Fundamental Forecast for Japanese Yen: Bearish

USD/JPY is quickly approaching the May-high (114.37) ahead of the semi-annual Humphrey-Hawkins testimony, with the pair at risk for a larger advance as the Federal Open Market Committee (FOMC) appears to be on course to further normalize monetary policy in 2017.

Fresh comments from Chair Janet Yellen may ultimately yield a bullish reaction in the greenback as Fed officials hold a growing discussion to unload the balance sheet over the coming months. With the economy now projected to expand an annualized 2.2% this year, the central bank head may endorse a more aggressive approach in normalizing monetary policy, and the Federal Open Market Committee (FOMC) may implement another rate-hike ahead of 2018 especially as the region nears full-employment. In turn, Fed Fund Futures may start to reflect a higher probability for a December rate-hike, and USD/JPY may continue to retrace the decline from earlier this year as the Bank of Japan (BoJ) sticks to its Quantitative/Qualitative Easing (QQE) Program with Yield-Curve Control.

However, the dollar may face a more bearish fate should Chair Yellen refrain from revealing anything new. The central bank head may largely promote a wait-and-see approach in front of U.S. lawmakers amid the mixed data prints coming out of the economy, and the FOMC may merely try to buy more time at the next interest rate decision on July 26 amid the ongoing weakness in household earnings.

USD/JPY Daily Chart

The broader outlook for USD/JPY has perked up as the pair makes a more meaningful attempt to break out of the downward trend from late-2016, and the exchange rate may extend the rebound from the June-low (108.80) as price & the Relative Strength Index (RSI) preserve the bullish trends carried over from the previous month. A break of the May-high (114.37) may expose the next topside hurdle around 116.00 (23.6% expansion) to 116.10 (78.6% expansion) especially as the momentum indicator appears to be pushing into overbought territory.

Nevertheless, lack of momentum to break and close above the Fibonacci overlap around 113.80 (23.6% expansion) to 114.30 (23.6% retracement) may produce range-bound conditions in USD/JPY, with the first area of support coming in around 112.40 (61.8% retracement) to 112.80 (38.2% expansion) followed by 111.10 (61.8% expansion) to 111.60 (38.2% retracement). Check out the Quarterly DailyFX Forecasts for additional trading ideas.

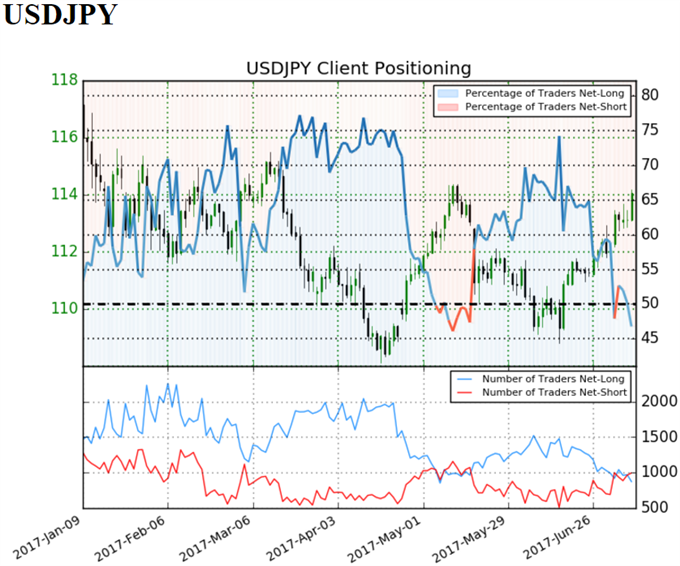

Retail trader data shows 46.8% of traders are net-long with the ratio of traders short to long at 1.14 to 1. The number of traders net-long is 10.5% lower than yesterday and 20.3% lower from last week, while the number of traders net-short is 0.1% higher than yesterday and 40.8% higher from last week.For more information on retail sentiment, check out the new gauge developed by DailyFX based on trader positioning.

Sign up for David's e-mail distribution list