FUNDAMENTAL FORECAST FOR THE US DOLLAR: BULLISH

- US Dollar shrugs off timid FOMC minutes, rises to six-month high

- Risk aversion reveals USD continues to command safe haven appeal

- Trade war and Italy fears might furnish the rally with fresh fodder

See our quarterly US Dollar forecast to learn what will drive prices through mid-year!

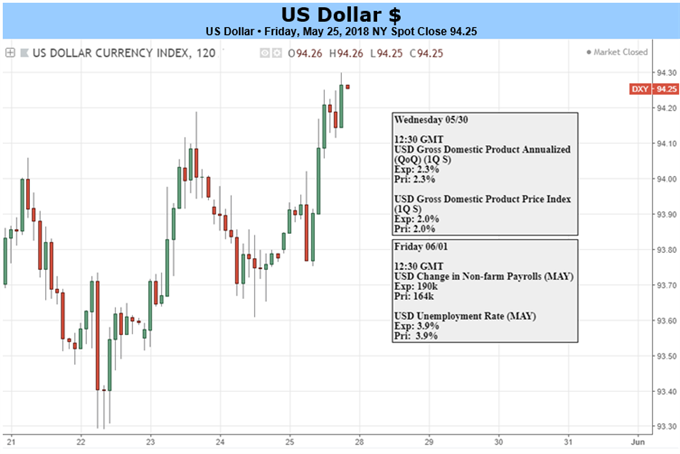

The US Dollar continued to push higher last week, hitting a six-month high against an average of its major counterparts. The release of minutes from the May 2 FOMC meeting inspired a pullback. The document did not advance the case for further steepening of the expected rate hike path. Markets took that as reason enough for a correction, but this proved to be short-lived.

Perhaps most interestingly, the greenback demonstrated its continued appeal as a haven asset during times of risk aversion. It roared higher as a steep drop in crude oil prices inspired a near-3 percent drop in energy shares that pulled down overall US stock benchmarks. The move came after oil ministers from Russia and Saudi Arabia signaled an output cut scheme they have championed might soon be unwound.

Top-tier economic data returns in the week ahead. The Fed’s favored PCE inflation gauge is expected to see on-year price growth holding at the target 2 percent for the second consecutive month while official labor-market statistics show job creation narrowly accelerated in May. On balance, such outcomes are likely to keep rate hike bets at status quo, neither advancing the cautiously hawkish narrative nor derailing it.

This may well keep sentiment trends at the forefront. A belligerent White House has unnerved investors, stoking trade war fears with comments disparaging US/China trade talks and hints at another hike in tariffs, this time on auto imports. Meanwhile, the populist eurosceptic government taking shape in Italy continues to inspire trepidation.

None of these headwinds appear likely to dissipate in the near term, suggesting a risk-off tone is more likely than not to persist in the coming. Absent an improbably dramatic disappointment on the data front, that seems to portend continued sentiment-linked gains for the global reserve currency.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Sr. Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter