EURO FUNDAMENTAL FORECAST: BEARISH

- ECB Forum likely to establish a dovish direction for forthcoming policy

- EU leaders will probably pick status-quo replacement for top ECB job

- Cross-currents from the US and the UK bode ill for the single currency

Did we get it right with our latest Euro forecast? Get it free to find out!

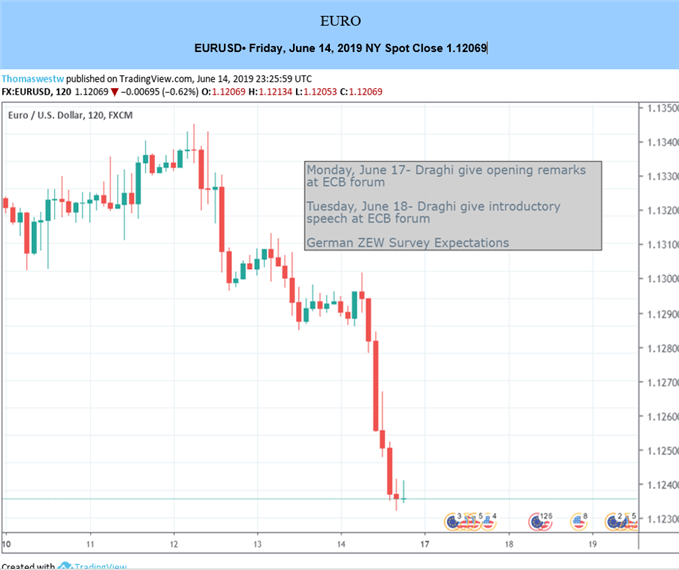

The Euro faces a decisive week ahead despite the what looks to be a relatively muted homegrown economic data docket. Regional policymakers are due to make several key regional strategy decisions, while the external front offers ample scope for volatility spillover potential.

EURO AT RISK AS ECB DRAFTS POLICY PATH AND THE EU PICKS ITS NEW PRESIDENT

First, the central bank officials will gather for the ECB Forum in Sintra, Portugal. They will weigh up the economic landscape and are expected to consider whether the Eurozone requires additional monetary stimulus. A formal policy announcement is not in the cards, but markets will keenly parse emerging commentary.

The pace of economic activity growth appears to have stabilized in 2019 after last year’s precipitous decline, but that’s cold comfort considering it is within a hair of six-year lows. Further, regional financial conditions have tightened while the markets’ baseline expectations for growth in 2020 continue to sink.

Taken together, this probably translates into a cautious wait-and-see stance as the ECB awaits the results of its upcoming round of TLTRO bank liquidity injections. A clear dovish tilt in official rhetoric signaling the capacity to do more as needed appears to be likely however.

Later in the week, EU heads of state will convene to fill upcoming leadership vacancies at the Commission and – perhaps more importantly – the ECB. Of the front-runners for Mario Draghi’s job, former Governor of the Bank of Finland Erkki Liikanen seems like a choice the markets would find reassuring.

Mr Liikanen is a known quantity in the EU and is broadly seen as consensus-building moderate with a steady hand. Germany’s ultra-hawkish Jens Weidmann may be supportive for the Euro but little else. Berlin will probably insist that France’s François Villeroy de Galhau be sidelined also on balance-seeking grounds.

On balance, a clearly accommodative bias emerging from the Forum coupled with a broadly status-quo pick like Mr Liikanen for the next ECB President seem most probable. Taken together, they probably carry modestly bearish implications for the single currency.

FED OUTLOOK UPDATE, BOE COMMENTARY MAY STOKE EURO VOLATILITY

Looking beyond the borders of the Euro area, potent cross-currents are likely to emerge from the US and UK. First, a monetary policy announcement from the Fed will bring an update of official rate path projections. The markets are priced for dramatic easing: 2-3 cuts this year, plus the end of the QT balance sheet unwind.

That strikes a hard contrast with the FOMC’s March forecast of no changes this year and one hike in 2020. While a dovish adjustment seems likely, a relatively more modest one than what investors have envisioned might boost the US Dollar and pressure the Euro via a lower EURUSD exchange rate.

Meanwhile, a second round of leadership voting in the UK Conservative Party might bring Boris Johnson closer to replacing Theresa May as Prime Minister. He won the first round by a landslide. That didn’t seem to register a strong market response, but progress on the contest may yet bring regional volatility.

A rate decision from the Bank of England and the annual Mansion House speech from its Governor Mark Carney are also due. No changes are expected as Brexit uncertainty keeps officials sidelined but steep economic deterioration over the past month may prompt worrying remarks, rattling European markets.

--- Written by Ilya Spivak, Sr. Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter

EURO TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a live webinar and have your trading questions answered

OTHER FUNDAMENTAL FORECASTS: