Fundamental Forecast for the US Dollar: Neutral

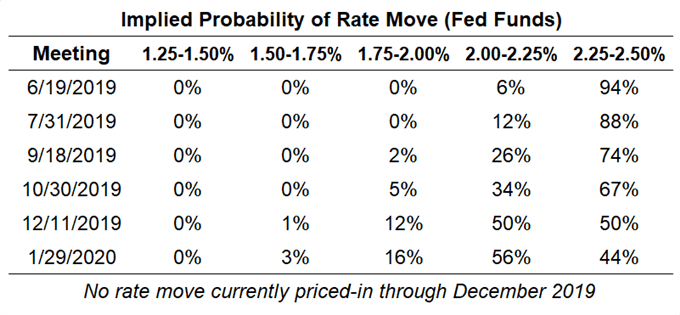

- After the May Fed meeting and the April US jobs report, odds of a 25-bps rate cut in 2019 by the Federal Reserve have fallen to exactly 50%, per Fed funds futures contracts.

- A slew of Fed policymakers will hit the lecture circuit this week, while the only ‘high’ rated data release is the April US inflation report due on Friday;

- The IG Client Sentiment Index shows that retail traders remain mostly net-short the US Dollar.

See our long-term forecasts for the US Dollar, Euro, Gold, Crude Oil, and more with the DailyFX Trading Guides.

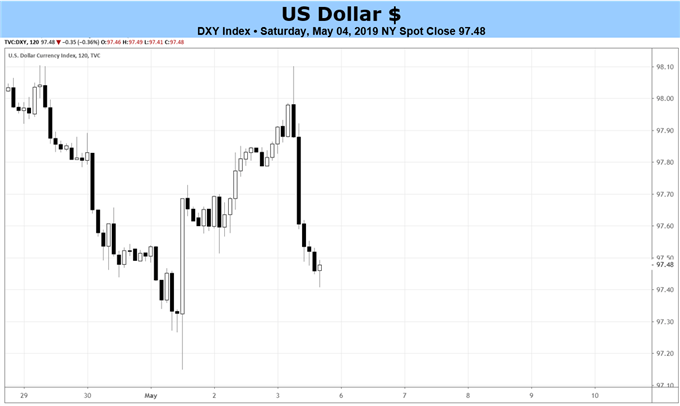

US Dollar Rates Week in Review

What appeared to be a strong end to the month of April for the US Dollar (via the DXY Index) faded away into a weak start at the beginning of May. The US Dollar lost ground against all but two of the other major currencies this past week, posting modest gains against the Australian and New Zealand Dollars (AUDUSD -0.34%, NZDUSD -0.23%).

Otherwise, with signs of a potential positive Brexit breakthrough coming late in the week, the British Pound was able to lead the way higher versus the greenback (GBPUSD 1.99%). US Dollar weakness after the April US jobs report also filtered through in preventing a major breakdown in gold prices for the time being.

In Aftermath of May Fed Meeting, 2019 Rate Cut Odds Fall

At the press conference following the May Fed meeting on Wednesday, Fed Chair Jerome Powell said that low inflation was “transitory” and not “persistent.” Market participants have largely interpreted this as a sign that the likelihood of a 25-bps rate cut this year is lower than previously expected. At their peak following the March Fed meeting, rates markets were pricing in a 58% chance of a 25-bps rate cut in September; now, odds of a September cut are only 26%. To this end, Fed funds are only pricing in a coin flip’s chance of a cut in 2019.

Fed Speeches to Watch For

Now that the May Fed meeting is in the rearview mirror, the blackout period for Fed policymakers is over and several will hit the lecture circuit in the week ahead. On Monday, May 6, Philadelphia Fed President Patrick Harker will give a speech on the US economic outlook. On Tuesday, May 7, Dallas Fed President Robert Kaplan will speak at a panel in Beijing, China. On Wednesday, May 8, Fed Governor Lael Brainard will make the opening remarks at the `Fed Listens' event.

The second half of the week is backloaded with Fed speakers as well. On Thursday, May 9, Fed Chair Powell will give the opening remarks at a Fed community development conference. Chicago Fed President Charles Evans will speak at the same event later in the day, as will Governor Brainard on Friday, May 10. Also, on Friday, New York Fed President John Williams will speak at a breakfast event in New York City.

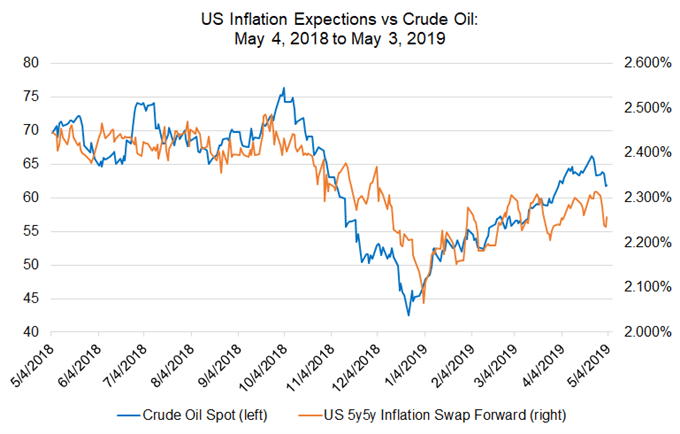

April US Inflation Data Due Friday; Inflation Expectations Have Stabilized

The April US Consumer Price Index on Friday is due to show another small rebound in price pressures, not much of a surprise given the rise in oil prices since the start of 2019. According to Bloomberg News, headline CPI is expected in at 2.1% from 1.9%, and core CPI is due in at 2.1% from 2% (y/y). Overall, the readings are due right at the Federal Reserve’s medium-term target of +2% - supporting Fed Chair Powell’s assessment at the May Fed meeting that low inflation seen earlier this year was “transitory.”

But with the oil price rebound moderating over the past few weeks, inflationary gains are due to be limited. Crude oil prices fell by -1.8% between April 5 and May 3, down from 63.08 to 61.94. In turn, medium-term US inflation expectations, as measured by the 5y5y inflation swap forwards, are off by -0.3-bps from 2.260% to 2.257% over the past month.

US-China Trade War Talks Update

US President Donald Trump ended the week saying that the US-China trade war negotiations were going “very well,” noting that “we’re getting close to a very historic, monumental deal.” While certainly a boost of optimism that investors surely liked to hear, the US president also said in the same breath that “if it doesn’t happen, we’ll be fine too. Maybe even better.”

These comments come on the heels of interim White House Chief of Staff Mick Mulvaney saying on Tuesday, April 30 that the US-China trade war negotiations would be resolved “one way or the other in the next couple weeks.”

Traders may want to keep on eye on USDCNH prices as a litmus test in the near-future: China has used devaluation as a tool to ward off the effects of the tariffs, so Chinese Yuan strength (USDCNH weakness) may be interpreted as a sign that the trade talks are nearing a positive resolution; Chinese Yuan weakness (USDCNH strength) may be interpreted as a sign that the trade talks are nearing a negative resolution.

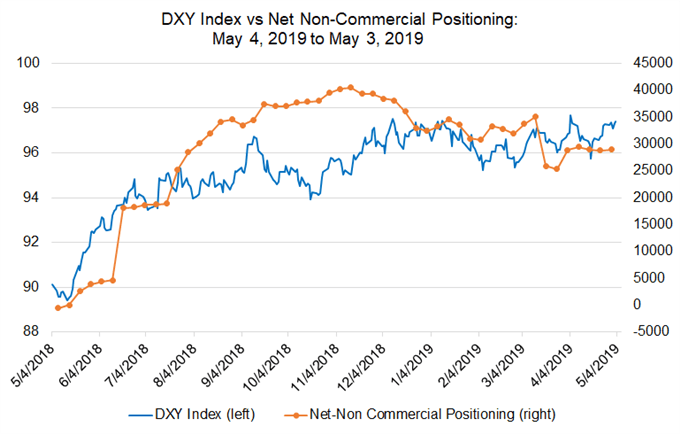

US Dollar Futures Positioning Remains Net-Long

Finally, looking at positioning, according to the CFTC’s COT for the week ended April 30, speculators increased their net-long US Dollar positions to 29K contracts, up from the 28.8K net-long contracts held in the week prior. Net-long US Dollar positioning has barely wavered since the start of the year: traders held 32.4K net-long contracts on January 1; and positioning remains below its 2018 high set during the week ended November 13 at 40.5K net-long contracts.

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher, email him at cvecchio@dailyfx.com

Follow him in the DailyFX Real Time News feed and Twitter at @CVecchioFX