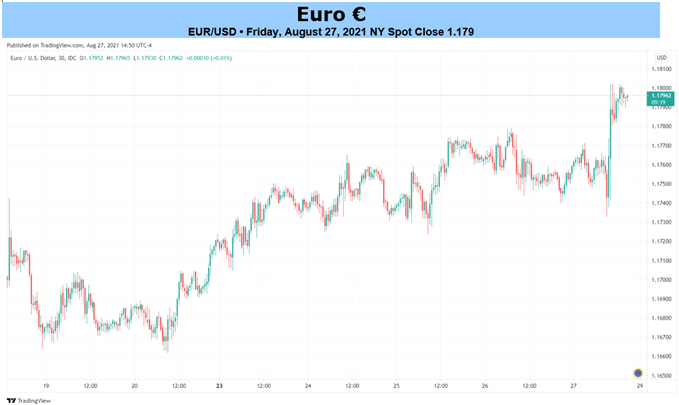

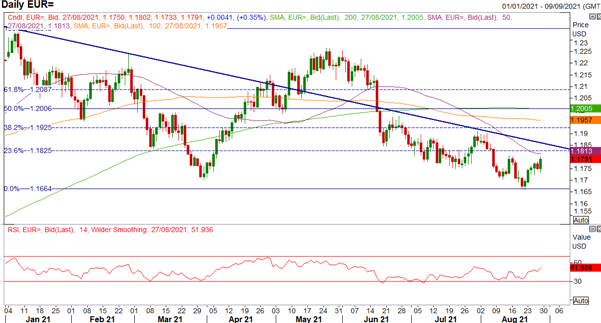

EUR/USD: A late Friday surge as Powell’s much anticipated Jackson Hole speech, failed to provide a notable signal for tapering, relative to the plethora of hawkish Fedspeak heading into Powell’s remarks. In turn, the USD succumbing to a typical “buy the rumour, sell the fact” type of trade pushing EUR/USD to test 1.1800. That being said, while there was a lack of a signal, Chair Powell did confirm that it may be appropriate to taper this year, which will be contingent on the upcoming key data releases, most notably next week’s jobs report. A figure similar to the prior two reports (850k in June and 943k in July), will likely provide a green light of having achieved significant progress on the jobs front and thus limiting the downside for the greenback. While German data will be on the docket next week, tier 1 US data will take precedence with ISM prints and the aforementioned NFP report. Although, with German CPI to be released next week, it is worth mentioning that the latest ECB minutes signalled that there are upside risks to the Bank’s inflation forecasts.

EUR/USD techs: Resistance at 1.1800, 1.1813 (50DMA), support at 1.1750 and 1.1725.

EUR/USD Chart: Daily Time Frame

Source: Refinitiv

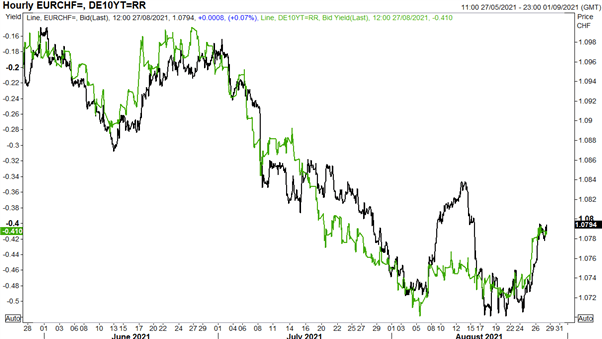

EUR/CHF Carving Out a Bottom

EUR/CHF: The cross working on a short-term bottom at 1.0700, having posted its strongest weekly advance since mid-June. The 1.0700 handle also appears to be the SNB’s soft line in the sand given the recent pick up in sight deposits (typically used as a signal of SNB FX intervention). That being said, for the cross to extend its move to the upside, a move higher in yields will be needed. For now, the strategy would be bullish on dips to 1.0700.

EUR/CHF vs German 10YR Yield

Source: Refinitiv