US Dollar Talking Points

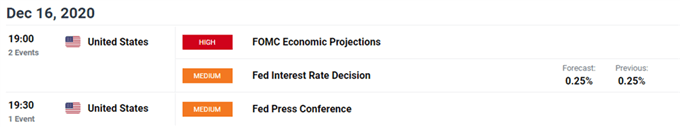

The Federal Reserve’s last interest rate decision for 2020 may shake up the near-term outlook for the US Dollar as the central bank is slated to update the Summary of Economic Projections (SEP), and it remains to be seen if the Federal Open Market Committee (FOMC) will take additional steps to support the US economy as Chairman Jerome Powell and Co. “assess how our ongoing asset purchases can best support our maximum employment and price-stability objectives as well as market functioning and financial stability.”

Fundamental Forecast for US Dollar: Neutral

The Greenback has struggled to hold its ground in December, with the US Dollar Index plummeting more than 4% off the September highs, and swings in risk appetite may continue to sway the reserve currency as the unprecedented efforts taken by monetary as well as fiscal authorities have helped to provided a backstop for investor confidence.

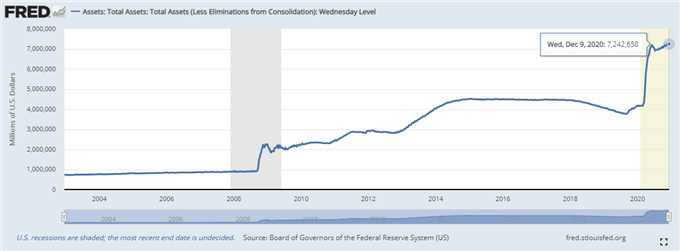

In turn, key market trends may carry into 2021 as the Chairman Powell tells US lawmakers that the FOMC remains “committed to using our full range of tools to support the economy and to help assure that the recovery from this difficult period will be as robust as possible,” and the European Central Bank’s (ECB) decision to expand the pandemic emergency purchase programme (PEPP) may put pressure on Fed officials to provide additional monetary stimulus on December 16 even as the balance sheet approaches the record high ($7.243 trillion) seen in November.

The Fed’s balance sheet widened to $7.243 trillion in the week of December 9 from $7.222 trillion the week prior, and the FOMC may rely on its asset purchases to combat the economic repercussions from COVID-19 as “most participants favored moving to qualitative outcome-based guidance for asset purchases that links the horizon over which the Committee anticipates it would be conducting asset purchases to economic conditions.”

With that said, the US Dollar may continue to reflect an inverse relationship with investor confidence amid the ongoing expansion in the Fed’s balance sheet, and key market trends may carry into the year ahead if the FOMC adjusts its policy to foster a stronger recovery.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong