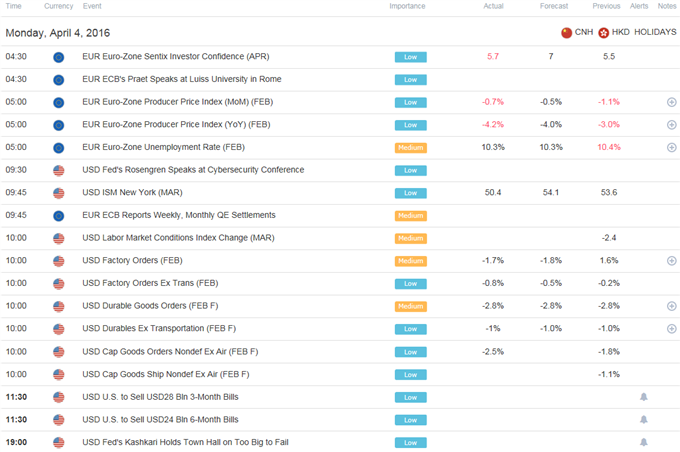

Click Here for the DailyFX Calendar

Read More:

S&P 500 - Rip-roar Recovery Inches Market Closer to Major Resistance

Largest Long Position for Gold Trend Followers Since November 2012

USD/MXN – Big Support Test Coming Up

USD/CAD Technical Analysis: All Eyes on 1.2835

Get our top trading opportunities of 2016 HERE

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand