The Dollar suffered its second worst week in a year and the S&P 500 tumbled after coming up short for a record high. Does something bigger await us ahead?

US Dollar Forecast– Dollar Stumbles but will it Fall as Markets Debate Fed Hikes?

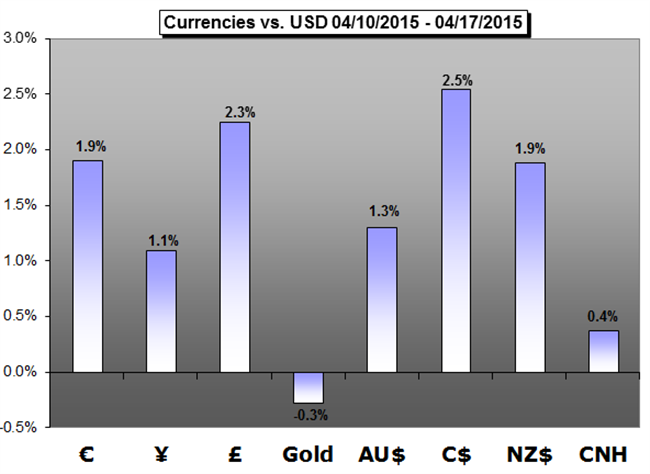

The Dow Jones FXCM Dollar Index (ticker = USDollar) dropped 1.1 percent this past week while the ICE Dollar Index tumbled 1.8 percent.

Euro Forecast - EUR/USD Appeal Due to Covering Potential, Not Yield Prospects

As yields fall further in the Euro-Zone, traders have dismissed concerns of the ECB tapering its QE program, pricing in the first rate move not until December 2019 at the earliest.

Japanese Yen Forecast – Japanese Yen Likely to test Major Levels on Key Week Ahead

The fundamental event risks lined up for the final full-week of April may heighten the appeal of the Yen and spark a further decline in USD/JPY as the Japanese economy gets on a firmer footing.

British Pound Forecast – British Pound Forecast to Trade Higher on Fundamental Strength

Impressive UK employment data helped push the British Pound sharply higher versus the US Dollar and other major counterparts, and the recent reversal in fortunes leaves us in favor of continued GBP gains through the foreseeable future.

Australian Dollar Forecast – Australian Dollar to Weigh 1Q CPI, China PMI as RBA Bets Evolve

The Australian Dollar is looking to first-quarter CPI data to support fading rate cut bets but soft Chinese news-flow may cap the currency’s upside potential.

Gold Forecast – 1173 Key Support in Focus as Gold Preserves Monthly Opening Range

Gold prices are softer for a second consecutive week with the precious metal off nearly 0.27% to trade at $1204 ahead of the New York close on Friday.

Sign up for a free trial of DailyFX-Plus to have access to Trading Q&A's, educational webinars, updated speculative positioning measures, trading signals and much more!

Want to develop a more in-depth knowledge on the market and strategies? Check out the DailyFX Trading Guides we have produced on a range of topics.