Talking Points:

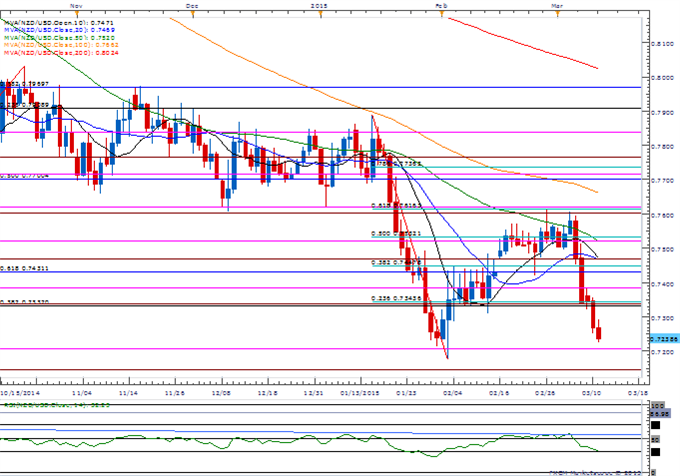

- NZD/USD Outlook Hinges on RBNZ; Forward-Guidance in Focus.

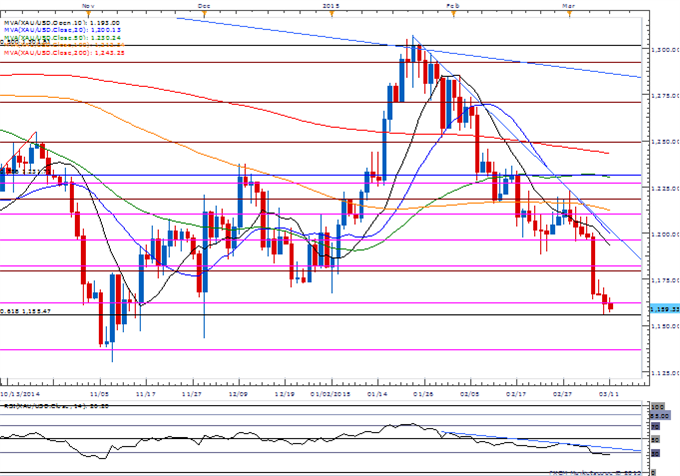

- Gold (XAUUSD)$1,155 Support at Risk as Bearish RSI Momentum Gathers Pace.

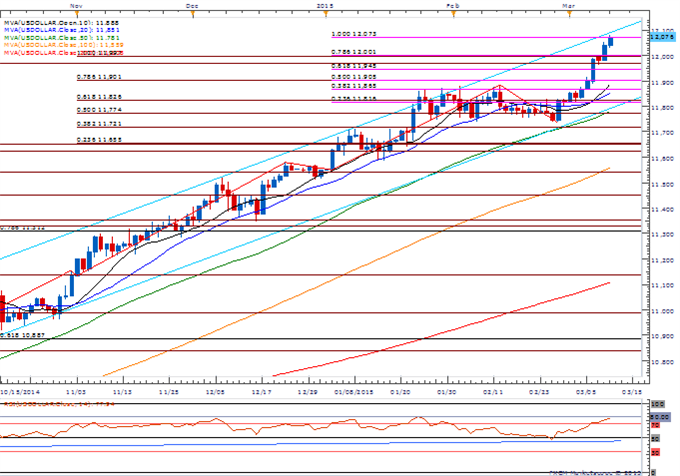

- USDOLLAR Approaching Channel Resistance Ahead of U.S. Retail Sales.

For more updates, sign up for David's e-mail distribution list.

Chart - Created Using FXCM Marketscope 2.0

- Even though the Reserve Bank of New Zealand (RBNZ) is widely expected to keep the cash rate at 3.50%, NZD/USD may face fresh 2015 lows should the central bank further delay its normalization cycle and implement a dovish twist to the forward-guidance for monetary policy.

- As the Relative Strength Index (RSI) retains the bearish momentum, a break of the February low (0.7175) would expose 0.7140-50 (78.6% expansion).

- Despite the recent weakness in NZD/USD, the DailyFX Speculative Sentiment Index (SSI) shows retail crowd has flipped net-long ahead of RBNZ, with the ratio currently standing at +1.06.

XAU/USD

Chart - Created Using FXCM Marketscope 2.0

- String of lower-highs in Gold (XAU/USD) favors the approach to ‘sell-bounces’ especially as the RSI retains the bearish momentum and pushes deeper into oversold territory.

- Still appears as though gold is being treated more as a commodity rather than a currency as it largely moves in-line with silver (XAG/USD).

- Break of the $1,155 (61.8% retracement) support zone would bring up $1,136 (100% expansion) next on the radar.

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

Read More:

Price & Time:Sterling Bucks USD Strength But For How Long?

GBPAUD Scalps Target 1.9850 Resistance Ahead of UK & AUS Data

USDOLLAR(Ticker: USDollar):

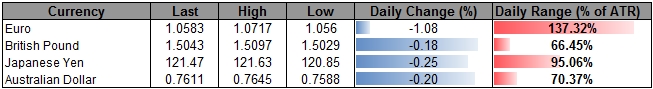

| Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

|---|---|---|---|---|---|

| DJ-FXCM Dollar Index | 12076.18 | 12084.41 | 12031.1 | 0.28 | 104.32% |

Chart - Created Using FXCM Marketscope 2.0

- Dow Jones-FXCM U.S. Dollar continues to clear near-term targets as the bullish RSI momentum gathers pace; will continue to look for further strength as the oscillator pushes deeper into oversold territory.

- Despite expectations of seeing a 0.3% rebound in U.S. Retail Sales, may see private-sector continue to disappoint as wage growth remains subdued.

- Looking for a close above 12,073 (100% expansion) to favor a further advance; will watch the 12,100 handle for psychological resistance.

Join DailyFX on Demand for Real-Time SSI Updates!

| Release | GMT | Expected | Actual |

|---|---|---|---|

| MBA Mortgage Applications (MAR 6) | 11:00 | -- | -1.3% |

Click Here for the DailyFX Calendar

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums