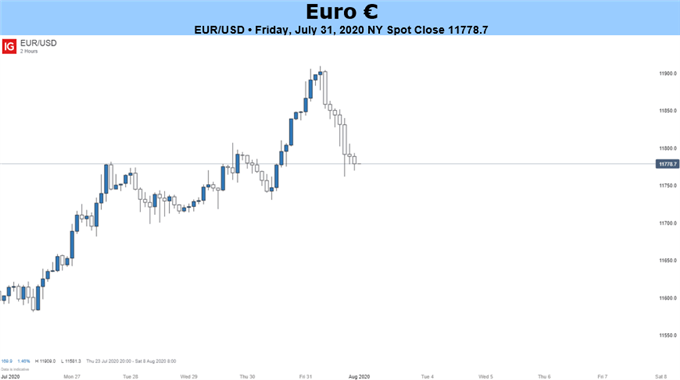

Source: IG Charts

Fundamental Euro Forecast: Bullish

- After climbing strongly since mid-May, EUR/USD is bound to falter at some point.

- However, with the US economy spluttering and the November election coming closer, it’s hard to identify any reason why EUR/USD’s advance should end soon.

Euro price outlook still rosy

As the chart below shows, EUR/USD has now made headway for the last six weeks and for nine of the past 11 weeks. After a rise like that there must be a period of consolidation or retracement eventually – the problem is to identify a catalyst, and none jumps to mind.

EUR/USD Price Chart, Weekly Timeframe (December 4, 2017 – July 30, 2020)

Chart by IG (You can click on it for a larger image)

| Change in | Longs | Shorts | OI |

| Daily | -1% | -4% | -3% |

| Weekly | 4% | -10% | -5% |

EUR/USD is already at levels last seen between May and September 2018, with last week’s dire US GDP data for the second quarter and President Donald Trump’s “delay the election” tweet adding to the reasons to stay well clear of the US Dollar. The key question therefore – after when a retracement will come – is just how high EUR/USD could go.

One answer is the area around 1.23, where it traded between late January and mid-April 2018. For sure that’s a long way away but is still a reasonable target for later this year – perhaps after the usual August lull.

Week ahead: PMIs, NFPs

Looking to the week ahead, there is little Eurozone data to move the markets, with only the final manufacturing and services PMIs for the region in July due on Monday and Wednesday respectively. Once again, therefore, it will likely be the USD side of the equation that drives EUR/USD – with Friday’s non-farm payrolls data the pick of the week’s economic statistics.

--- Written by Martin Essex, Analyst and Editor

Feel free to contact me on Twitter @MartinSEssex