Talking Points

- USD/JPY stalls near December high

- USD/CAD trades at highest level in a month

- 1.5000 area key for Cable

Get real time volume on your charts for free. Click HERE

Foreign Exchange Price & Time at a Glance:

Price & Time Analysis: USD/JPY

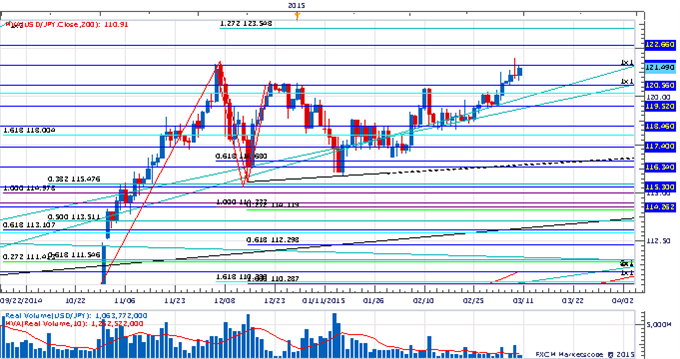

Charts Created using Marketscope – Prepared by Kristian Kerr

- USD/JPY touched its highest level in 7-years on Tuesday before failing just above 122.00

- Our near-term trend bias is positive while above 120.00

- A move through 122.00 is now needed to signal that the exchange rate is emabrking on a new leg higher

- A minor turn window is eyed today

- A close below 120.00 would turn us negative on USD/JPY

USD/JPY Strategy: Like the long side while above 120.00

| Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

|---|---|---|---|---|---|

| USD/JPY | *120.00 | 120.80 | 121.55 | 121.65 | *122.00 |

Price & Time Analysis: USD/CAD

Charts Created using Marketscope – Prepared by Kristian Kerr

- USD/CAD touched its highest level in over a month today

- Our near-term trend bias is higher while above 1.2400

- The year’s closing high at 1.2720 is a clear near-term pivot with a move above needed to confirm that the next leg of the advance in Funds is underway

- A minor turn window is seen early next week

- A close below 1.24000 would turn us negative on USD/CAD

USD/CAD Strategy: Like the long side while over 1.2400

| Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

|---|---|---|---|---|---|

| USD/CAD | *1.2400 | 1.2575 | 1.2700 | *1.2720 | 1.2795 |

Focus Chart of the Day: GBP/USD

Some interesting price action in GBP/USD to start the week as the pair seemingly responded to the cyclical turn window highlighted last week by rallying fairly aggressively off the lows near 1.5000 Our question is whether the exchange rate can buck the broader USD advance engulfing the FX markets at the moment? It seems like a rather big ask given just how powerful this latest dollar move is proving to be. Stranger things have happened, but the exchange rate really would need to get above 1.5125 to convince us that anything other than a minor reprieve is taking shape. Conversely a clear break of last week’s low would invalidate the cyclical support and set the stage for Cable to resume the broader decline.

To receive Kristian’s analysis directly via email, please SIGN UP HERE.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be achieved.

To contact Kristian, e-mail instructor@dailyfx.com. Follow me on Twitter @KKerrFX