Fundamental Forecast for New Zealand Dollar: Neutral

The New Zealand dollar remains bid ahead of the election as opinion polls show Prime Minister Bill English as the favored candidate, but fresh remarks from the Reserve Bank of New Zealand (RBNZ) may sway the near-term outlook for NZD/USD as the central bank appears to be on course to preserve the record-low cash rate throughout 2017.

Sign Up and Join the DailyFX Team LIVE for an Opportunity to Discuss Potential Trade Setups

Despite the change in leadership, Deputy Governor Grant Spencer may strike a similar tone as his predecessor, Graeme Wheeler, as ‘numerous uncertainties remain and policy may need to adjust accordingly.’ As a result, the, the RBNZ is widely expected to retain the current policy at the September 28 meeting and the central bank may merely attempt to buy more time as ‘GDP in the March quarter was lower than expected, adding to the softening in growth observed at the end of 2016.’ It seems as though the RBNZ will continue to lag behind its U.S. counterpart as the Federal Open Market Committee (FOMC) shows a greater willingness to implement another rate-hike in 2017, and the kiwi-dollar exchange rate may exhibit a bearish behavior going into the end of the month should Deputy Governor Spencer and Co. tame expectations for higher borrowing-costs.

At the same time, the RBNZ may toughen the verbal intervention on the local currency as ‘a lower New Zealand dollar is needed to increase tradables inflation and help deliver more balanced growth,’ and the kiwi-dollar exchange rate stands at risk of giving back the advance from earlier this month if the central bank threatens to intervene in the currency market.

NZD/USD Daily Chart

Download the DailyFX 3Q NZD/USD Forecast

The recent advance in NZD/USD has largely negated the risk for a head-and-shoulders reversal as the pair pushes to a fresh monthly-high (0.7433) and clears the near-term hurdle around 0.7330 (38.2% retracement) to 0.7350 (23.6% expansion). In turn, topside targets remain on the radar going into the last full week of September, but a string of failed attempts to test the 0.7470 (50% expansion) region may generate range-bound conditions, with the 200-Day SMA (0.7143) on the radar, which sits just above the Fibonacci overlap around 0.7100 (38.2% retracement) to 0.7110 (38.2% expansion).

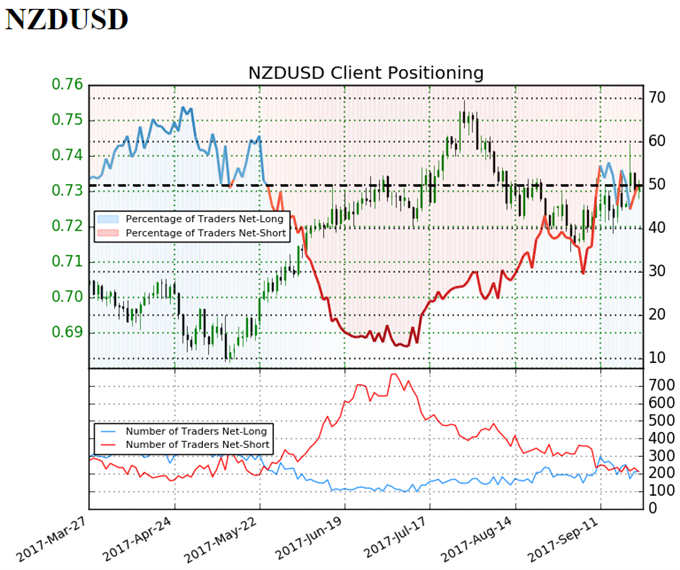

Retail Sentiment

Retail trader data shows 63.4% of traders are net-long with the ratio of traders long to short at 1.73 to 1. The number of traders net-long is 2.7% lower than yesterday and 2.8% lower from last week, while the number of traders net-short is 3.0% higher than yesterday and 6.9% lower from last week.

Sign up for David's e-mail distribution list