Oil Price Talking Points

The price of oil clears the $80 handle as the Organization of Petroleum Exporting Countries (OPEC) remain reluctant to push production towards pre-pandemic levels, and current market may keep crude prices afloat amid the tepid recovery in US output.

Fundamental Forecast for Oil Price: Bullish

The price of oil trades at its highest level since 2014 as OPEC stays on track to “adjust upward the monthly overall production by 0.4 mb/d for the month of November 2021,” and crude may stage a larger rally over the coming days as the US struggles to recover from the disruptions caused by Hurricane Ida.

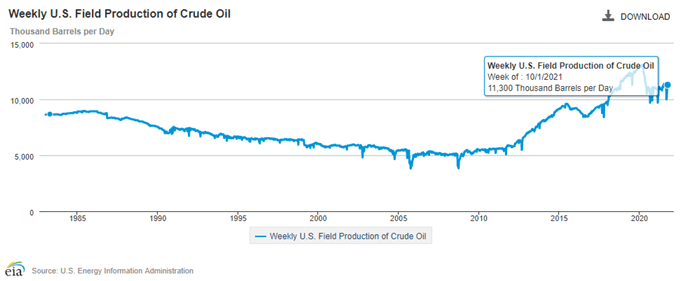

Fresh figures from the US Energy Information Administration (EIA) shows weekly field production increasing for the fourth consecutive week, with output climbing to 11,300K from 11,100K in the week ending. However, the US remains far from the conditions seen prior to COVID-19 as production reached a record high of 13,100K in March 2020.

As a result, the price of oil may continue to trade to fresh yearly highs ahead of the next OPEC and non-OPEC Ministerial Meeting on November 4, and signs of limited supply may keep the price of oil afloat as the most recent Monthly Oil Market Report (MOMR) emphasizes that“in 2022, oil demand is expected to robustly grow by around 4.2 mb/d, some 0.9 mb/d higher compared to last month’s assessment.”

With that said, current market conditions may keep crude prices afloat as expectations for stronger demand are met with limited supply, and the price of oil may continue to exhibit a bullish behavior over the coming days as it stages a seven week rally.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong