S&P 500 FUNDAMENTAL FORECAST: NEUTRAL

- US stocks retreated as longer-dated Treasury yield surged to a fresh 12-month high

- Upbeat data, vaccine progress and a dovish Fed may underpin the fundamental outlook

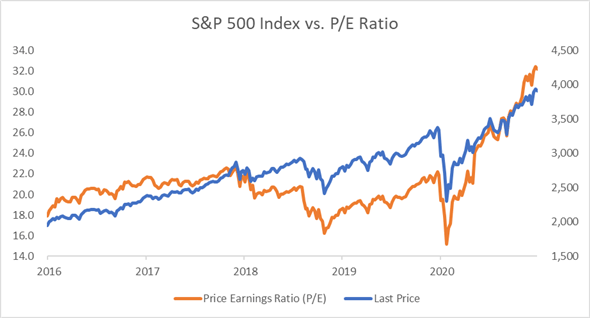

- The S&P 500 index is trading at a 31.6 price-to-earnings (P/E) ratio, far above its 5-year average

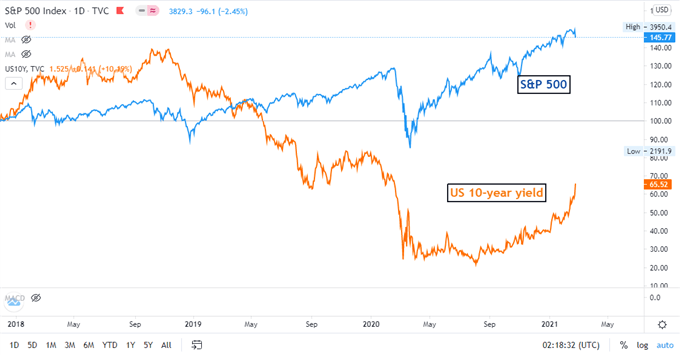

The S&P 500 index pulled back sharply towards the end of last week as rising Treasury yields triggered broad profit-taking activity in equities. The tech sector was among the hardest hit. The US 10-year treasury yield climbed more than 200% from an August low of 0.508% to a recent high of 1.600% on the back of rising reflationary expectations. Higher Treasury yields make stocks less appealing as compared to government bonds, as the latter appear to be offering better returns considering a risk-adjusted basis.

The recent selloff may again prove to be another healthy correction along the stock market’s upward trajectory, as the fundamental picture remains largely supportive for a long-term bull run. President Joe Biden’s US$ 1.9 trillion Covid relief aid is around the corner, and a new multitrillion infrastructure bill is likely to be revealed in March. Aggressive fiscal spending points to rising reflation hopes, which inevitably led longer-dated Treasury yields higher as a result.

S&P 500 Index vs. US 10-year Treasury Yield

Chart by TradingView

Nonetheless, an improved fundamental picture and robust Q4 corporate earnings may continue to buoy equity prices. The latest US retail sales, consumer confidence, durable goods order and jobless claims figure have all beaten market expectations, a sign that the economy is rebounding at a faster-than-expected pace.

Vaccine rollouts helped to bring down daily Covid-19 infections rapidly in the past few weeks, with 7-day average counts falling to 68k on February 24th from a January peak of 259k. More encouragingly, Johnson & Johnson’s Covid-19 was endorsed by the FDA last week, paving the way for emergency use soon. The rollout of a third vaccine candidate after Pfizer/BioNTech and Moderna may help to further expedite economic reopening and bring business back to normal.

Fed Chair Jerome Powell reiterated his dovish stance in the face of rising inflation, reassuring the market that the central bank will keep interest rates unchanged for a long period of time before considering tapering. With that in mind, it appears that accommodative monetary policy settings are here to stay, which will likely to keep equities afloat in the medium- to long-run.

Valuation-wise, the S&P 500 index is trading at a 31.6 price-to-earnings (P/E) ratio, which is the highest level seen in two decades and more than 50% above its five-year average of 21.2. Rich valuation may render the index vulnerable to profit-taking should rising yields continue to exert downward pressure over risk assets.

S&P 500 Index vs. P/E Ratio – 5 Years

Source: Bloomberg, DailyFX

--- Written by Margaret Yang, Strategist for DailyFX.com

To contact Margaret, use the Comments section below or @margaretyjy on Twitter