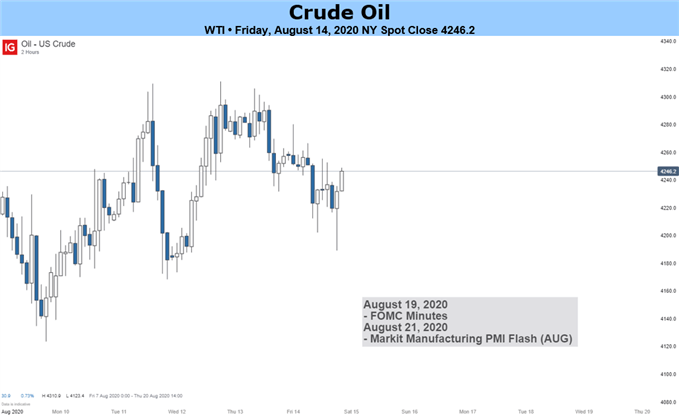

Source: IG Charts

CRUDE OIL FUNDAMENTAL HIGHLIGHTS:

- Crude Oil Upside Stalling

- OPEC Meeting

- US-China Compliance Review to Set the Tone Early

| Change in | Longs | Shorts | OI |

| Daily | 3% | -7% | 1% |

| Weekly | 31% | -38% | 7% |

Crude Oil Upside Stalling

Modest gains for Brent crude futures with a 1% increase (at time of writing). However, with virus concerns remaining in the backdrop, upside has begun to stall for oil prices as the outlook begins to look less bullish. This had been emphasised by OPEC’s recent forecast, in which they downgraded their global oil demand for this year by 400kbpd and 500kbpd for 2021. This also comes at a time where OPEC are looking to continue tapering its production cuts.

OPEC Meeting

Next week OPEC+ JMMC meeting will take place on August 19th. However, as is typically the case with OPEC meetings, sources will likely catch wind of the latest plans regarding the oil market prior to the meeting. In turn, headline risk is likely to be slightly elevated for oil prices in the coming week.

As a reminder, at the prior meeting, OPEC+ had agreed to taper its record production cuts of 9.7mbpd to 7.7mbpd from the beginning of August, which had been line with the original plan. That said, oil prices have remained in a tight range with COVID cases across America and the re-emergence in Europe casting doubts over fuel consumption. Although, with oil prices somewhat broadly stead, it is expected that OPEC+ will take a “wait and see” stance and thus we expect little in way of significant changes to current policy.

US-China Compliance Review to Set the Tone Early

Aside from OPEC, the tone for the oil market is likely to be set early in the week on the fallout from the US-China compliance review of the phase 1 deal (scheduled Aug 15th). In recent weeks, President Trump has stated that the trade deal means less to him, as such, focus may turn towards the rhetoric on several issues around cybersecurity (Huawei, TikTok) as well as geopolitical concerns (namely Hong Kong Security Laws). That said, source reports from the South China Morning Post signal that little is expected in terms of a breakthrough, as such, risk appetite may struggle to begin the week, keeping oil upside contained.

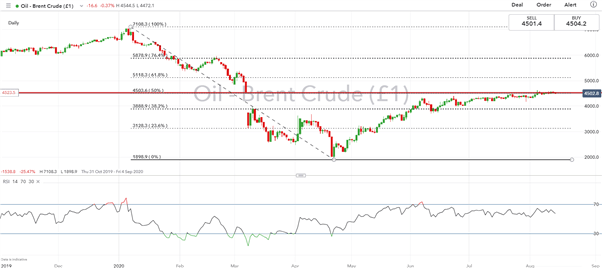

CRUDE OIL CHART: DAILY TIME FRAME

Source: IG