Gold Price Analysis and News

- Choppy Trading for Gold Likely to Persist

- Gold Techs to Watch

Choppy Trading for Gold Likely to Persist

Gold is on course for a weekly loss for the first time in 4-weeks as rising global yields and a surging USD continues to weigh on the precious metal. However, price action remains somewhat choppy, which appears likely to persist between 1800 and 1880.

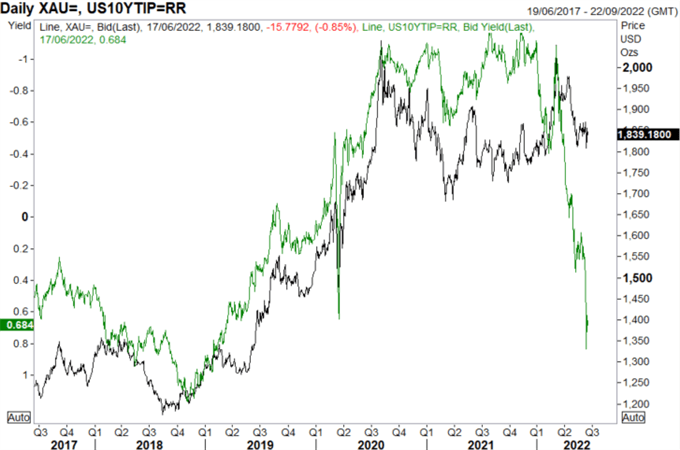

As I have said previously, I struggle get bullish on gold given the significant rise in real yields (see chart below). Although, what I would say is should yields begin to pullback with a return to 3% for the US 10yr (currently at 3.25%), then this will keep gold afloat. Ultimately, going forward price action is likely to remain rangebound in the short-term.

| Change in | Longs | Shorts | OI |

| Daily | 1% | -3% | -1% |

| Weekly | 2% | -8% | -2% |

Gold vs US 10YR Real Yields

Source: Refinitiv

Fed Speak In Focus

Looking ahead to next week, Fed speak will be the key risk for gold amid a plethora of Fed Officials on tap, most notably, Fed Chair Powell delivering his testimony on June 22nd. As we saw at his press conference, the Fed Chair noted that a 75bps move will not be common. Although, as even the most uber-doves on the committee, such as, Fed’s Kashkari, talk up the possibility of a 75bps rate hike in July, this will remain on the agenda during Chair Powell’s testimony. That being said, in light of the recent data prompting Fed Officials back away from their forward guidance, economic data will be the key focus to gauge the outlook for monetary policy.

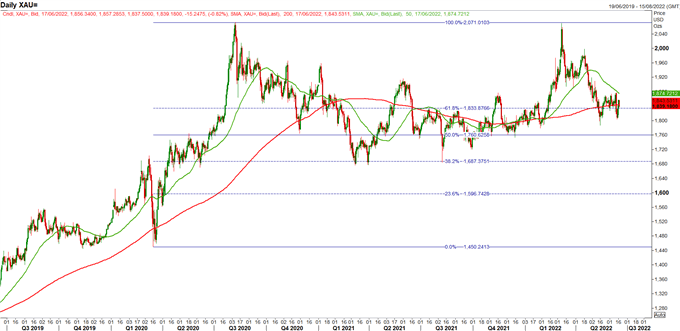

Gold Techs to Watch

Support: 1833 (61.8% Fib), 1800 (Psychological), 1786 (May 16th Low)

Resistance: 1843 (200MA), 1874 (50DMA), 1880 (Monthly Highs)