Gold Fundamental Forecast: Neutral

- Gold prices trim gains going into the weekend despite ongoing Ukrainian conflict

- FOMC set to raise rates by 25 bps but otherwise likely to take “wait and see” approach

- XAU/USD tailwinds to stay in place for now, but bulls may rest before next push higher

Gold, XAU/USD, Ukraine, War, FOMC, Inflation Expectations

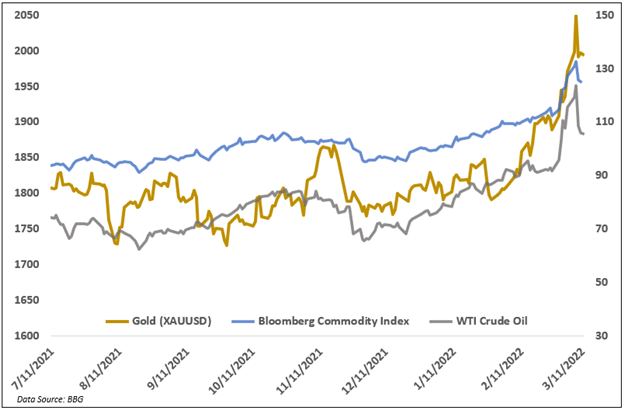

Gold prices ended higher last week, trimming losses into the weekend after bulls failed to hold the high-profile 2,000 level. Still, bullion prices remained over 4% higher on the month amid surging inflation expectations driven by the conflict in Ukraine and the subsequent volley of Western sanctions. The yellow metal is also benefiting from higher volatility across equity markets, driving XAU’s appeal as a haven asset.

However, a big drop in oil prices late last week tempered the gold-friendly inflation bets despite the United States reporting its highest inflation print in 40 years. The surge in prices cast a fresh cloud of doubt over the Federal Reserve’s calculus ahead of Wednesday’s rate decision when policymakers are expected to hike the US benchmark rate by 25 basis points.

Typically, gold and other assets would be keenly focused on a Fed rate decision, but the FOMC event may take a backseat to the ongoing and rapidly changing situation in Ukraine. That is partly due to the economic uncertainty that has been injected into the global economy. Outside the 25 bps hike, the Fed may opt to take a “wait and see” approach instead of offering firm guidance on policy. That said, the war has likely already pushed actual inflation higher in the near term. The Fed will likely have to respond more aggressively later this year in response to that inflation, especially if the war persists into the summer months, but for now, it will likely dampen the Fed’s actions. That should benefit gold, a non-interest-bearing asset.

Gold prices may fall if near-term risks recede, whether it be a major escalation or a complete resolution to the war. Inflation expectations would likely fall back to or near pre-invasion levels under that scenario. That would likely drag gold lower, but prices may remain higher than where they were before Putin’s invasion, given the spillover effects that will likely outlast the conflict, albeit to an unknown degree. The International Monetary Fund, on Thursday, said they would soon downgrade global growth projections due to the crisis in Ukraine.

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

--- Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter