Dow Jones, Nasdaq 100, FTSE 100 Price Outlooks:

- The Dow Jones has lagged the Nasdaq 100 and S&P 500 as gains become more concentrated

- Earnings season will continue to provide key insight for equity traders and investors

- The FTSE 100 will look to an update on the country’s sovereign credit rating

Dow Jones & Nasdaq 100 Forecast

Outlook: Neutral

The Dow Jones, Nasdaq and S&P 500 continued their upward trajectory last week as new coronavirus cases in the United States appeared to slow and the first round of stimulus checks were delivered to eligible Americans. Still, threats to the rebound rally remain as funding for small business assistance quickly dried up and the early stages of earnings season revealed a troubled outlook for the months ahead.

Nasdaq Continues to Outpace Dow Jones and S&P 500

Chart created with TradingView

In all of the coronavirus-induced madness, the Nasdaq has emerged as a clear frontrunner among the three major US indices – despite its higher exposure to the “risky” technology sector. Evidenced in the chart above, the Nasdaq has continued its outperformance over the Dow Jones and S&P 500 as some of the leading tech stocks stand above more traditional businesses.

Chart created with TradingView

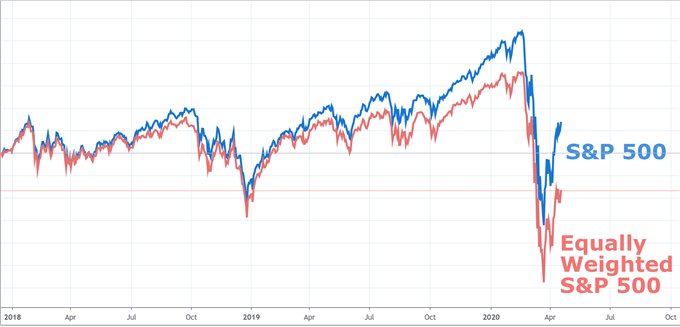

That being said, recent equity gains have become highly concentrated in a few stocks. As a result the S&P 500 has climbed faster in the recent rebound than its equal-weighted counterpart, which is not unusual, but the degree to which the two have diverged is notable. Consequently, we can surmise the rebound has on the back of targeted strength rather than a widespread economic boom that would lift an entire market.

Therefore, upcoming earnings from companies like Netflix, Snapchat, Intel and Texas Instruments in the week ahead may offer information that could make or break the rally. If the tech leaders that have been largely to blame for the rebound disappoint market expectations, a drawdown in the Nasdaq could be expected. In the meantime, follow @PeterHanksFX on Twitter for updates and insights.

FTSE 100 Forecast

Outlook: Neutral

In the case of the FTSE 100, traders will look to an upcoming sovereign credit rating for insight on the country’s perceived ability to repay debt. Given the relatively strong standing of the Bank of England, I would argue no change is expected, but a surprise negative revision to the country’s outlook could seriously undermine the FTSE 100 and British Pound.

--Written by Peter Hanks, Junior Analyst for DailyFX.com