Talking Points:

- EUR/USD Outlook Weighed as EU Tries to Buy More Time For Greece.

- GBP/USD Threatens Bearish Channel Ahead of BoE Inflation Report..

- USDOLLAR Outlook Vulnerable to Further Contraction in Retail Sales.

For more updates, sign up for David's e-mail distribution list.

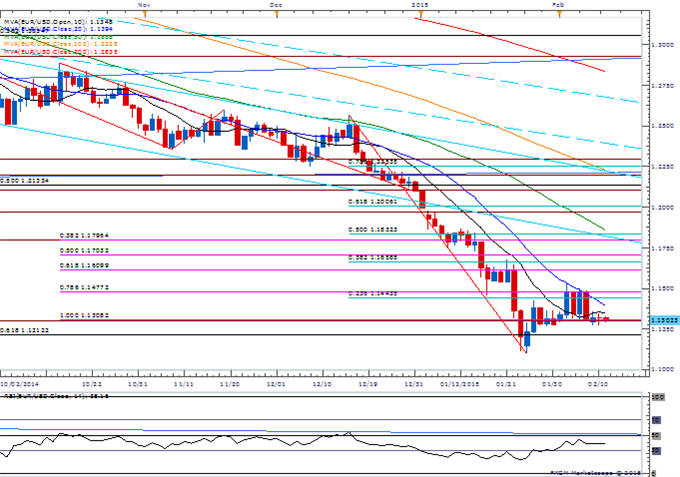

Chart - Created Using FXCM Marketscope 2.0

- EUR/USD remains vulnerable as Greece struggles to secure a bailout agreement with the EU; may put increased pressure on the European Central Bank (ECB) to further support the monetary union as policy makers struggle to meet on common ground.

- Will retain a bearish outlook for EUR/USD as long as the Relative Strength Index (RSI) preserves the downward trend dating back to October 2013.

- DailyFX Speculative Sentiment Index (SSI) shows retail crowd remains net-short EUR/USD, but seeing the ratio narrow as it currently stands at -1.56.

GBP/USD

- GBP/USD making another assault at channel resistance ahead of the Bank of England (BoE) inflation report; remains at risk for a larger rebound as the RSI has already broken out of the bearish momentum.

- There’s growing speculation the BoE may further reduce its inflation forecast, but will keep a close eye on the forward-guidance for monetary policy as Governor Mark Carney continues to prepare U.K. households and businesses for higher borrowing-costs.

- Will keep a close eye on the opening range, with the key region of interest coming in around the former support zone near 1.5500-10.

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

Read More:

AUDCAD Threatens Weekly Opening Range- Long Scalps Favored Above 9750

Weekly Setups Target Key Opening Ranges in USD, GBP, Gold & Silver

USDOLLAR(Ticker: USDollar):

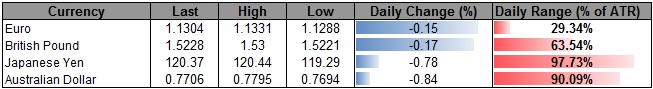

| Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

|---|---|---|---|---|---|

| DJ-FXCM Dollar Index | 11873.83 | 11877.34 | 11827.79 | 0.31 | 74.66% |

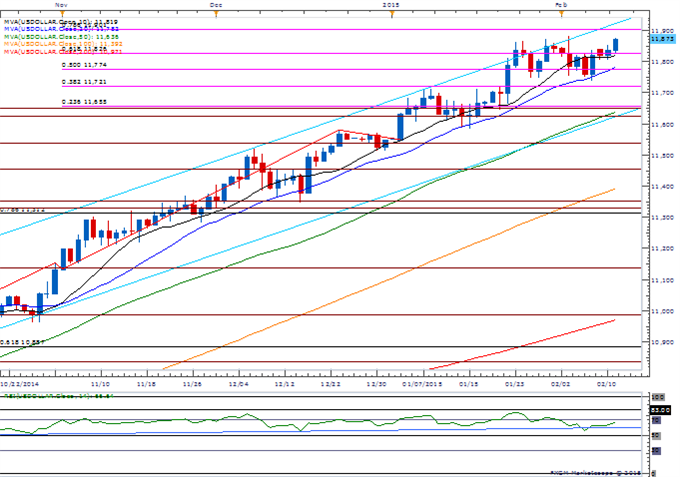

Chart - Created Using FXCM Marketscope 2.0

- Dow Jones-FXCM U.S. Dollar may retain the monthly opening range as U.S. Advance Retail Sales are expected to contract another 0.4% contraction in January.

- A further downturn in household spending may dampen the Fed’s scope to normalize monetary policy in mid-2015 as lower energy prices fail to boost private-sector consumption.

- Will continue to watch the broader range from 11,721 (38.2% expansion) to 11,901 (78.6% expansion).

Join DailyFX on Demand for Real-Time SSI Updates!

| Release | GMT | Expected | Actual |

|---|---|---|---|

| MBA Mortgage Applications (FEB 6) | 12:00 | -- | -9.0% |

| Fed’s Richard Fisher Speaks on U.S. Economy | 13:00 | ||

| Monthly Budget Statement | 19:00 | -$19.0B |

Click Here for the DailyFX Calendar

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums