Fundamental Forecast for the US Dollar: Neutral

- US Dollar avoided outright breakdown on Yellen’s Jackson Hole speech

- Gold prices also held their range, hinting Fed rate hike bets remain alive

- All eyes now turn to payrolls, PCE inflation and revised GDP statistics

Prepare to trade what’s next for the US Dollar. Join our weekly cross-market outlook webinar !

The US Dollar spent most of last week in wait-and-see mode as markets braced for a speech from Fed Chair Janet Yellen at the US central bank’s annual symposium in Jackson Hole, Wyoming. The gathering has frequently served as the venue to unveil major turns in monetary policy.

Traders speculated that Yellen might use the occasion to set the stage for “quantitative tightening” (QT), the gradual unwinding of its massive balance sheet accumulated following the 2008-9 global financial crisis. When the fateful day finally arrived, Yellen conspicuously steered clear of any policy guidance.

Not surprisingly, this led a disappointed greenback broadly lower against its G10 FX counterparts. In another curious display of resilience however, the benchmark unit managed to hold up within the range that has confined price action against an average of the most-traded majors for the better part of a month.

Gold prices echoed the US currency’s performance, showing ample intraday volatility but ultimately failing to break out from their own congestion range. The yellow metal epitomizes anti-fiat assets – the Dollar’s polar opposite – and its lack of conviction seems to confirm that hopes for a hawkish Fed remain alive.

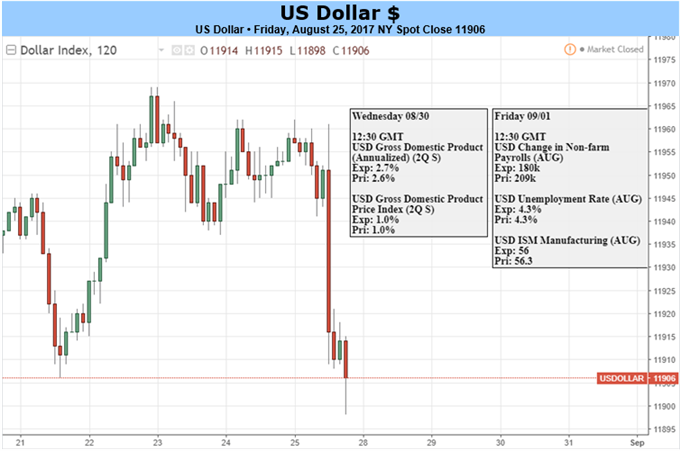

A stream of top-tier economic data will continue to steer this narrative in the week ahead. A revised set of second-quarter GDP figures, the Fed’s favored PCE inflation measure and the always closely monitored set of official labor-market statistics are all due to cross the wires.

Realized US data outcomes have steadily improved relative to consensus forecasts since mid-June. This hints that analysts’ models are underestimating the economy’s vigor and opens the door for more of the same ahead. If this proves to be the case, USD may come roaring higher as bets on stimulus withdrawal heat up.