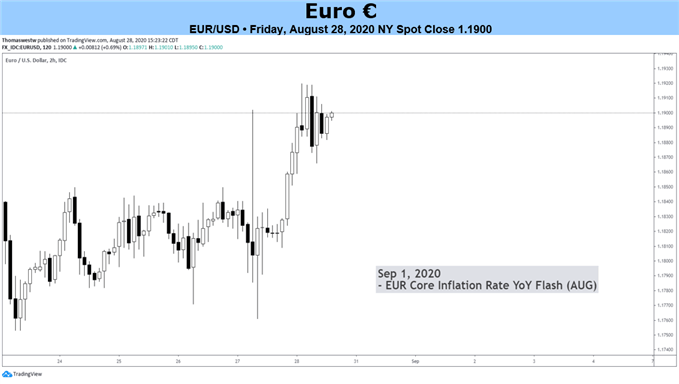

Chart Created with TradingView

EUR/USDFUNDAMENTAL HIGHLIGHTS:

- Fed Delivers as Expected, USD Selling Exacerbated by Month-End Flows

- Euro Tailwinds Have Eased

- Stretched Euro Positioning Reduces the Appeal in the Short Term

Fed Delivers as Expected, USD Selling Exacerbated by Month-End Flows

As widely expected, Fed Chair Powell announced that the Fed will shift towards AIT (Average Inflation Target), in short, this would essentially mean that the Fed endorse a lower (rates) for longer approach via a reactive function as opposed to a previously pre-emptive function when normalisation policy. In reaction, the theme of US Dollar selling remained, albeit, exacerbated by month-end rebalancing. While the longer term picture for the USD remains lower, there are short-term risks to a possible snapback against the Euro.

| Change in | Longs | Shorts | OI |

| Daily | -1% | -4% | -3% |

| Weekly | 4% | -10% | -5% |

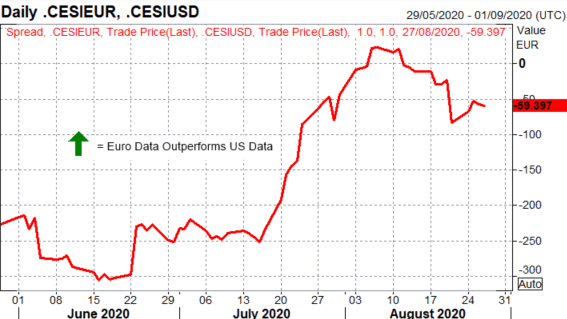

Euro Tailwinds Have Eased

The overriding narrative for the Euro has largely been on growth expectations moving in favour of Europe relative to the US. However, in light of the strides made in recent months, a large chunk of this view is in the price amid the sizeable mark up from 1.10 to 1.19. That said, the narrative has also been challenged as of late, following the August PMI surveys, in which the Eurozone saw a notable pullback (French Manufacturing back in contraction).

European Data Has Stopped Outperform US Data

Source: Refinitiv

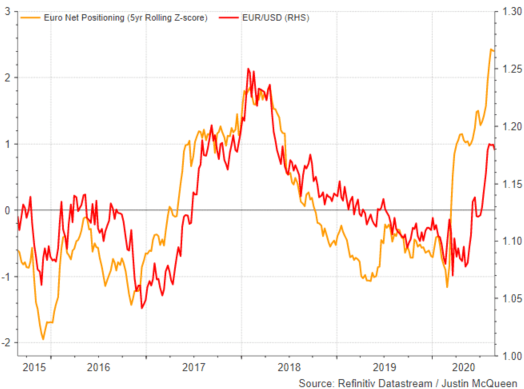

Stretched Euro Positioning Reduces the Appeal in the Short Term

It has been well documented that speculative positioning is very stretched in the Euro with outright contracts at a record high, while on an open-interest adjusted basis we are at 2yr highs (non-commercials 28% long). In turn, this reduces the risk-reward appeal for a continuation higher in the short run and thus see scope for pullbacks towards 1.1700, in which a break opens the door to 1.1600.

Euro Bulls In a Crowded Trade

Next Week’s Agenda

Looking to next week, much of the focus for the Euro will on from stateside with Fed speakers out in full force (namely Clarida & Brainard) who are likely to shed further light on the Federal Reserve’s policy shift. On the economic schedule, US ISM Manufacturing and NFPs are likely to take precedent over German inflation figures, which are likely weighed by recent VAT cuts.

EUR/USD Price Chart: Daily Time Frame

Source: DailyFX

When looking at the Euro over the past month it is as we were with the currency maintaining a 1.17-1.19 range. While above 1.19 there is the potential tactical bias for a pullback to 1.17, the longer term trend remains on the upside, which could come earlier than expected on a break above 1.1965.

.jpg)