S&P 500, FTSE 100 Analysis and News

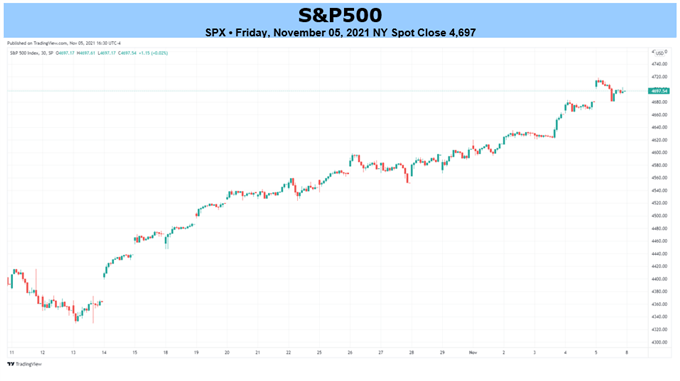

S&P 500 | Another Week, Another Record High

Another week, another record high for the S&P 500, which now hovers around 4700. Speculative appetite remains strong, you only have to look at Tesla shares, up another 8% this week. Meanwhile, the Nasdaq 100 is on course for the longest daily win streak since December 2020 at 10 days and now the most overbought since August 2020. The latest move on the upside catalysed by this week’s dovish central bank activity.

- RBA scrapped yield curve control as expected, however, pushed back against rate hike speculation, continues to stick with 2024 liftoff

- Fed annonuces a well-telegraphed taper, reiterating that inflation is largely transitory

- BoE with the shock of the week, by not raising rates in a 7-2 vote split

Looking ahead to next week, it will be more of the same, although, judging by the 20yr seasonal trend, equities begin to tail off midway through November. And while I am aware that much like 2020, this year, is not exactly your average year, the seasonal playbook worked very well during the late Sep-Early Oct pullback. On the economic calendar, the main highlight will be on inflation and given the Federal Reserve’s flexibility on tapering, a notable upside surprise on the headline rate has the possibility to wobble risk appetite.

S&P 500 vs 20YR Trend

Source: Refinitiv

| Change in | Longs | Shorts | OI |

| Daily | 1% | -1% | 0% |

| Weekly | 15% | -13% | -1% |

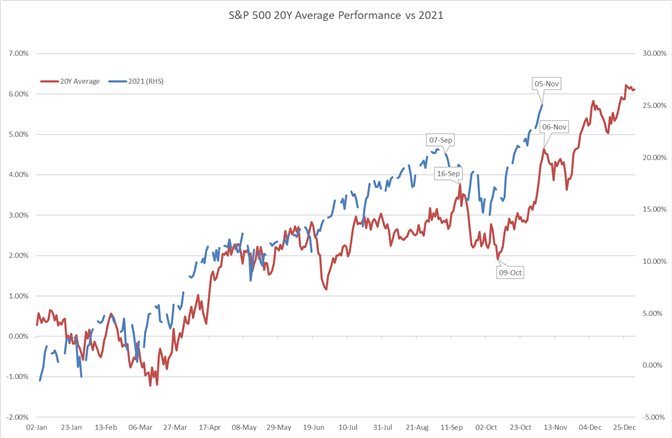

FTSE 100 | UK Banks Struck Down, UK-EU Tensions Lurking

Unfortunately for UK Banks, the Unreliable Boyfriend curse at the Bank of England strikes again. This comes after the Bailey and Co. defied market expectations are kept interest rates on hold, despite fuelling the increase in rate hike bets in the run up to the meeting. However, with the hiking now looking a lot less aggressive post meeting, this will likely see pressure remain on UK Banks.

UK Bank Index vs UK 3-Month Overnight Index Swaps

Source: Refinitiv

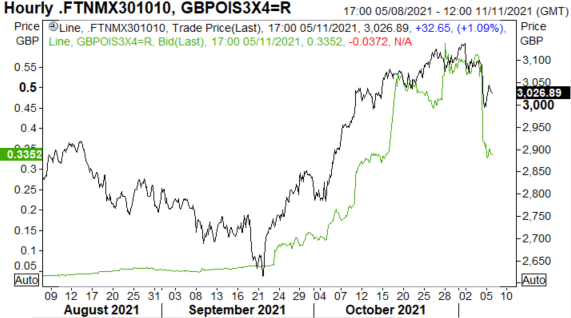

Elsewhere, tensions between the UK and EU continue to linger, particularly as the UK suggest that triggering Article 16 is on the table. This is in relation to the Northern Ireland protocol in avoiding a hard border with Ireland as part of the Brexit agreement. In terms of Article 16, this allows any one side to take steps or in other words safeguards if the protocol upsets the the balance of trade or brings about serious economic difficulties. While the UK have highlighted that conditions have been met to trigger Article 16, they have refrained from doing so thus far. That said, while there is little on the docket besides GDP, headlines over UK/EU tensions will be closely watched as a breakdown in talks is likely cap upside for the FTSE 100. On the technical front, near term support resides at 7200-20.

FTSE 100 Price Chart: Daily Time Frame

Source: Refinitiv

| Change in | Longs | Shorts | OI |

| Daily | -30% | 25% | 2% |

| Weekly | -44% | 44% | 0% |

RESOURCES FOR TRADERS

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.