US Dollar Talking Points

The US Dollar Index (DXY) breaks out of the range bound price action from the first of January amid the recent pullback in global equity prices, and key market themes may continue to influence the reserve currency as the Greenback still reflects an inverse relationship with investor confidence.

Fundamental Forecast for US Dollar: Neutral

The US Dollar trades to fresh monthly highs going into the inauguration of President-elect Joe Biden, but it remains to be seen if the Greenback will continue to appreciate ahead of the Federal Reserve interest rate decision on January 27 as the rebound in longer-dated US Treasury yields starts to unravel.

Recent remarks from Vice-Chair Richard Clarida suggests the Federal Open Market Committee (FOMC) will retain the current policy at its first meeting for 2021 as the board member insists that the central bank “will continue to increase our holdings of Treasury securities by at least $80 billion per month and our holdings of agency mortgage-backed securities by at least $40 billion per month until substantial further progress has been made toward our maximum-employment and price-stability goals.”

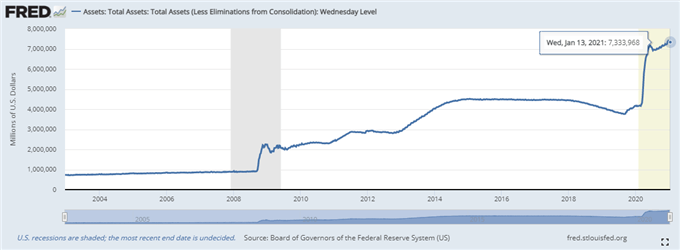

In turn, it seems as though the FOMC will retain a dovish forward guidance as Chairman Jerome Powell and Co. lay out an outcome-based approach for monetary policy, and swings in risk appetite may continue to sway the US Dollar as the FOMC relies on its balance sheet to achieve its policy targets.

However, a further contraction in the Fed’s balance sheet may drag on investor as it narrows for the third consecutive week, with the latest figure sitting at $7.334 trillion in the week of January 13 compared to $7.335 trillion the week prior.

With that said,a further pullback in global equity prices may produce fresh monthly highs in the US Dollar index as the reserve currency still reflects an inverse relationship with investor confidence, and the rebound in the Greenback may persist going into the US Presidential inauguration as DXY breaks out of the opening range for January.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong