Fundamental Forecast for GBP: Neutral

Sterling (GBP) Talking Points:

- UK PM may still face a leadership challenge.

- Sterling roiled by a constant flow of Brexit bad news.

The DailyFX Q4GBP Forecast is available to download.

With the current fractured political backdrop within the UK, taking a position in Sterling has become a very risky trade as technical and fundamental analysis can be rendered null and void in seconds by commentary or unofficial announcements from a wide range of media sources and platforms. While Sterling volatility had been widely expected to rise as the Brexit clock ticked down, the current state of the UK political backdrop makes arguing for a position on GBP nigh on impossible.

The current state of play sees UK PM May possibly facing a vote of no confidence next week, while the draft agreement in its present form is said to be unlikely to be passed by the UK Parliament. This would leave negotiations in a stalemate ahead of calls for either a second referendum or a general election. The EU’s current negotiating position is that they have done all that they possibly can while respecting their red lines, although they may make some, small, concessions if they believe that they can get a deal done. Again, nothing is counted out or can be taken for granted.

Brexit Effect on Pound and UK Stocks: Impact of Deal or No Deal.

Latest Brexit stories:

Brexit News: Sterling Remains at Risk of UK Government Breakup.

Brexit Latest: Sterling Slumps as Brexit Minister Resigns, PM Leadership in Doubt.

On Mondays we will take an in-depth look at important UK data releases, Brexit and other UK asset market drivers at 10:30GMT in our UK Key Events and Markets Webinar. and we will try and make sense of what is going on and how it will affect markets.

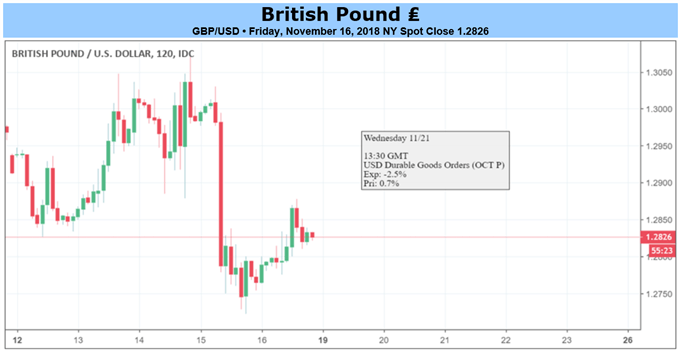

This week’s GBPUSD chart is being shifted around by moves in both Sterling and the US dollar, making position taking difficult. With moves so sharp, the current levels of risk/reward do not justify getting involved in the market and it may well be better to sit this one out on the sidelines until the market becomes clearer. Traders should remember that there are a wide variety of other asset classes where strong technical and fundamental analysis will currently give you a better risk/reward.

GBPUSD 30 Minute Price Chart (November 12 - 16, 2018)

IG Client Sentiment data show 66.2% of traders are net-long with the ratio of traders long to short at 1.96 to 1. The number of traders net-long is 2.7% higher than yesterday and 17.1% higher from last week, while the number of traders net-short is 5.7% lower than yesterday and 5.8% lower from last week. We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests that GBPUSD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBPUSD-bearish contrarian trading bias

--- Written by Nick Cawley, Analyst

To contact Nick, email him at nicholas.cawley@ig.com

Follow Nick on Twitter @nickcawley1

Other Weekly Fundamental Forecast:

Oil Forecast – Crude Oil at Risk as OPEC Supply Cut Bets Undermined by Russia, US

Australian Dollar Forecast –Australian Dollar Can Hang On Again, But Downward Bias Remains