Weekly Fundamental Gold Price Forecast: Neutral

- Rising inflation expectations and falling long-end bond yields have given a new shine to gold prices.

- If real yields – nominal yields less inflation – continue to fall, gold prices will likely continue their rally.

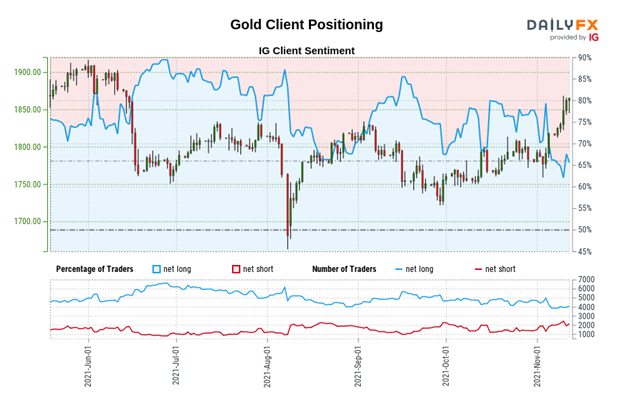

- The IG Client Sentiment Index suggests that gold prices in USD-terms (XAU/USD) have a bearish trading bias.

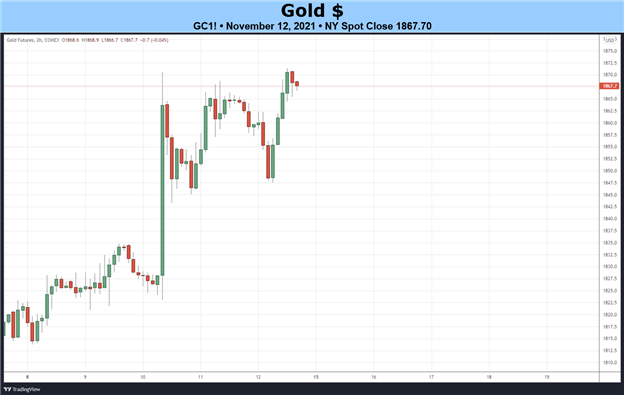

Gold Prices Week in Review

It was a great week for gold prices across the board. Every single gold-cross gained at least +3%, but for one – gold in USD-terms (XAU/USD), which added +2.57%. The top performing gold-cross was gold in EUR-terms (XAU/EUR), which added +3.72%, while gold in AUD-terms (XAU/AUD) and gold in NZD-terms (XAU/NZD) were not far behind, adding +3.60% and +3.66%, respectively.

The bulk of gains emerged mid-week after the October US inflation report (CPI), which showed the highest price pressures in the United States since 1990. Gold’s gains came as rising realized inflation readings were met with a corresponding jump in inflation expectations, which outpaced nominal long-end yields, curating an environment of falling real yields. If US real yields stay near record lows, gold prices may still be able to tack on further gains in the coming sessions.

Economic Calendar Week Ahead

The turn through the ides of November will see several more inflation reports due from G10 economies, which may provide another boost for gold prices in the middle of the week. Speeches from various European Central Bank and Federal Reserve policymakers could help determine whether or not gold’s gains stick, insofar as central bankers ignoring the continued rise in inflation pressures could bring about another wave of fresh lows in real yields.

- On Tuesday, gold in GBP-terms (XAU/GBP) will be in focus when the September UK unemployment rate and the August UK employment change figures are released. Gold in EUR-terms (XAU/EUR) could also see some volatility around the release of the revised Eurozone 3Q’21 GDP report. October US retail sales will bring gold in USD-terms (XAU/USD) into the spotlight.

- On Wednesday, a trio of inflation reports should produce the most volatile trading day of the week for gold prices. The October UK inflation report (CPI), the final October Eurozone inflation report (HICP), and the October Canada inflation report (CPI) should catalyze gold in GBP-terms (XAU/GBP), gold in EUR-terms (XAU/EUR), and gold in CAD-terms (XAU/CAD), respectively.

- On Thursday, the October Japan inflation report (CPI) will bring gold in JPY-terms (XAU/JPY) into focus, although it is likely to be the least important set of inflation date due over the course of the week in terms of potential market impact.

- On Friday, the November UK GfK consumer confidence report will bring gold in GBP-terms (XAU/GBP) into the spotlight once more.

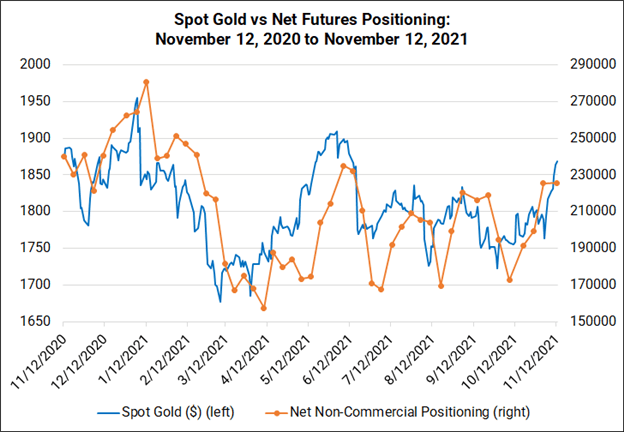

GOLD PRICE VERSUS COT NET NON-COMMERCIAL POSITIONING: DAILY TIMEFRAME (November 2020 to November 2021) (CHART 1)

Next, a look at positioning in the futures market. According to the CFTC’s COT data, for the week ended November 9, speculators increased their net-long gold futures positions to 225,597 contracts, up from the 225,443 net-long contracts held in the week prior. The futures market remains at its most net-long positioning since the second week of June.

IG CLIENT SENTIMENT INDEX: GOLD PRICE FORECAST (November 12, 2021) (CHART 2)

Gold: Retail trader data shows 66.31% of traders are net-long with the ratio of traders long to short at 1.97 to 1. The number of traders net-long is 1.27% lower than yesterday and 1.84% higher from last week, while the number of traders net-short is 2.10% lower than yesterday and 1.74% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Gold prices may continue to fall.

Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Gold-bearish contrarian trading bias.

--- Written by Christopher Vecchio, CFA, Senior Strategist