British Pound Rate Talking Points

GBP/USD trades to fresh monthly lows, with U.K. data prints doing little to influence the British Pound, and the Brexit negotiations may continue to drag on the Pound Dollar exchange rate as Prime Minister Theresa May struggles to secure a deal.

Fundamental Forecast for British Pound: Neutral

The British Pound may continue to get battered even though the economic docket stands fairly light for the last full week of May amid the renewed the threat for a ‘hard Brexit.’

Headlines surrounding Brexit may continue to shake up the near-term outlook for GBP/USD as Prime Minister May lacks support for the Withdrawal Agreement Bill, and the ongoing rift between U.K. lawmakers may keep the Bank of England (BoE) on the sidelines even though the Consumer Price Index (CPI) show the reading for inflation climbing to 2.1% from 1.9% per annum in March.

In turn, the British Pound stands at risk of facing headwinds ahead of the next BoE meeting on June 20 as the Monetary Policy Committee (MPC) insists that ‘the economic outlook will continue to depend significantly on the nature and timing of EU withdrawal,’ but the pickup in GBP/USD volatility continues to shake up market participation, with retail sentiment still stretched going into the end of the month.

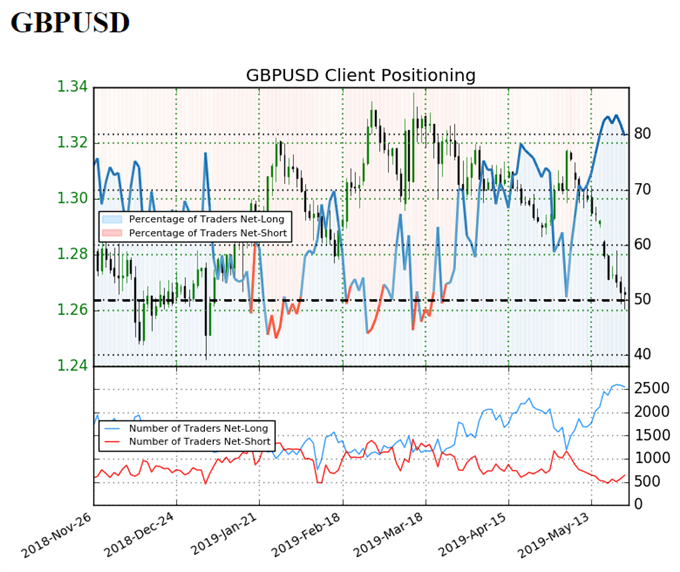

The IG Client Sentiment Report shows 79.8% of traders are net-long GBP/USD compared to 81.7% earlier this week, with the ratio of traders long to short at 3.95 to 1. Keep in mind, traders have remained net-long since March 26 when GBP/USD traded near 1.3210 region.

The number of traders net-long is 2.4% lower than yesterday and 6.3% higher from last week, while the number of traders net-short is 9.9% higher than yesterday and 16.8% higher from last week. It remains to be seen if the rise in GBP/USD interest will persist going into the final days of May, but the extreme reading in net-long position suggests the retail crowd is still attempting to fade the decline in the Pound Dollar exchange rate as it trades to a fresh monthly low (1.2605).

Keep in mind, the tilted in retail interest offers a contrarian view to crowd sentiment especially as GBP/USD snaps the bullish trend from late-2018, with the Relative Strength Index (RSI) highlighting a similar dynamic.

Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

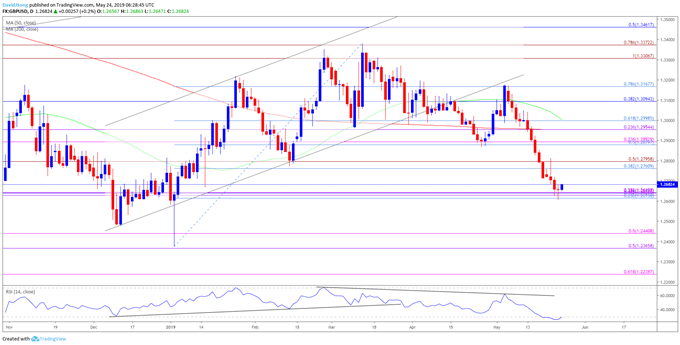

GBP/USD Rate Daily Chart

The broader outlook for GBP/USD is no longer bullish as the exchange rate snaps the upward trend from late last year after failing to close above the Fibonacci overlap around 1.3310 (100% expansion) to 1.3370 (78.6% expansion).

As a result, the advance from the 2019-low (1.2373) may continue to unravel, with a break/close below the 1.2610 (23.6% retracement) to 1.2640 (38.2% expansion) region opens up the Fibonacci overlap around 1.2370 (50% expansion) to 1.2440 (50% expansion).

Will keep a close eye on the RSI as the oscillator pushes into oversold territory, but a move back above 30 may foreshadow a rebound in GBP/USD as the bearish momentum abates.

Additional Trading Resources

For more in-depth analysis, check out the 2Q 2019 Forecast for GBP/USD

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong.