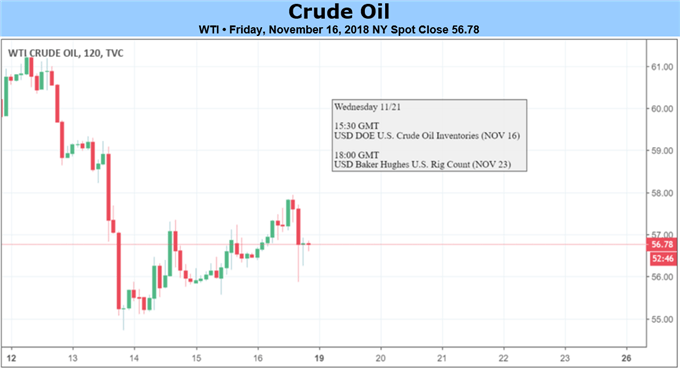

Oil Fundamental Forecast: Bearish

- Crude oil prices clocked in the longest losing streak since 1984+ on fading OPEC oil demand

- Saudi Arabia revived output production cuts as oil paused its descent, but those may be in vain

- Russia doesn’t seem to be for cuts as US keeps pumping oil, perhaps undermining OPEC efforts

Trade all the major global economic data live and interactive at the DailyFX Webinars. We’d love to have you along.

Crude oil prices extended declines from last week as anticipated, clocking in a remarkable 12 days of consecutive losses. This was the longest consecutive sessions of losses since at least 1984. The backdrop for weakness in the commodity was as a result of warnings from OPEC that they see demand for their stockpiles easing.

As a result, speculation has been renewed that supply cuts from the petroleum-producing cartel could be on the table. Saudi Arabia proposed lowering output in excess of more than one million barrels per day. But cooperation within OPEC nations may not be easily achieved. Even if it is, the impact of production cuts could be limited.

This is because Russia, a key producer of oil, may not be on the same page with OPEC cuts like it was back in 2016. Russia’s President Vladimir Putin briefly met with US President Donald Trump last Sunday in Paris where they talked about oil. During their conversation, Putin said that he would not commit to cutting output.

Instead, he noted that he is happy with current prices and that they are in a “wait and see approach”. Vladimir Putin also wants to restore relations with the US which actually recently overtook Russia in terms of crude oil production. Meanwhile, Mr. Trump has at this point expressed numerous times that his preference is for lower prices.

Combining this potentially undermines efforts from OPEC to lift prices and attempts that crude oil makes to climb in the week ahead could be in vain down the road. In addition, the sentiment-linked commodity could have more room to fall should Brexit fears inspire risk-off trading dynamics. Finally, the US economic docket is notably lacking data given the Thanksgiving Holiday which also brings with it illiquidity. With that in mind, the crude oil fundamental outlook remains bearish.

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter