Fundamental Euro Forecast: Mixed

- The coming week marks the start of a new month, a new quarter and a new half year, when asset managers are traditionally expected to rebalance their portfolios.

- That could lead to turbulent trading in EUR/USD, the Euro crosses and assets more generally.

- The coming week also sees the deadline for the UK to ask the EU for an extension of the Brexit transition period but it is not expected to do so.

Choppy Euro price action

Wednesday this week marks the start of a new month, a new quarter and a new half year, when market folklore suggests that asset managers such as hedge funds, pension funds and insurance companies rebalance their portfolios. While it is hard to know whether or not that is true, profit taking in assets that have outperformed and dip buying of those that have underperformed is forecast to result in larger than normal flows as investment managers make sure the balance in their portfolios is returned to where they would like it to be.

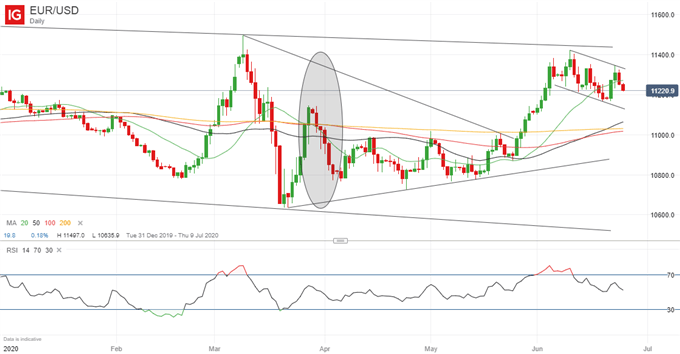

As the chart below shows, EUR/USD fell back in the days ahead of and after the last quarter end on March 31. This time round, the outperformance of US stocks compared with Eurozone stocks in Q2 could lead to flows out of the US and into Europe, boosting EUR/USD. However, that could be offset by the Euro’s outperformance of the US Dollar over the same period.

EUR/USD Price Chart, Daily Timeframe (January 1 – June 25, 2020)

Chart by IG (You can click on it for a larger image)

| Change in | Longs | Shorts | OI |

| Daily | -1% | -4% | -3% |

| Weekly | 4% | -10% | -5% |

June 30 is also the deadline for the UK to ask the EU for an extension of the Brexit transition period beyond the end of this year. UK Prime Minister Boris Johnson has said repeatedly that he will not do that, although the coronavirus pandemic could provide him with an excuse to change his mind. Either way, any impact would likely be on GBP rather than EUR – with GBP perhaps benefiting if an extension were asked for and agreed.

Week ahead: inflation and unemployment

Data in the coming week include inflation and unemployment statistics from several EU countries and the Eurozone as a whole. However, with global markets expected to remain dominated by risk-on/risk-off trades on good news/bad news about the coronavirus, the numbers are not expected to have an impact on EUR/USD, which will likely continue to rise when the Covid-19 news is good and fall when it is bad.

Elsewhere, traders need to keep an eye open for any new developments in the growing US-EU trade dispute over subsidies to Europe’s Airbus and its US rival aerospace company Boeing. Last week, the US Trade Representative’s office added $3.1 billion of items to its list of European goods eligible to be hit with duties - including black olives, beer and gin - and said it could target other goods too. Any escalation of the row would likely send EUR/USD lower.

Find out here how to combine fundamental and technical analysis

--- Written by Martin Essex, Analyst and Editor

Feel free to contact me on Twitter @MartinSEssex